Lockheed Martin Boosts Quarterly Dividends 10% (LMT)

By: Ned Piplovic,

A defense equipment manufacturer and contractor boosted its quarterly dividends 10% versus the previous quarter and has rewarded shareholders with a share price growth of more than 37% in the last 12 months.

While President Trump has been promising to cut and streamline military expenditures by renegotiating costs, his promise to build up U.S. military readiness and the increasing tensions in international relations could offset those cost cuts and even increase total spending on military equipment. As a result, even foreign nations are considering expanding their military buildup.

This spending should allow the Pentagon’s number one supplier of weapons and defense systems to maintain its accelerated asset appreciation path and dividends growth that the company has experienced since 2012.

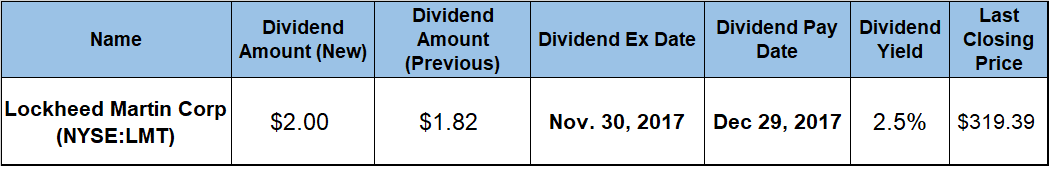

The company has its next ex-dividend date on November 30, 2017, and its next pay date is scheduled for December 29, 2017.

Lockheed Martin Corp. (NYSE:LMT)

The Lockheed Martin Corporation – a security and aerospace company – engages in the research, design, development, manufacture and integration of technology systems, products and services worldwide. The company operates through four segments: Aeronautics, Missiles and Fire Control, Rotary and Mission Systems and Space Systems. The Aeronautics segment offers combat and air mobility aircrafts, unmanned air vehicles and related technologies. The Missiles and Fire Control segment provides air and missile defense systems, tactical missiles and air-to-ground precision strike weapon systems, logistics and fire control systems, manned and unmanned ground vehicles and energy management solutions. Additionally, the Rotary and Mission Systems segment offers military and commercial helicopters, sensors for rotary and fixed-wing aircraft, sea and land-based missile defense systems, radar systems and simulation systems for training. This segment also provides government cybersecurity and delivers communications and command capabilities for defense applications. The Space Systems segment offers satellites, strategic and defensive missile systems and space transportation systems. Also, this segment offers classified systems and services for the support of national security systems. Lockheed Martin was founded in 1909 and the company’s headquarters are in Bethesda, Maryland.

The company’s share price rose with almost no volatility over the past five years. Through that period, the company’s share price climbed more than 240%. In the last 12 months, the share price increased 37.3% from $232.57 on October 13, 2016, to $319.39 at the close of trading on October 13, 2017. Last October’s share price and the current share price are only marginally – less than 1% – away from a 52-week low of $230.52 on October 13, 2017, and its 52-week high of $321.15 on October 12, 2017.

If the share price performance is not enough for investors to consider taking a long position in LMT, its equally impressive dividend performance may seal the deal. The company hiked its quarterly dividends by 10% from $1.82 in the previous quarter to the current $2.00 quarterly dividend. The annualized $8.00 dividend amount yields 2.5%.

An industry giant, Lockheed Martin also is a leader among its peers when it comes to dividend yields. Its current 2.5% yield is 116% higher than the 1.16% average yield of the entire Industrial Goods sector and 191% higher than the average yield of LMT’s peers in the Aerospace & Defense segment.

The company’s share price growth drove the current yield below its five-year average yield. However, that does not mean that LMP’s dividends underperformed. Since 2002, the company boosted its annual dividend payout for 15 consecutive years. Over that period, the annual dividend amount rose at an average rate of 21.3% per year. At this rate, the current $8.00 annual dividend is more than 18-fold higher than the $0.44 total annual dividend amount from 2002.

Whether investors are looking for consistent asset appreciation or steady dividends income, Lockheed Martin’s stock provides both. The combined benefit of the rising dividends and share price ascent compensated LMT’s shareholders with total returns of 42%, 97% and 280% over the past one year, three years and five years, respectively.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic