National Storage Affiliates Trust Boosts Quarterly Dividend 7.7%, Offers 4.2% Yield (NSA)

By: Ned Piplovic,

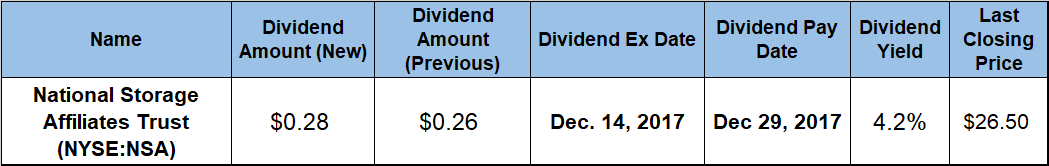

The National Storage Affiliates Trust boosted its most recent quarterly dividend 7.7% and rewards its shareholders with a 4.2% dividend yield, which is higher than the Financials sector’s average yield.

The company boosted its quarterly dividend payout in six out of the last 11 quarters and in the process doubled its quarterly dividend amount in less then three years. Additionally, the share price doubled over the same period and rose almost 30% just in the past 12 months.

The next ex-dividend date is on December 14, 2017. The pay date will follow the ex-dividend date by approximately two weeks and is set for December 29, 2017.

National Storage Affiliates Trust (NYSE:NSA)

Formed in 2013 and based in Greenwood Village, Colorado, National Storage Affiliates is a self-administered, self-managed real estate investment trust (REIT) whose primary focus is acquisition, ownership and operation of self-storage facilities. The company operates and expands through ongoing contributions from its Participating Regional Operators (PROs), third party acquisitions and joint venture partnerships. Since its formation in 2013 by three self-storage operators that collectively owned 100 properties, the REIT has added five additional operators and expanded its property base more than five-fold. As of November 1, 2017, NSA had ownership interests in and operated 512 self-storage properties located in 29 states with more than 250,000 individual storage units that have a combined rentable space of approximately 32 million square feet. Out of the 512 total facilities, the trust wholly owns 441 locations and the remaining 71 locations are owned through joint ventures. According to the 2016 Self-Storage Almanac, NSA is the sixth-largest owner and operator of self-storage facilities in the United States.

The REIT boosted its $0.26 quarterly dividend from the previous period by 7.7% to the current $0.28 dividend payout. This current quarterly dividend converts to a $1.12 annualized dividend amount and yields 4.2%. The trust’s current yield is 10% higher than the 3.84% average yield of the Financials sector and 9.5% higher than the 3.86% average yield of all the companies in the Industrial REITs segment.

Over the 11 quarters since the REIT’s initial public offering in 2015, the trust hiked its dividend distribution amount six times, which is an average of more than twice per year. The result of these hikes is an average growth rate of 5.8% per quarter and the doubling of the quarterly dividend amount in less than three years. The average quarterly growth rate is equivalent to a 25%-plus average annual growth rate.

Over the last year, the share price rose steadily with only one significant drop, but recovered quickly and ended the period even higher than it was prior to that downturn. The share price experienced an initial growth of 31% between its 52-week low of $19.78 on December 1, 2016, to $25.94 on April 18, 2017. After stopping just short of hitting $26, the share price reversed course and dropped 18% to $21.24 by August 18, 2017.

However, the share price reversed trend once again, recovered all losses since April 18 by November 7, 2017, and continued to ascend towards its new 52-week high of $26.67, which it reached on November 27, 2017. The share price pulled back marginally and closed on November 29, 2017, at $26.50, which was just 0.6% below the 52-week high from just two days earlier and 28.8% higher than the 52-week low from December 1, 2016.

The combination of a rising dividend that pays above-average yield and a substantial asset appreciation over the last 12 months have rewarded National Storage Affiliates Trust’s shareholders with a 33.9% total return. If the REIT pays the same current dividend amount next quarter, the three-year total return will be 123%.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic