Newtek Offers Shareholders 26% Quarterly Dividend Increase, 10% Dividend Yield (NASDAQ:NEWT)

By: Ned Piplovic,

Despite a recovering share price, which suppresses the dividend yield, Newtek Business Services Corporation’s (NASDAQ:NEWT) rising dividend distributions managed to deliver a dividend yield of 10%.

As a business development company, which is one type of a regulated investment company (RIC), Newtek must distribute at least 90% of its profits to shareholders to the favorable taxation status. The business development company classification means that Newtek does not pay any corporate income tax on profits before distribution, which is the main draw to investing in business development companies. The flow through of profits directly to shareholders without taxation results in high dividend yield rates desired by most income investors.

In addition to distributing at least 90% of its profits to shareholders, business development companies must meet few additional requirements to maintain their status. A company must register to operate as a business development company in compliance with Section 54 of the Investment Company Act of 1940. Additionally, the business entity must be a domestic company and the company’s securities must be registered United States Securities and Exchange Commission (SEC).

Furthermore, the business development company must invest at least 70% of its assets into public or private U.S. companies whose market value does not exceed $250 million. Many of these small and medium business companies are new businesses in need of financing, in financial difficulties or emerging from financial problems, which is the main risk factor of investing in business development companies. Therefore, the business development company also must provide management assistance to the companies in its portfolio.

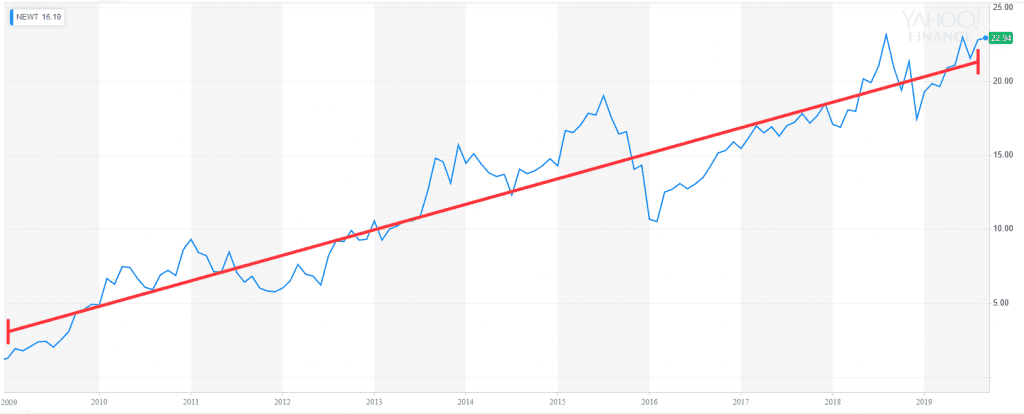

However, Newtek has managed to deliver strong dividend income payouts, as well as asset appreciation over the long term. Driven by the downward pressure from the overall market correction, Newtek’s share price has experienced a pullback in late 2018. However, just as few other pullbacks over the past decade indicated in the graph below, this was just a temporary event. The share price has been rising since the beginning of 2019 and has recovered almost all of its losses.

Graph Source: Yahoo Finance

Furthermore, during its recovery, the rising share price has pushed the 50-day moving average back above the 20-day average in a bullish manner at the beginning of May 2019. Driven by the rising share price, the 50-day average has been continuing its uptrend and is currently 5.6% above its 200-day counterpart. Additionally, after a brief dip below the 50-day moving average, the share price has been trading above both moving averages since late August, which might be an indication that the current share price uptrend could continue.

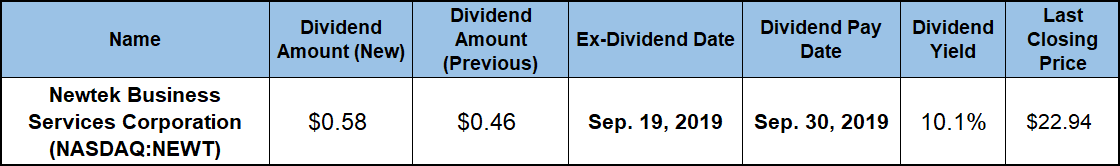

Newtek’s next ex-dividend date is set for September 19, 2019. All investors who can claim stock ownership before that date will be eligible to receive the next round of dividend distributions on the September 30, 2019, pay date.

Newtek Business Services Corporation (NASDAQ:NEWT)

Headquartered in Lake Success, New York, and founded in 1998, the Newtek Business Services Corporation is a management investment company. The company began trading publicly in 2000 and has been a business development company since 2014. The company provides a wide range of business and financial solutions under the Newtek brand to small and medium business companies. Newtek offers business loans, electronic payment processing, payroll management processing and employee tax filing, as well as receivable purchasing and financing services. Furthermore, the company offers nationwide commercial, health, benefits and personal lines of insurance. Additionally, Newtek offers a selection of technology and web-based services, including full service web hosting, domain registration, online shopping cart tools, customized web design and development services. Also, Newtek provides outsourced digital bookkeeping and recordkeeping.

Dividends

The company began dividend distributions in December 2009. Because of its business development company status, Newtek’s quarterly distributions fluctuate from period to period. However, the company has increased its total annual dividend payout nearly 50% over the past three consecutive years. This advancement pace corresponds to an average growth rate of nearly 14% per year.

The current $0.58 payout amount for the upcoming dividend distribution is 26% higher than the $0.46 distribution from the previous period. This new quarterly payout corresponds to a $2.32 annualized payout and a 10.1% forward dividend yield. Because the share price rose faster than Newtek’s dividend payouts, the current dividend yield is almost 16% lower than the company’s own 12% average yield over the last five years.

However, while trailing its own five-year average, Newtek’s current dividend yield is almost six times higher than the 1.69% average yield of the overall Services sector. Additionally, the current dividend yield also outperformed by 640% the 1.37% simple average yield of the Business Services industry segment. Furthermore, Newtek’s current dividend yield is also 320% higher than the 2.4% average yield of the segment’s only dividend-paying equities.

Share Price

After spiking in July and August 2018, the share price reversed direction and started declining in the last quarter of 2018 along with the overall markets. Riding that downtrend, the share price began its trailing 12-month period from its 52-week high of $23.13 on September 12, 2018. From there, the shareprice lost 32% of its value before reaching its 52-week low of $15.69 on December 21, 2018.

However, since reversing direction in late-December 2018, the share price has been on a steady uptrend. The share price recovered more than 97% of these losses before closing on September 11, 2019, at $22.94. While still 0.8% below the 52-week high from one year earlier, this closing price was 46.3% above the 52-week low from late-December 2018, as well as 68% higher than it was five years ago.

The high dividend yield overcame the small difference to deliver a 7.6% total return over the past 12 months. However, the shareholders nearly doubled their investment with a total return of more than 98% over the past three years and enjoyed a 143% total return over the last five years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic