Mobile Mini Offers 10%-Plus Dividend Surge (MINI)

By: Ned Piplovic,

Mobile Mini, Inc. (NASDAQ:MINI) boosted its first-quarter dividend amount more than 10% for the fourth consecutive year and offers its shareholders a 2.4% yield.

In addition to the rising dividend, the company rewarded its investors with asset appreciation of more than 30% and a total return of nearly 34% over the past 12 months. The company’s fourth-quarter results exceeded analysts’ expectations and the 2018 outlook for the company’s business segment looks promising for continued dividend and share price growth in the near-term.

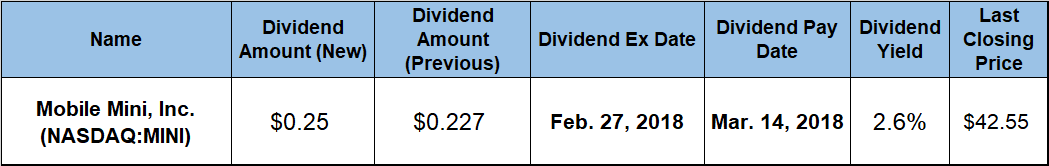

Mobile Mini’s next upcoming ex-dividend date is set for February 27, 2018, and the pay date follows just a few weeks later, on March 14, 2018.

Mobile Mini, Inc. (NYSE:MINI)

Based in Phoenix, Arizona, and founded in 1983, Mobile Mini, Inc. provides various portable storage and office products, as well as specialty containment solutions primarily for industrial applications. The company’s storage and office products segment offers steel storage containers and steel ground level offices for use in a range of applications. Additionally, the company’s containment solutions business segment provides a range of specialty containment equipment and services comprising tanks, tank trailers, pumps and filtration equipment. As of December 31, 2017, the company owned more than 215,000 storage containers and office units located in more than 160 locations across the U.S., Canada and the United Kingdom. The company has been publicly traded on the NASDAQ exchange since 1994 and is part of the Russell 2000, Russell 3000 and the S&P Small Cap indices.

Since starting to distribute dividends to its shareholders in 2014, the company has hiked its first-quarter dividend amount at least 10% every year, and this year was no exception. The current $0.25 quarterly dividend is 10.1% higher than the $0.227 payout from the first quarter of 2017. This current quarterly distribution is equivalent to a $1.00 annualized amount and a 2.4% forward yield. The consistent annual dividend hikes resulted in a 10.1% compounded annual growth rate and a 47% total annual payout increase over the past four years.

The company’s current yield is 8.6% higher than the 2.18% average yield of all the companies in the Packaging & Containers market segment and on par with the 2.4% average yield of only the dividend-paying companies in the segment. Compared to the 1.76% average yield of Mobile Mini’s peers in the entire Consumer Goods sector, the company’s current yield is almost 35% higher.

The company’s share price declined more than 15% from $32.10 on February 8, 2017 to its 52-week low of $27.25 on May 12, 2017. After the year’s low, the share price recovered all its previous losses, continued to rise for a total gain of 33% and closed on January 25, 2018, 13% above the February 7, 2018, price level.

After the positive fourth-quarter data release, the share price surged almost 21% in just 12 days to reach its 52-week high of $43.75 on February 6, 2018. The share price pulled back 2.7% and closed at the end of trading the following day at $42.55. This closing price was 56% above the 52-week low from May 2017, 32.6% higher than it was one year earlier and nearly 70% above its price from five years prior.

The combined benefit of a steady asset appreciation and rising dividend payouts rewarded Mobile Mini’s shareholders with a total return on investment of nearly 34% over the past 12 months. The company’s share price peaked at the end of June 2014, and the current price is more than 13% below that peak level. Therefore, the three-year total return of 28% is lower than the total return for the trailing one-year period. The total return over the past five years was 93.4%.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic