Is Apple’s Current 1.7% Dividend Yield Enough to Incentivize Investor Buying? (AAPL)

By: Ned Piplovic,

Apple, Inc. (NASDAQ:AAPL) has a current streak of annual dividend hikes and currently pays a 1.7% dividend yield which, along with a potential share price rebound, could incentivize investors to consider taking a long position or adding additional shares to their existing positions in the company’s stock.

Apple initiated dividend distributions back in 1987 and doubled its quarterly payout amount by the time the company suspended its dividend distributions after the end of 1995. However, since resuming the quarterly distributions in mid-2012, the company has hiked its annual dividend distribution every year. Apple’s current dividend payout ratio of just 23% is very low and offers significant assurance that the company will be able to maintain its dividend distributions and annual hikes going forward. In addition to paying less than a quarter of its earnings as dividends, the company’s current $245 billion in cash on hand inspires additional confidence that the dividend distributions will continue.

In addition to a steady streak of annual dividend hikes, the company’s recent share price pullback might provide an additional stock buying incentive for investors convinced that the share price will recover and that the company will extend its rising dividend streak. Investors will have to wait until the next period to find out whether the company will increase its dividend for 2019. Based on Apple’s dividend boost pattern since 2013, investors should expect the company to declare its next dividend hike — if any — at the beginning of May 2019, to be distributed approximately three weeks later.

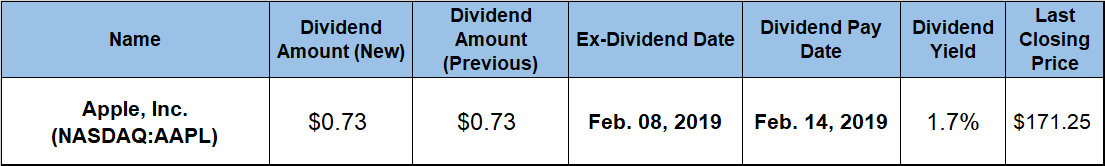

However, in the interim, the company declared on January 29, 2019, that it will distribute its current quarterly dividend on the February 14, 2019, pay date to all its eligible shareholders prior to the February 8, 2019, ex-dividend date. Therefore, investors interested in taking a long position or extending their existing positions should conduct their research quickly to confirm that Apple’s current asset appreciation potential and dividend yield fit within their investment portfolio strategy.

Apple, Inc. (NASDAQ:AAPL)

Headquartered in Cupertino, California, and founded in 1977, Apple Inc. designs, manufactures and markets mobile communication and media devices and personal computers. The company also sells related software, services, accessories, networking solutions, third-party digital content and applications. The company’s main product offerings include the iPhone line of smartphones, the iPad line of tablet computing devices and the Mac line of desktop and portable personal computers. Additionally, Apple offers several media devices, such as the Apple TV digital content streaming device, the Apple Watch personal electronic device, the iPod touch digital music and media player, as well as Apple-branded and third-party accessories for its devices. The company also offers several proprietary operating systems to run its devices. Apple’s other software offerings include the iWork integrated productivity suite and other application software, such as Final Cut Pro, Logic Pro X and FileMaker Pro. Furthermore, the company provides its iCloud service for remote data storage, the AppleCare customer support service and its Apple Pay cashless payment service. The company distributes digital content and applications through the iTunes Store, App Store, Mac App Store, TV App Store, iBooks Store and Apple Music.

The company’s current $0.73 quarterly dividend payout amount corresponds to a $2.92 annualized distribution and a 1.7% forward dividend yield, which is identical to the company’s average yield over the last five years. However, if Apple follows the recent hike pattern and boosts the quarterly payout at least 10%, the total annual dividend distribution could exceed $3.20 per share for 2019, which would be equivalent to a dividend yield of nearly 1.9% at the current share price.

Apple’s current dividend yield of 1.7% is lower than what most income investors desire. However, while below the average dividend yield of many other sectors, Apple’s current yield is nearly 45% above the 1.18% simple average yield of the entire Technology sector. Over the past six consecutive years, the company has enhanced its total annual dividend payout amount nearly 80%. This growth level corresponds to an average annual growth rate of more than 10% per year.

The company’s share price declined significantly at the end of 2018. However, after gaining more than 20% in 2019, the asset appreciation combined with the dividend income has managed to provide an 11% total return on shareholders’ investments over the past 12 months. Long-term investors have enjoyed even higher returns, with a total return of more than 80% over the past three years and nearly 150% over the past five years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic