Nucor Corporation Offers 45 Consecutive Years of Dividend Boosts (NUE)

By: Ned Piplovic,

Featured Image Source: June 2018 Investor Overview Presentation – http://www.nucor.com/media/Investor_Overview_Slide_Package.pdf

Nucor Corporation (NYSE: NUE) started distributing dividends in 1973, and since then, the company has provided shareholders with 45 consecutive years of annual dividend boosts.

In addition to the aforementioned track record of dividend increases, Nucor’s stock has recovered quite well from some traumatizing losses in the aftermath of the 2008 financial crisis, though it still has some more ground to make up before retaking the pre-2008 highs.

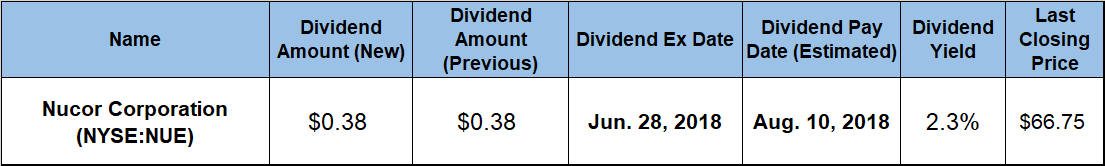

While Nucor’s share price and dividend growth rates are not very high, the combined benefit of both measures is steady long-term growth that has provided shareholders with consistent double-digit-percentage total returns. Investors looking to partake of the company’s strong total returns may want research NUE and take a position prior to the next ex-dividend date on June 28, 2018. Doing so will ensure eligibility for the upcoming distribution on August 10, 2018.

Nucor Corporation (NYSE:NUE)

Based in Charlotte, North Carolina and founded in 1940, the Nucor Corporation manufactures and sells steel and steel products through three business segments. The Steel Mills segment produces hot-rolled, cold-rolled and galvanized sheet steel products, as well as hollow structural section steel tubing, steel electrical conduit, plate steel and structural steel products. Additionally, this segment produces bar steel products, such as blooms, billets, concrete reinforcing and merchant bars, wire rods and special bar products. The Steel Products segment produces steel joists and joist girders, steel decks, fabricated concrete reinforcing, cold finished steel products, steel fasteners and metal. This segment also manufactures building systems and steel gratings, as well as wire and wire mesh products. The Raw Materials segment produces direct reduced iron, as well as processing and brokering ferrous and non-ferrous metals, pig iron, hot briquetted iron and ferro-alloys.

At this time last year, NUE distributed a $0.3775 per share dividend, which makes the current $0.38 per share payout 0.7% higher. This current quarterly dividend amount corresponds to a $1.52 annualized distribution and a 2.3% forward dividend yield at current share price levels. With asset appreciation of almost 50% over the past five years, the company’s current dividend yield has been suppressed more than 18% below the 2.8% five-year average yield. However, Nucor’s current 2.3% yield is slightly above the 2.19% average yield of the entire Basic Materials sector, and it outperforms the 1.06% simple average yield of all the companies in the Steel & Iron industry segment by nearly 115%. Even if only the segment’s dividend-paying companies were included, Nucor’s 2.3% yield is still almost 20% higher.

Between 2005 and 2008, Nucor paid special dividends in addition to its regular annual increases. Over those four years, the total special dividend distribution amount equaled 103% of the combined regular dividend payouts. For the past 20 years, the total annual dividend amount advanced more than 12-fold at an average growth rate of 13.5% per year. However, the growth rate has dropped to 1.9% over the past decade and down to 0.67% over the past five years.

After declining to a 52-week low of $53.48 on September 12, 2017, the share price ascended more than 30% towards its 52-week high of $70.18 on January 11, 2018. After the January peak, the share price experienced some volatility along with the overall markets, but nowhere near as much as some stocks. As of June 18, NUE shares had pulled back nearly 5% from their January high to close at $66.75. That closing price was almost 20% higher than it was 12 months earlier and almost 25% above the September low.

Investors who held Nucor over the last year were rewarded with a 26% total return on investment, counting share price appreciation and dividend income. Over the last three years, the total return was 51% and the five-year total return reached 67%.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic