Meredith Corporation Offers Investors 4% Dividend Income Payouts (MDP)

By: Ned Piplovic,

Meredith Corporation (NYSE:MDP) – a magazine publisher – continues to reward its shareholders with strong dividend income distributions over the long term.

The company has been rewarding investors with dividend income distributions since 1930 and has hiked its annual dividend amount for the past 25 consecutive years. Over that period, the company managed to maintain an average growth rate of 11% per year and enhanced its total annual dividend income payouts more than 13-fold.

While providing a steady asset appreciation for nearly three decades, the company encountered some headwinds in 2007 while converting its business from traditional magazine and newspaper print model and incorporating digital media into its product portfolio. During this transition, the company’s share price lost nearly 80% of its value between May 2007 and February 2009. While experiencing increased volatility, the share price has recovered nearly 85% of its losses and advanced 325% since bottoming out in early 2009.

The share price is down almost 10% over the past 12 months. However, the 50-day moving average (MA) continues to rise after crossing above the 200-day MA on November 9, 2018. Furthermore, the share price also has remained above both moving averages since the beginning of November. These technical indicators might suggest a prolonged uptrend. If the rising trend indeed continues, the current share price has nearly 15% room on the upside before it reaches the analysts’ average target rate of $60.20.

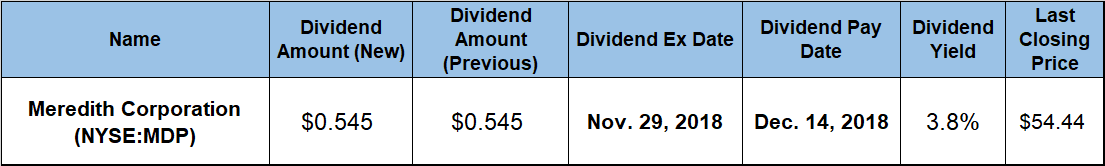

The company will distribute its next dividend on the company’s December 14, 2018 pay date to all its shareholders of record prior to the November 29, 2018 ex-dividend date.

Meredith Corporation (NYSE:MDP)

Headquartered in Des Moines, Iowa and founded in 1902, the Meredith Corporation operates as a diversified media company in the United States, Europe and Asia through two main business segments. The Local Media segment operates approximately 17 television stations that include local CBS, FOX, ABC, NBC and MyNetworkTV affiliates, as well as 2 independent stations. The National Media segment offers national consumer media brands through various media platforms, including print magazines, digital and mobile media, brand licensing, database-related activities and business-to-business marketing services. The company distributes multiple publications, including People Magazine, Better Homes & Gardens, InStyle, Allrecipes, Real Simple, Shape, Southern Living and Martha Stewart Living, as well as 275 other special interest publications under nearly 70 separate brands. Additionally, this segment operates a creative content studio called The Foundry, which develops content marketing programs across various platforms. The content studio provides native advertising that enables clients to engage new consumers and build long-term relationships with existing customers for a range of industries.

The company’s share price peaked at $71.80 on December 11, 2017 and then settled into a six-month-long decline. After that decline, the share price bottomed out at $47.85 on June 5, 2018 and reversed direction again to embark on a volatile and slow recovery. The share price declined again almost 9% during the overall market pullback in October 2018 but recovered all those losses by the first week in November. While the overall markets continued to struggle, the MDP’s share price maintained its level and closed on November 20, 2018 at $54.44. While still 9.5% lower than it was last year, this closing price was almost 14% higher than the 52-week low from the beginning of June 2018.

Unlike the struggling share price, the company’s dividend continues to advance. The current $0.545 quarterly dividend income payout is 4.8% higher than the $0.52 payout amount from the same period last year. This new dividend amount corresponds to a $2.18 annualized distribution and yields 4%, which is 11% above the company’s own 3.6% five-year average. Furthermore, MDP’s current dividend yield is double the 2% average yield of the overall Services sector, as well as nearly 90% higher than the 2.12% simple average of the Publishing & Newspaper industry segment.

Over the past two decades the company enhanced its total annual dividend income payout nearly eight-fold, which corresponds to an average annual growth rate of nearly 11%. Even over the past decade, the Meredith Corporation managed to maintain an average dividend growth rate of nearly 10% while advancing the total annual payout amount more than 150%

While the dividend income was unable to fully compensate for the share price decline over the past year, the dividend payouts managed to offset some of the damages and limit the total shareholders’ loss to 3.2%. However, the company delivered a total return of more than 28% over the past five years and a total return of 36% over the past three years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic