NextEra Energy Offers Two Decades of Annual Dividend Boosts (NEE)

By: Ned Piplovic,

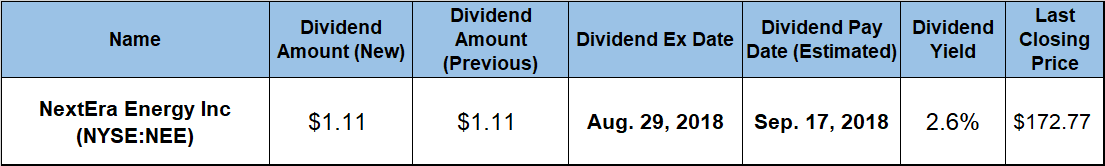

NextEra Energy, Inc. (NYSE:NEE), a Florida-based electricity producer and distributor, has rewarded its shareholders with annual dividend boosts for the past 20 consecutive years and is currently offering a 2.6% forward dividend yield.

In addition to rewarding its shareholders with two decades of annual dividend hikes, the company also offered a relatively steady asset appreciation for nearly a decade. Just over the past year, the company’s 16% capital growth combined with the annual dividend income for a total return on shareholders’ investment of nearly 20%. The shareholders also more than doubled their money over the past five years.

Investors interested in a stock with balanced returns from increasing annual dividend income, as well as stable share price growth, should confirm the company’s financial stability by conducting their own due diligence. Any investors that choose to take a long position in NextEra’s stock should do so before the next ex-dividend date on August 29, 2018. The pay date will follow a few weeks later, on September 17, 2018.

NextEra Energy, Inc. (NYSE:NEE)

Headquartered in Juno Beach, Florida, and founded in 1984, NextEra Energy, Inc. generates electric power and distributes electricity to residential and commercial customers primarily in Florida. Based on more than 46,000 MW of generating capacity with electric generation facilities located in 30 U.S. states and four Canadian provinces, NEE is one of the largest electric power companies in North America. The company operates through two main subsidiaries – Florida Power & Light Company (FPL) and NextEra Energy Resources (NEER). FPL provides electricity distribution to more than 5.5 million residential and commercial customer accounts and 10 million people across almost half the state of Florida.

Through its NEER subsidiary and its affiliated entities, NextEra Energy is the largest generator of renewable energy from the wind and sun in the world based on Megawatt hours (MWh) produced in 2016. Representing approximately 6% of U.S. nuclear power electric generating capacity, the company had one of the largest arrays of nuclear power stations in the United States, with eight reactors at five sites located in Florida, New Hampshire, Iowa and Wisconsin. NEER’s assets accounted for approximately 11% of the installed base of universal solar power production and about 16% of the installed base of wind power production capacity in the United States.

The company’s current $1.11 quarterly dividend is almost 13% higher than the $0.9825 payout from the same period last year. This new $1.11 quarterly distribution corresponds to a $4.44 annualized payout and currently yields 2.6% at current share price levels, which is in line with the company’s yield average over the past five years.

The company managed to maintain an average dividend growth rate of 7.7% over the past two decades. As a result of compounding its annual dividend boosts at that rate, the company has advanced its total annual dividend payout almost 350% above the $1.00 annualized dividend distribution paid in 1997. Additionally, the company’s current yield is right on pace with the average yields of NextEra Energy’s peers in the Electric Utilities industry segment and 2% higher than the average yield of the overall Utilities sector.

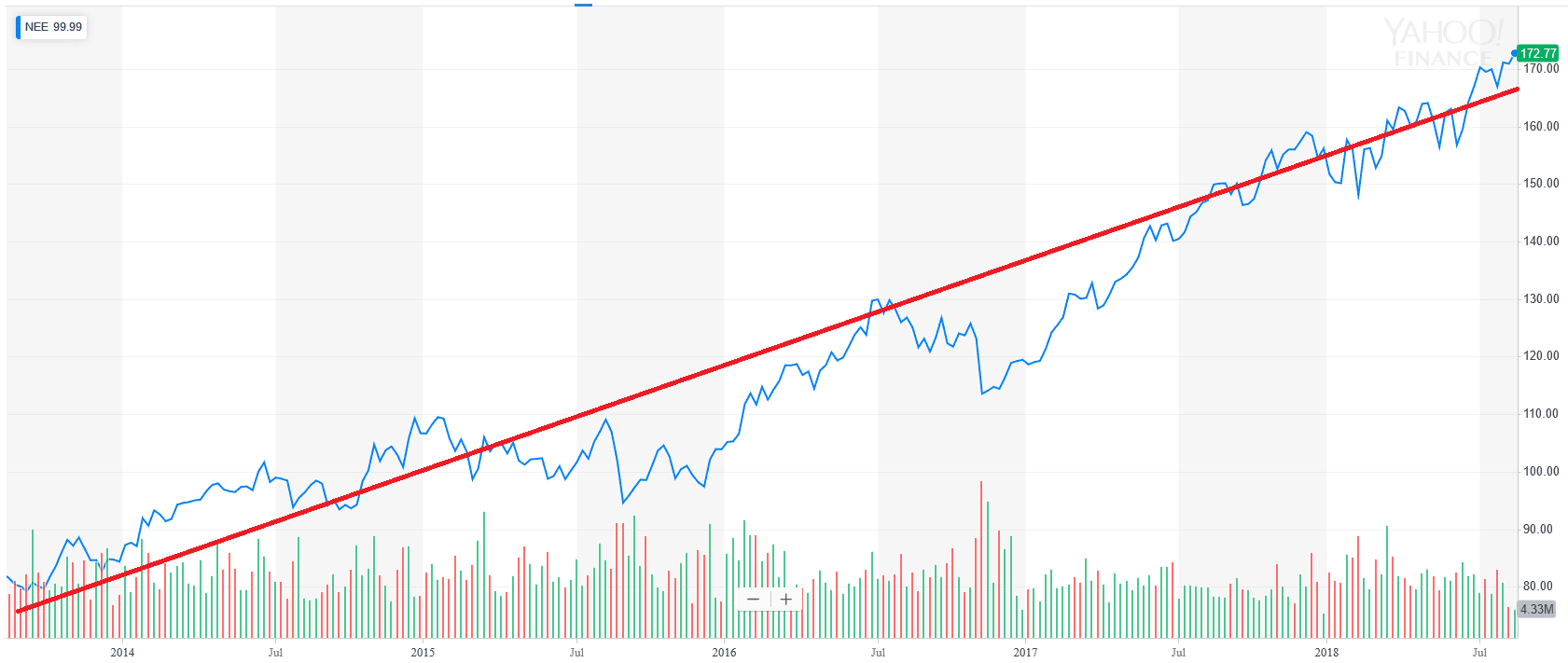

The company’s share price has performed as a textbook example of a long-term growth equity. As the graph below shows, the share rose steadily with minimal volatility. The share price’s performance seems almost boring, which is exactly what long-term investors should seek for their portfolio.

NextEra Energy, Inc. (NYSE:NEE): share price over last five years; Chart Source: Yahoo Finance

NextEra Energy, Inc. (NYSE:NEE): share price over last five years; Chart Source: Yahoo Finance

Similar to its five-year performance, the share price grew almost uneventfully over the last 12 months. The only significant step outside the rising trend was an 8.2% drop in the first week of February, when NEE’s share price followed the drop of the overall market. However, the share price fully recovered those losses by mid-March and continued to ascend towards its 52-week high of $172.77 on August 15, 2018. That closing price marked a total gain of nearly 19% above the February low. Additionally, the August 15 closing price is also 16% higher than it was 12 months earlier and more than 110% higher than it was five years ago.

The combined benefit of the company’s increasing share price and its rising dividend income rewarded the shareholders with a total return on investment of nearly 20% over the last year and almost 70% over the past three years. However, the shareholders more than doubled their investment over the past five years with a total return of 125%.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic