Polaris Grows Annual Dividend Double-Digit Percentages for Two Decades (PII)

By: Ned Piplovic,

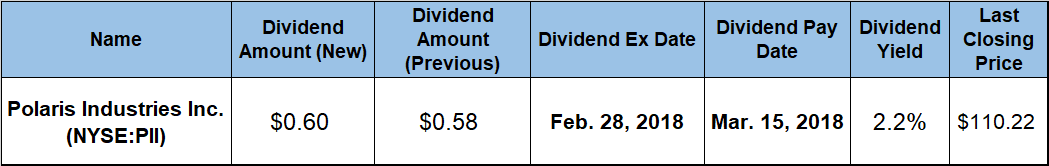

Polaris Industries, Inc. (NYSE:PII) hiked its quarterly dividend more than 3% for the first quarter of 2018 to extend its current streak of annual dividend boosts to 20 consecutive years.

While the company’s current dividend yield might not seem high compared to other industries, Polaris’ 2.2% yield is above industry average and higher than all but one yield in the company’s market segment. The company’s share price ascended more than 25% to help it deliver a total return of almost 35% for the trailing 12-month period.

The company’s upcoming ex-dividend date will occur on February 28, 2018, and the pay date will follow just a little more than two weeks later, on March 15, 2018.

Polaris Industries, Inc. (NYSE:PII)

Based in Medina, Minnesota and founded in 1954, Polaris Industries, Inc. designs, engineers, manufactures and markets power sports vehicles. The company operates through four segments – Off-Road Vehicles (ORVs) and Snowmobiles, Motorcycles, Global Adjacent Markets and Other. From its initial focus on manufacturing snowmobiles only, the company first added all-terrain vehicles (ATVs) to its product portfolio in 1984 and currently also offers ATV-based commercial vehicles for government and military use, electric motorcars and power generators.

Additionally, the company offers two brands of motorcycles – including the iconic Indian brand acquired in 2011 that dates back to 1901 – and the revolutionary Slingshot 3-wheel moto-roadster. Additionally, the company also produces and supplies replacement parts, vehicle accessories, recreational apparel and safety equipment.

The company’s $0.60 quarterly dividend distribution for the first quarter of 2018 is 3.4% above the $0.58 payout from the previous quarter. The company’s $2.40 annualized dividend for 2018 would yield 2.2% and is almost 9% higher than the company’s own average yield over the past five years.

Polaris Industries’ current 2.2% yield is almost 21% higher than the simple average yield of the entire Consumer Goods sector and 75% above the average yield of all the companies in the Recreational Vehicles market segment. Even excluding all the companies that do not distribute dividends, Polaris’ current yield is 17.7% higher than the average yield of all the dividend-paying companies in the segment. Within the Recreational Vehicles segment, the company’s current dividend yield trails only the 3.1% yield distributed by Harley-Davidson, Inc. (NYSE: HOG).

Polaris Industries has provided its investors with a reliable long-term dividend growth strategy. Over the past 20 consecutive years of dividend boosts, the company advanced its annual dividend payout at an average growth rate of 13.8% per year. The result of compounding dividend growth at such a high rate over two decades is that the annualized distribution for 2018 is more than 1,200% higher than the company’s $0.18 annual dividend distributed in 1998.

The company’s share price dropped more than 10% at the onset of the trailing one-year period from $87.72 on February 9, 2017 to reach its 52-week low of $78.82 by April 13, 2017. After bottoming out in mid-April 2017, the share price experienced some volatility but remained on a general uptrend for more than eight months and rose almost 72% to reach its 52-week high of $135.34 on January 25, 2018.

Along with the overall market drop, Polaris’ share price declined more than 18% after the late-January peak and closed on February 8, 2018 at $110.22, That closing price was still almost 40% above the 52-week low from mid-April 2017 and 25.6% higher than it was one year earlier at the beginning of February 2017.

The share price lost more than half of its value after reaching its all-time high in November 2014. However, after reversing direction in September 2016, the share price rose with minimal volatility and gained almost 92% by its current 52-week high in late January 2018, which was just 14% short of the November 2014 all-time high. Because the share price dropped after its all-time peak in 2014, the company delivered a total loss of 20% over the past three years. However, the total return over the past five years is nearly 45% and over the past 12 months the shareholders enjoyed a 35% total return on their investment.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic