Pharma Giant, Merck Pays Rising Dividends for Seven Consecutive Years (MRK)

By: Ned Piplovic,

After paying a flat annual dividend for seven years between 2005 and 2011, Merck & Co reverted to distributing rising dividends for the last seven years.

During the 35 years prior to the seven years of flat annual dividends between 2005 and 2011, the company has hiked its annual dividends 31 times – almost 90% of the time. Even including the past 14 years where the record of rising dividends is only 50%, the overall share of years with rising dividends is still almost 80% over nearly five decades.

Like the rising dividends, the company’s share price struggled to post any gains and traded flat for four years from the beginning of 2014 until the end of the first quarter of 2018. Merck’s share price embarking on its current uptrend in early April and currently trades at levels unseen since late 2001. Because of the combined benefit of this share price growth, as well as the rising dividends, Merck was able to deliver for its shareholders a double-digit percentage total return over the last 12 months.

The share price’s 50-day moving average (MA) crossed above the 200-day MA in a bullish manner on June 11, 2018 and continues to rise. Additionally, the share price crossed above both moving averages in late May and continues to distance itself from both indicators. With a rising dividends trend in place, these technical indicators suggest that the share price might have more room on the upside to continue its climb.

Furthermore, seven out of 11 analysts currently covering the stock have a “Strong Buy” recommendation, with one “Buy” vote and only three “Hold” recommendations.

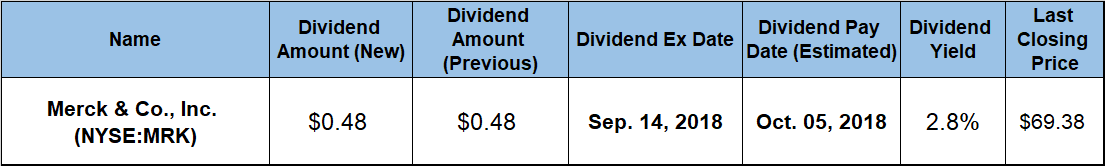

Therefore, interested investors should do their own research to confirm MRK’s compatibility with their own portfolios and act prior to the company’s next ex-dividend date on September 14, 2018. The company will distribute its next round of dividend distributions on the October 5, 2018, pay date to all its eligible shareholders.

Merck & Co., Inc. (NYSE:MRK)

Headquartered in Kenilworth, New Jersey and founded in 1891, Merck & Co., Inc. is a global health care company that focuses on the development of pharmaceutical products. Among its full spectrum of drugs and medications, the company provides therapeutic and preventive agents to treat cardiovascular diseases, type 2 diabetes, acute and chronic pulmonary conditions, chronic hepatitis C virus, HIV-1 infection, fungal, intra-abdominal infections, arthritis and pain, inflammatory, osteoporosis and fertility diseases. Additionally, the company offers products to prevent chemotherapy-induced and post-operative side-effects, treat brain tumors and certain types of lung cancer, as well as offers vaccines for measles, mumps, rubella, varicella, shingles, rotavirus gastroenteritis and pneumococcal diseases.

The company’s current $0.48 quarterly dividend is one cent — or 2.1% — higher than the $0.47 paid out in the same period last year. The company has followed this pattern of increasing its quarterly dividends by one cent in the first quarter of the year for the past six consecutive years. Merck’s current quarterly payout is equivalent to a $1.92 annualized payout per share and currently yields 2.8%. The rapid share-price growth in the second half of 2018 suppressed the current dividend yield to 7.8% below the 3.0% five-year average yield. At the beginning of April 2018, the yield was nearly 3.6%.

However, even the lower current yield is still 360% higher than the 0.6% average yield of the entire health care sector. Furthermore, Merck’s current 2.8% yield is 52% above the 1.82% simple average yield of Merck’s competitors in the Major Drug Manufacturers industry segment and even 6.4% higher than the 2.6% average yield of the segments’ only dividend-paying companies.

While paying rising dividends over the past seven consecutive years, the company enhanced it total annual dividend amount 26%, which is equivalent to a 3.4% average annual growth rate.

Merck’s share price fell 17% between the beginning of the trailing 12 months and its 52-week low price on April 6, 2018. However, the share price reversed direction and ascended more than 31% to peak at its 52-week high of $70.10 by August 20, 2018. After peaking in late August, the share price retreated approximately 1% to close on September 6, 2018 at $69.38. This closing price was almost 8% higher than one year earlier, 30% above its April low and 45% higher than it was five years ago.

The resurgence of capital growth and rising dividends rewarded Merck’s shareholders with significant total returns over the past few years. While the one-year total return came in at 11.4%, total returns over the past three and five years were 45.4% and 65.5%, respectively.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic