Pope Resources Boosts Quarterly Distribution Amount 14.3% (POPE)

By: Ned Piplovic,

Pope Resources LP (NASDAQ: POPE) — a Delaware Limited Partnership that manages timber resources in the U.S. Northwest — is going to boost its quarterly distribution amount nearly 15% for the upcoming payout in mid-September 2018.

This quarterly distribution hike marks the company’s return to raising its annual payouts after failing to do so in 2017. However, 2017 was an atypical year, seeing as Pope Resources hiked its annual distribution six consecutive years before that. Going farther out, POPE has raised the annual distribution in 13 out of the past 16 years.

In addition, the partnership’s unit price has grown steadily over the long term. Though this growth has been accompanied by a level of volatility that many risk-averse investors would strive to avoid, it is a level normal for what can be expected from small-cap master limited partnerships (MLPs).

As such, investors looking to diversify their portfolio away from trade conflict-prone large-cap technology, manufacturing and basic materials companies should consider doing some research on Pope Resources.

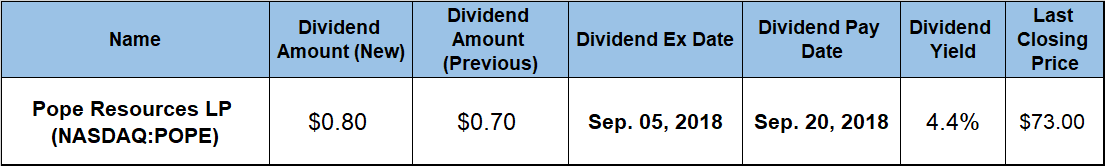

If this research indicates that POPE would be good fit for an investment portfolio strategy, investors may want to take a position before the increased quarterly distribution payout on September 20, 2018. To do so, investors need to acquire units before the ex-dividend date of Sept. 5.

Pope Resources LP (NASDAQ:POPE)

Headquartered in Poulsbo, Washington and founded in 1985, Pope Resources manages timber resources in the United States through three business segments. The Fee Timber segment grows, harvests and markets timber from more than 200,000 acres of forest land that the company owns or manages as tree farms. The company sells its logs to lumber mills, plywood mills and other wood fiber processors in western Washington, western Oregon and northern California, as well as export intermediaries located in Washington state and Oregon. Additionally, this business segment also engages in commercial thinning operations and leasing ground for cellular communication towers, gravel mines and quarry operations. The company’s Timberland Investment Management segment provides management, acquisition, disposition and consulting services to third-party owners of timberland. Lastly, the Real Estate segment secures entitlements and/or infrastructure for the development and leasing of residential and commercial properties. This segment operates nearly 3,000 acres in the west Puget Sound region of Washington and also manages daily operations of the company’s commercial properties in the historic town of Port Gamble, Washington. Pope MGP, Inc. and Pope EGP, Inc. operate as Pope MLP’s general partners.

The partnership’s unit price traded relatively flat between the beginning of the trailing 12-month period and the end of January 2018. The unit price then followed the overall market pullback in the first week of February 2018 and declined more than 5% in just one week to reach its 52-week low. However, the unit price recovered fully by the end of February and embarked on a more pronounced uptrend at the beginning of March 2018. After bottoming out in early February, the share price advanced more than 10% before it peaked at its 52-week high of $73.50 on June 26, 2018.

As of the close on Aug. 24, POPE prices had fallen back only marginally to $73.00, which was 3.6% higher than one year earlier and nearly 10% above the February 2018 low.

After paying a $0.70 per share distribution for the past 12 consecutive quarters, POPE is finally raising the distribution amount to $0.80 per share, which is 14.3% higher than prior levels. This current quarterly distribution amount corresponds to a $3.20 annual payout and a 4.4% yield, which is nearly 10% higher than the partnership’s 4% distribution over the past five years.

Even with one quarterly distribution cut and two years of flat payments, the firm has enhanced its annual distribution amount more than 13-fold and has managed an average growth rate of nearly 19% over the past 15 years. Furthermore, the company’s unit price rose more than four-fold over the past seven years — equivalent to an average annual growth rate of almost 21%.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic