Post-Election Dividend Investments to Purchase Before They Take Flight

By: Paul Dykewicz,

Post-election dividend investments to purchase before they take flight feature four funds, gold, an insurer and an e-commerce company for pet owners.

The post-election dividend investments to purchase include O’Shares funds dreamed up by Kevin O’Leary, chairman of the investment company and a wealthy panelist on the “Shark Tank” television program. O’Leary, who offered his post-election outlook in a Nov. 12 podcast, said equities offer a good place for investors during the next 36 months. He followed his own advice recently in switching from an allocation of 50% stocks and 50% fixed income in his family trust to 70% and 30%, respectively.

Paul Dykewicz completes an interview with O’Shares ETFs’ chairman.

O’Leary shared that his family trust is managed to distribute 6% per year. To meet that requiremen, he is putting about 40% of his family trust in O’Shares US Quality Dividend ETF (BATS:OUSA), offering a 2.83% dividend yield.

That exchange-traded fund (ETF) consists of high-quality, dividend-paying equities that are a subset of S&P 500 companies possessing strong balance sheets, O’Leary said. OUSA has notched returns of 1.36% in the last month, 2.50% in the last three months, 3.08% so far this year and 6.74% in the past 12 months.

Chart courtesy of www.stockcharts.com

O’Leary Deploys Several O’Shares ETFs Among Post-Election Dividend Investments to Purchase

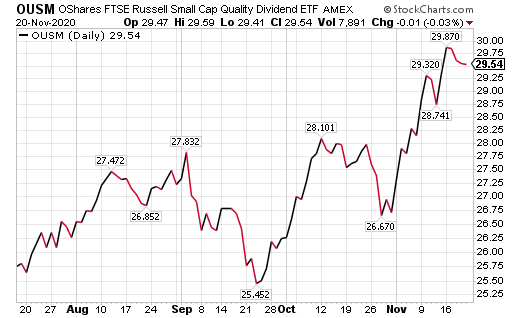

Plus, O’Leary said his family trust also uses O’Shares Small Cap Quality Dividend ETF (BATS:OUSM), targeting mid-cap stocks that have strong balance sheets. That ETF has surged lately after lagging the market much of the past year.

OUSM is up 6.79% in the past month, 9.24% in the last three months, 2.60% so far in 2020 and 4.79% in the last year. It also offers a 1.84% dividend yield.

Chart courtesy of www.stockcharts.com

O’Leary said that his family trust further has exposure to his fund company’s O’Shares Global Internet Giants ETF (BATS:OGIG), which notched gains of 0.46% in the last month, 14.97% in the past three months, 82.41% thus far in 2020 and 94.53% in the last year. He remarked that the 56 U.S. companies he owns use technology from OGIG’s holdings.

Wall Street’s Scaramucci Also Favors Equities for the Next Three Years

Anthony Scaramucci, founder and managing partner of Skybridge Capital, also served briefly as President Trump’s White House communications director and told listeners during the Nov. 12 podcast, with O’Leary, that his investment company has 26,000 clients and a required minimum investment of $25,000. Scaramucci said he is trying to “democratize” hedge funds and hopes to attract investors with $1 million portfolios that ideally would include “every dentist in America.”

The Federal Reserve’s monetary policy intervention has produced the current liquidity-driven bull market, Scaramucci said. Extra capital is expected to keep coming from the Fed during the next 12-18 months, he added.

However, the current second wave of COVID-19 cases will slow down the market in the months ahead, Scaramucci said. It is a predictable outcome if previous pandemics are studied, he added.

Once hundreds of millions of people are inoculated by an effective COVID-19 vaccine, it will be a major lift for markets and consumer demand, Scaramucci said. Growth of 5G telecommunications, artificial intelligence (AI) applications and other technologies will boost the markets in the future, he added.

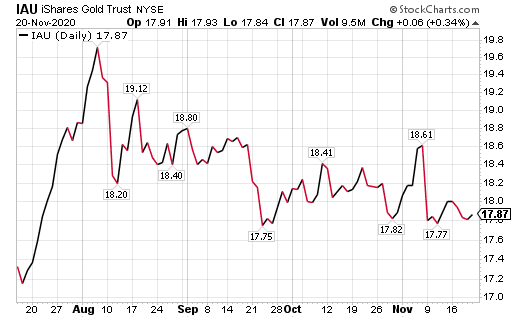

Gold Is Recommended by Pension Fund Chairman as an Alternative to the Post-Election Dividend Investments to Purchase

“At this point, every portfolio should have a position in gold,” said Bob Carlson, chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System, with more than $4 billion in assets and head of the Retirement Watch investment newsletter. “For most investors, an allocation of around 15% to gold is appropriate.”

The Federal Reserve has indicated it will ensure there is liquidity in the markets and that interest rates will stay low. The U.S. central bank can buy government bonds and take other actions to meet these goals. Foreign central banks are taking similar actions.

Thus, expect higher inflation and lower values in paper currencies during the next few years, Carlson said. Gold is the best way to profit from those trends, he added.

“I recommend owning gold through an exchange-traded fund (ETF),” Carlson told me. “An ETF is a very liquid and efficient way to buy and sell gold. My choice is iShares Gold Trust (NYSE Arca:IAU). It usually has the lowest fees of the gold ETFs.”

Chart courtesy of www.stockcharts.com

Central Bank Policies Aid Post-Election Dividend Investments to Purchase

Investors too often make significant changes due to potential consequences of an election, Carlson told me. People can overreact and make ill-advised moves, he said.

An election does not change an economy or the markets in the short term. Even after a change in power, it takes time to enact new policies on taxes, spending and regulation.

There are two main drivers of economic activity for now: COVID-19 and monetary policy.

The Federal Reserve and monetary policy are key drivers of the economy and will remain unchanged heading into 2021. The Fed’s aggressive easy-money policy, or low rates, will continue and be followed by similar actions from central banks elsewhere.

So far, some sectors are doing very well, either benefiting from the pandemic or not being affected by it. Other sectors keep struggling.

Post-Election Dividend Investments to Purchase Face Bifurcated Economy

A key issue over the next few months is whether the bifurcated economy can continue indefinitely or if the lagging sectors will drag down the others.

A second issue is how much fiscal stimulus is needed to replace the income lost by the portions of the economy that are closed or operating at reduced capacity. The main fiscal stimulus measures expired at the end of July and have yet to be restored.

While the economy has rebounded significantly from the low point of last spring, gross domestic product (GDP) still is well-below its high and at a depressed level. Even so, the economy has been resilient despite the expended stimulus.

Pension fund chairman Bob Carlson answers questions from Paul Dykewicz in an interview before social distancing became the norm after the COVID-19 outbreak.

Would President-elect Biden Seek to Tax to the Max?

On the tax front, there likely will be no change to corporate or individual tax rates during a Biden administration, if the Republicans can retain control of the Senate. That situation should be positive for equity prices during the medium-and-longer-term.

There also is coronavirus stimulus legislation in the $1.5-2 trillion range that could pass by the end of 2020 or early in 2021. But a $4-5 trillion stimulus bill that the Democrats were seeking seems dead without them gaining control of the Senate.

A Biden administration is much more likely to impose new mandates and lockdowns to curb the spread of COVID-19 than the Trump administration. Such lockdowns may save lives but will hurt the economy, corporate earnings and the price of equities.

Clean Energy Shines as an Investment Opportunity Regardless of Politics

A sector likely to do well without the Democrats or Republicans controlling both the White House and Congress is alternative energy. For example, solar, wind, electric vehicle makers and lithium miners are likely to gain a lift from a green-energy friendly administration.

An ETF that offers exposure to the alternative energy segment is the iShares Global Clean Energy ETF (ICLN), a $2.3 billion portfolio of 30 large-cap renewable energy stocks that include wind, solar and utility industries, said Jim Woods, who heads the Successful Investing and Intelligence Report investment newsletters, as well as the Bullseye Stock Trader advisory service. After a recent rebalancing, one of the ETF’s largest holdings is Plug Power Inc. (NASDAQ:PLUG).

Biden Administration May Aid Investors Who Are High on Cannabis

The cannabis sector also should benefit from a Biden administration, since it could influence the Justice Department to ease restrictions and enforcement on recreational marijuana use. With Congress and many Americans largely in favor of decriminalizing marijuana, it should aid this sector’s stocks.

“Although there are new funds in this space, the leader for exposure to marijuana stocks is the ETFMG Alternative Harvest ETF (NYSEArca:MJ),” Woods said. “This fund owns 35 stocks designated by the Prime Alternative Harvest Index. This includes exposure to publicly traded cannabis growers, as well as traditional tobacco stocks, pharmaceutical companies and agricultural firms. The result is a diversified portfolio of cannabis-related stocks with a truly global footprint.”

Other potential winners from a Biden administration include industrial stocks, especially those involved in infrastructure, along with health care and Chinese stocks, if that country’s trade war with the United States eases.

As for sector losers, expect the oil and gas industries to come under pressure. Such stocks could face increased regulation, since, in his final presidential debate, Biden said that he supports a multi-year transition away from fossil fuels toward clean energy.

Paul Dykewicz meets with investment guru Jim Woods before the COVID-19 crisis.

Follow Market’s Long-Term Trajectory, Kramer Counseled

“This year has taught alert investors many things, but the most important is simple: remain disciplined,” said Hilary Kramer, host of a national radio program, “Millionaire Maker,” and head of the GameChangers and Value Authority advisory services. “Follow your sense of the market’s long-term trajectory. And while the heat on Wall Street rotates across sectors and themes over the economic cycle, a well-balanced portfolio has kept making money over the past century, through recessions, wars and even presidential elections. Maybe that will change someday but it will take something more than the pandemic.

“Think back to February before the COVID-19 outbreak went global and you’ll remember that stocks already looked overpriced and overextended. Growth was sputtering in the trade war’s wake. The mood was brittle. When the pandemic struck, the natural impulse was to sell and move to the sidelines until we saw exactly how bad it would get.”

Lockdowns occurred in New York City and elsewhere in the country to trigger the “most savage recession” in memory, Kramer said. Investors who held on have seen the S&P 500 climb 9% since March. The Nasdaq rose 27% and the Dow Jones Industrial Average is nearing 30,000 for the first time ever, she added.

Columnist and author Paul Dykewicz interviews money manager Hilary Kramer, whose premium advisory services include 2-Day Trader, Turbo Trader, High Octane Trader and Inner Circle.

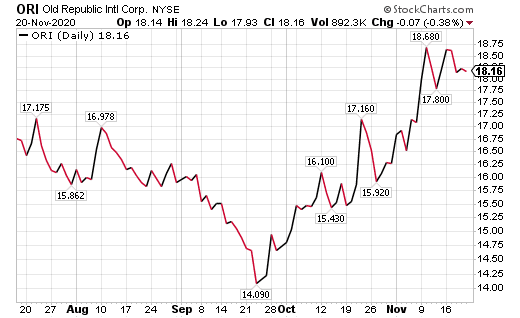

Kramer Advises to Consider Investing in Two Post-Election Dividend Stocks

The market has absorbed the effects of the COVID-19 outbreak and strong stocks have kept breaking enough records to compensate for those that have faced serious challenges in 2020, Kramer said. That is how the market always works, she added.

Kramer said her favorite stocks are the same ones as a year ago. Some are old-economy stalwarts that pay strong dividends on reliable cash flow.

Look at Old Republic International Corp. (NASDAQ:ORI) as an example, Kramer said. It has beaten the S&P 500 this year and still offers a 4.5% dividend yield.

Chart courtesy of www.stockcharts.com

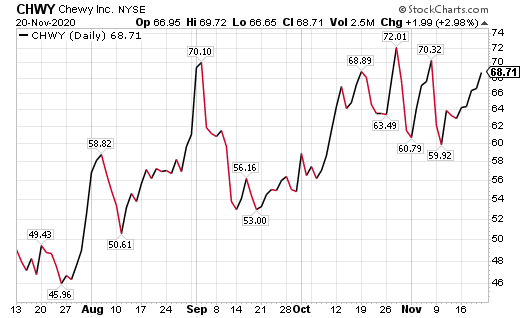

For growth, Kramer said she still loves Chewy Inc. (NASDAQ:CHWY), an e-commerce company for pet owners.

“We’ve doubled our money here in my IPO Edge service,” Kramer said. “I loved it before the pandemic accelerated migration to electronic commerce and I’ll love it when the virus has been defeated. This stock was always the future.”

Chart courtesy of www.stockcharts.com

The COVID-19 pandemic not only has caused big economic woes and huge job cuts but led to a second surge in cases recently that included the infection of President Trump and his hospitalization Friday, Oct. 2, until Monday, Oct. 5. COVID-19 cases have totaled 11,908,395 and led to 254,383 deaths in the United States, along with 57,495,631 cases and 1,371,241 deaths worldwide, as of Nov. 20, according to Johns Hopkins University. America has reported the most cases and deaths of any country in the world and set a single-day record on Thursday, Nov. 19, with 187,000 new cases.

The post-election dividend investments to buy amid COVID-19 offer funds and three stocks that should take flight in the months ahead. Investors seeking to profit should focus on sectors that have the best growth prospects.

Connect with Paul Dykewicz

Connect with Paul Dykewicz