Norwood Financial Corporation Boosts Annual Dividend for Two Decades (NWFL)

By: Ned Piplovic,

Norwood Financial Corporation (NASDAQ:NWFL) has hiked its annual dividend distribution every year since it started paying dividends in 1998 and currently offers its investors a 2.6% dividend yield.

In addition to raising its annual dividend payout amount for 20 years, the company’s current yield is significantly higher than the average yield of all the other regional banks in the U.S. Northeast. To complement its steadily rising income, the company grew its share price almost 50% over the past 12 months for a total shareholder return of more than 54% since December 2016.

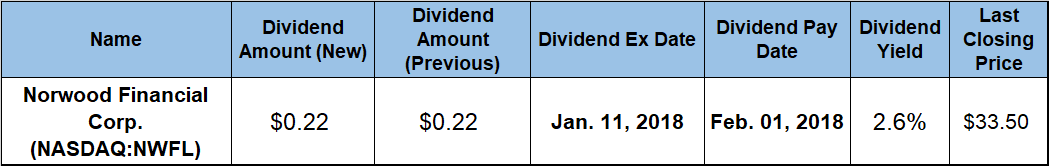

Norwood Financial Corporation‘s next ex-dividend date is set for January 11, 2018, and the company’s pay date will be on February 1, 2018.

Norwood Financial Corporation (NASDAQ:NWFL) has hiked its annual dividend distribution every year since it started paying dividends in 1998 and currently offers its investors a 2.6% dividend yield.

Norwood Financial Corporation (NASDAQ:NWFL) has hiked its annual dividend distribution every year since it started paying dividends in 1998 and currently offers its investors a 2.6% dividend yield.

Norwood Financial Corporation (NYSE:NWFL)

The Norwood Financial Corporation operates as the bank holding company for Wayne Bank, a small regional bank with operations in Northeastern Pennsylvania and two neighboring counties in New York state. The bank provides customary banking services, including a range of deposit products and various loans, as well as indirect dealer financing of new and used automobiles, boats and recreational vehicles. Additionally, the bank provides investment securities, cash management, automated clearing house, trust, title and real estate settlement services.

Founded in 1871 as the Wayne County Savings Bank in Honesdale, Pennsylvania, the bank currently operates 14 offices in Northeastern Pennsylvania, 12 offices in New York’s Delaware and Sullivan Counties and 28 automated teller machines (ATMs). Wayne bank became a subsidiary of the Norwood Financial Corporation when the new bank holding company was created in 1996.

The company’s current $0.22 quarterly dividend distribution is equivalent to a $0.88 annualized payout and currently yields 2.6%. This current quarterly distribution amount is 3.1% higher than it was in the same period last year. The most recent annual dividend hike marks the company’s 20th consecutive annual dividend boost. Since starting to pay dividends in 1998, the company has boosted its annual payout amount every year. Over the last two decades, the annual dividend payout rose at an average rate of 8.6% per year and resulted in a nearly five-fold boost to the company’s annual distribution amount.

The company’s current 2.6% dividend yield is about 1% higher than the average yield of the entire financials sector. This is a significant accomplishment, as high-yield equities, such as real estate investment trusts (REITs), tend to drive higher the average yield of the entire sector. When compared to the 1.76% average yield of its peers in the Northeast Regional Banks segment, Norwood Financial Corporation’s current 2.6% yield is 49% higher.

The company’s share price traded flat in the $18 to $21 range for more than three years between late 2012 and late 2016, before taking off on the current uptrend that saw the share price rise almost 50% over the past 12 months. In the first few days of the trailing 12-month period, the share price dropped 6.3% to reach its 52-week low of $21.23 on December 29, 2016.

After bottoming out at the end of December 2016, the share price embarked on a 12-month growth spurt with minimal volatility and no significant drops. The share price rose almost 65% and reached its new 52-week high – as well as all-time high – of $34.91 on December 21, 2017. After that peak, the share price pulled back 3.7% and closed on December 27, 2017, at $33.50, which was still 47.8% higher than it was one year ago, 57.8% higher than the December 29, 2016, 52-week low and 86% higher than the share price from five years earlier.

A dividend with yields that are higher than peer average yields and the significant asset appreciation rewarded the company’s shareholders with outstanding total returns. Just over the past 12 months, the total return exceeded 54%, with the three-year total return coming in at nearly 89% and the five-year total return reaching almost 110%.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic