OGE Energy Boosts Quarterly Dividend Payout Nearly 10% (OGE)

By: Ned Piplovic,

After raising its dividends for more than a decade, the OGE Energy Corporation (NYSE: OGE) has hiked its quarterly dividend payout almost 10% in time for its last round of dividend distributions in 2018.

The company’s share price suffered a decline of more than 20% early in the trailing 12-month period. However, after bottoming out at the beginning of February 2018, the share price fully recovered those losses, and the technical indicators suggest that the uptrend might continue for at least a couple of periods.

While the share price experienced increased volatility in late 2017 and early 2018, it has advanced more than 150% since embarking on its current uptrend in March of 2009. This trend reversal ended a 50% share price drop that began in February 2007. However, unlike the share price, which performed well over the long term but experienced some headwinds over more recent time horizons, the company’s dividends have been rising at full speed for decades.

OGE Energy has been distributing dividends for more than a century and has not cut its stock-split-adjusted quarterly dividend payouts for more than seven decades.

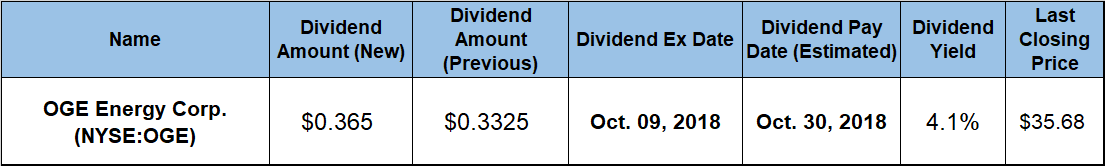

Investors looking for a long position in an electrical utility company that pays a rising dividend should take a closer look at the OGE Energy Corporation. Acquiring a long position in the company’s stock prior to the October 9, 2018 ex-dividend date will ensure eligibility to receive dividend income distributions on the upcoming October 30, 2018, pay date.

OGE Energy Corporation (NYSE:OGE)

Headquartered in Oklahoma City, Oklahoma and founded in 1902, OGE Energy Corporation is a regulated utility company that serves more than 840,000 customers in a 30,000 square mile area of Oklahoma and western Arkansas. The company’s Electric Utility segment provides retail electric service in more than 260 communities, as well as their contiguous rural and suburban areas. In addition, the segment owns and operates coal-fired, natural gas-fired, wind-powered and solar-powered generating facilities. As of May 2018, the company had approximately 6,800 megawatts of generating capacity. Half of this capacity used natural gas as a fuel source, 39% used coal and 11% used renewable energy sources. The company’s transmission and distribution infrastructure included more than 440 substations and more than 50,000 miles of electrical lines. The Natural Gas Midstream Operations segment gathers, processes, stores and distributes natural gas and crude oil to producers, industrial end users and marketers. Additionally, OGE Energy holds a 25.6% limited partner interest and a 50% general partner interest in Enable Midstream Partners, L.P. (NYSE: ENBL).

Following a decade of flat annual dividend distributions, the company started boosting its annual payouts again in 2007. The most recently declared dividend boost raised the quarterly dividend payout nearly 10% from the $0.3325 amount from the previous quarter to the current $0.365. This new quarterly dividend amount is equivalent to a $1.46 annualized payout and currently yields 4.1%, which is 24% higher than the company’s own 3.3% average yield over the past five years.

The 4.1% forward yield outperform the 2.56% average yield of all companies in the entire Utilities sector by nearly 60%. OGE Energy’s current yield is also more than 56% above the 2.56% simple average yield of the Electric Utilities industry segment. Additionally, the current yield is also almost 2% higher than the 4.02% average yield of the segment’s only dividend-paying companies.

Over the past dozen years, the company enhanced its total annual dividend amount by 120%. This level of advanced dividend growth corresponds to an average growth rate of nearly 7% per year.

The share price carried its rising trend only a month into the trailing 12-months, before reversing direction and dropping more than 20% to reach a 52-week low of $29.60 on February 8, 2018

However, after bottoming out in early February, the share price turned higher and gained 27% before reaching its 52-week high on September 10, 2018. A couple of weeks after this new peak, the share price closed on September 27, 2018 at $35.68. This closing price was marginally lower (-0.9%) than it was one year ago and more than 20% above the February low.

Over the past 12 months, the company delivered to its shareholders a small total return of 2.25%. However, the total return is significantly higher when taken into account its rising dividends, amounting to a gain of more than 45% over the past three years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic