McDonald’s Offers Four Decades of Dividend Hikes (MCD)

By: Ned Piplovic,

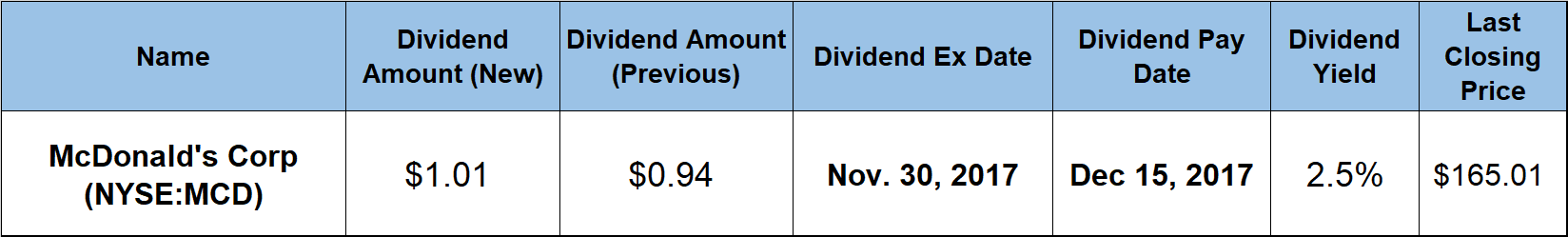

A fast food company boosted its quarterly dividend 7.4% to reward its shareholders with the 41st consecutive year of dividend hikes.

In addition to more than four decades of consecutive dividend increases, the company brought its investors a 47.4% total return over the last 12 months and currently pays a 2.5% dividend yield. McDonald’s is a member of the exclusive Dividend Aristocrats group of 51 S&P 500 companies with market capitalization of at least $3 billion that have a minimum of 25 years of consecutive annual dividend hikes.

The company’s next upcoming ex-dividend is on November 30, 2017 and the next pay date is about two weeks later, on December 15, 2017.

McDonald’s Corp (NYSE:MCD)

Founded in 1948 as the McDonald’s Bar-B-Q restaurant in San Bernardino, California, McDonald’s Corporation operates and franchises McDonald’s restaurants in the United States and more than 100 countries internationally. The company’s restaurants offer hamburgers and other food products, desserts, soft drinks, coffee and other beverages. While McDonald’s restaurants offer a very standardized menu across all its locations, there are geographic variations to suit local consumer preferences and tastes. Since 2015, McDonald’s has been operating under a new organizational structure with four segments grouped by markets with similar characteristics, challenges and opportunities for growth.

The U.S. Market is the largest in terms of number of restaurants, revenues and operating income. The International Lead Markets segment includes some of the largest, best resourced and most established markets in developed countries and similar market. Eight key markets in Asia and Europe – China, Korea, Russia, Poland, Italy, Spain, the Netherlands and Switzerland – make up the High Growth Markets segment, which has higher-than-average restaurant expansion and franchising potential. The Foundational Markets is the company’s largest and most diverse geographical segment. his segment spans more than 80 markets across Latin America, Europe, Middle East & Africa and Asia. Currently, the company has nearly 37,000 locations worldwide. In early 2018, the company will relocate its headquarters from its current location in Oak Brook, Illinois, to Chicago’s West Loop.

The company boosted its quarterly dividend 7.4% from $0.94 to the current $1.01 payout. This current quarterly payout is equivalent to a $4.04 annual amount and a 2.5% dividend yield. The current boost is just the most recent in a series of 41 consecutive annual dividend hikes since the company started paying a dividend in 1976. Over the past 20 years, MCD managed annual dividend hikes at an average annual rate of 17.3% per year. Because of two decades of significant dividend hikes, the company enhanced its total annual dividend more than 24-fold. Additionally, the company’s current dividend yield outperformed the average yield of the Services sector and the Restaurant segment by more than 27%.

In addition to the significant and growing dividend income, MCD’s investors received a 46.8% asset appreciation over the past year. After a 1.6% drop in the middle of October 2016, the share price closed at its 52-week low of $110.57 on October 20, 2016. However, since the beginning of November 2016, the share price reversed course and rose almost 50% between the October 2016 and its new 52-week high, as well as an all-time high, of $165.37 on October 13, 2017. One trading day after the October high, the share price dropped slightly and closed at $165.01, which is 46.8% higher than its was 12 months ago.

While the stock traded relatively flat for almost four years prior to 2015, the last two years showed significant share price growth to accompany the rising dividend income. Just in the past 12 months, MCD’s investors enjoyed a 47.2% total return and almost doubled their investment with a 95.19% total return over the past three years.

Related Articles:

5 Best Dividend Aristocrats to Buy Now

The Dividend Aristocrats Investing Strategy and Stocks List

The Best Dividend Aristocrats ETFs

Why Invest in the Dividend Aristocrats?

The S&P 500 Dividend Aristocrats — Everything You Need to Know

What are the Dividend Aristocrats?

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic