International Paper Nearly Doubles Annual Dividend Payout in Nine Years (NYSE:IP)

By: Ned Piplovic,

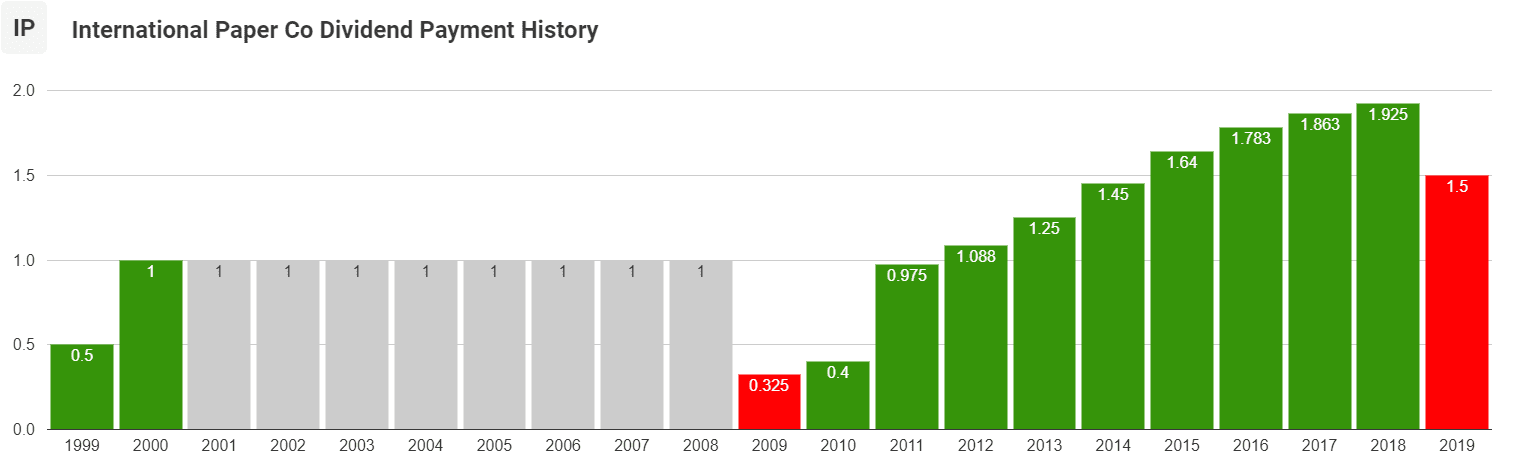

Following a 70% cut to its annual dividend payout in the aftermath of the 2008 financial crisis, the International Paper Company (NYSE:IP) has boosted its annual dividend payout every year for the past decade and currently offers its shareholders a 4.7% dividend yield.

Immediately after the 2009 dividend cut, the International Paper Company began increasing its annual dividend payout distributions. Within just two years, the company’s annual dividend payout came back to within 3% of the annual payout amount that was distributed before the 2009 cut.

Over the subsequent eight years, International Paper continued to increase its total annual payout. The total dividend payout amount advanced nearly six-fold and is currently double the 2008 distribution, which was the last full-year dividend payout before the 2009 cut.

Over the subsequent eight years, International Paper continued to increase its total annual payout. The total dividend payout amount advanced nearly six-fold and is currently double the 2008 distribution, which was the last full-year dividend payout before the 2009 cut.

While International Paper’s dividend income distributions have continued to rise, the company’s share price has been subjected to some headwinds that resulted in significant fluctuations and a double-digit percentage pullback over the trailing 12-month period.

However, the share price has advanced more than 25% since the beginning of 2016. Furthermore, the share price has risen more than 10-fold since reaching its all-time low of $4.03 on March 9, 2009, in the aftermath of the overall market correction due to the 2008 financial crisis.

Some investors might disregard the International Paper stock because of the falling stock price and the perceived decline of the demand for paper goods in an global economy that is continuously becoming more electronic. However, the largest share of International Paper’s product offering relates to paper packaging and shipping products. The demand for these goods has increased exponentially with the growth of e-commerce retail.

Therefore, while it might take a little time for the share price to deliver robust growth, the constant dividend payout income boosts might be sufficient for some investors to consider adding the International Paper stock to their investment portfolio. The company has delivered strong results over the past several quarters despite the declining share price. International Paper even beat analysts’ earning expectation every quarter during the trailing 12 months, including the time when it beat its first-quarter 2019 earnings expectations by nearly 22%.

As of July 2018, 10 out of 18 (56%) of the Wall Street analysts that are currently covering the stock have given IP a “Buy” (5) or a “Strong Buy” (5) rating. Furthermore, the company’s current share price has more than 17% room on the upside before it reaches the $50.09 current average target price that analysts have put forth.

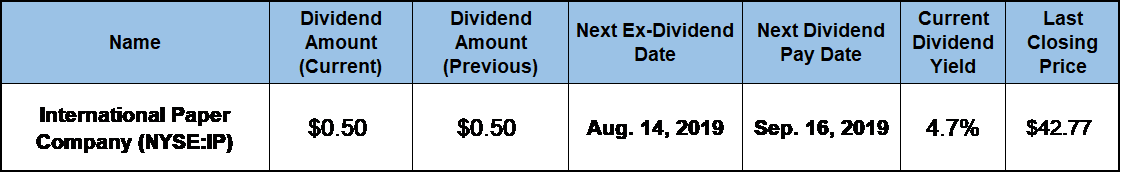

Therefore, after conducting their own due diligence, investors who are confident in International Paper’s share price rebound might consider taking a long position before the next ex-dividend date on July 30, 2019. While waiting for the share price to rebound, these investors can enjoy collecting dividend income payouts that yield 4.7%. The company will deliver the next round of these dividend income distributions on the September 16, 2019, pay date.

International Paper Company (NYSE:IP)

International Paper Company (NYSE:IP)

Headquartered in Memphis, Tennessee, and founded in 1898, the International Paper Company is one of the world’s leading producers of fiber-based packaging, pulp and paper. The company has approximately 52,000 employees operating in more than 24 countries throughout North America, Europe, Latin America, North Africa, India and Russia. However, North American operations still provide the vast majority of the company’s sales. Based on 2018 year-end numbers, the North American region’s revenues — nearly $18.7 billion — accounted for more than 80% of International Paper’s total global revenue of $23.3 billion.

International Paper operates through three business segments. The Industrial Packaging segment manufactures containerboards, including linerboard, medium, whitetop and recycled medium cardboard stock. The Printing Papers segment produces printing and writing papers, such as uncoated papers for end-use applications such as brochures, greeting cards, books and direct mail, as well as envelopes, business forms and file folders. This segment sells uncoated papers under several brand names, including Hammermill, Postmark, Accent and Great White. The Global Cellulose Fibers segment provides the fluff, market and specialty pulps that are used in absorbent hygiene products, tissue and paper products and non-absorbent end applications.

IP’s share price entered the trailing 12 months on a downtrend that began after the price reached its five-year high in January 2018. After some minor fluctuations, the share price reached its 52-week low of $54.58 on September 20, 2018, which was just 2% above the price level from the beginning of the 12-month period two months earlier.

However, the share price resumed the downtrend that began in early 2018 immediately after peaking in mid-September. Pressured by the overall market correction in late 2018, the share price dropped more than 31% by Christmas Eve 2018 to close at its 52-week low of $37.56. After bottoming out in late December 2018, the share price began rising again. The share price advanced to close at the end of trading at $42.77 on July 12, 2019. While still 20% below its level from one year earlier, the July 12, closing price was 13.3% higher than the 52-week low from late December 2018.

Dividends

International Papers’ upcoming $0.50 quarterly dividend payout is 5.3% higher than the $0.475 amount from the same period last year. This new quarterly dividend amount is equivalent to a total annual distribution of $2.00 and a 4.7% forward dividend yield. This yield level is nearly 26% higher than International Paper’s own five-year yield average of 3.74%.

Moreover, International Paper’s current 4.7% yield is 154% higher than the 1.85% average yield of the entire Consumer Goods sector and 83% above the 2.56% simple average yield of the Paper & Paper Products industry segment. Also, the 4.7% current yield is even 6.1% higher than the 4.43% average yield of the segment’s only dividend-paying companies.

Since resuming dividend hikes in 2010, IP has enhanced its annual dividend distribution more than six-fold. This advancement corresponds to an average annual growth rate of nearly 20%.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic