Public Service Enterprise Group Offers 3.4% Dividend Yield (PEG)

By: Ned Piplovic,

Public Service Enterprise Group, Inc. (NYSE:PEG) — the largest electricity and gas distribution utility in New Jersey — continues to provide shareholders with a dividend yield that outperforms sector averages and has managed to hike its annual dividend amount in 14 out of the past 15 years, including the last seven consecutive years.

In addition to providing its shareholders with a steady stream of rising dividend income, the company also supplied a relatively steady asset appreciation that saw the company’s share price advance more than 60% just over the past five years. This advancing share price and the rising dividend income offered a combined total return on shareholders’ investment of more than 80% over the five-year period.

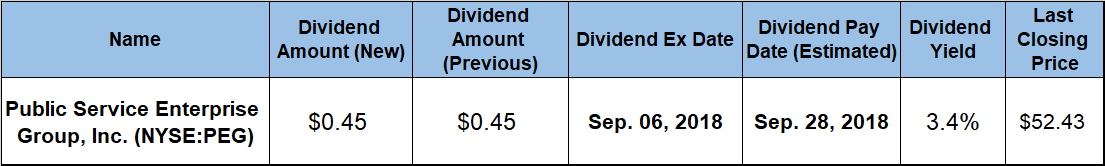

The company’s ex-dividend date is coming up shortly, on September 6, 2018. All interested investors whose research shows compatibility with their investment portfolio strategy should consider adding PEG shares before that ex-date to ensure eligibility for the next round of dividend distributions on the upcoming September 28, 2018, pay date.

Public Service Enterprise Group, Inc. (NYSE:PEG)

Headquartered in Newark, New Jersey, and founded in 1903 as the Public Service Corporation, New Jersey Public Service Enterprise Group Incorporated is a diversified energy company that operates primarily in the Northeastern and Mid-Atlantic United States. The company’s Power business segment operates nuclear, coal, gas, oil-fired, solar and renewable electric power generation facilities with approximately 11,500 megawatts of generating capacity. Additionally, the company’s distribution segment provides gas and electricity to more than 3 million customers in New Jersey and on Long Island. With approximately 2.2 million electric customers and 1.8 million gas customers, the Public Service Electric and Gas (PSE&G) division is New Jersey’s largest provider of electric and gas services. Furthermore, the company’s PSEG Long Island division operates the electric transmission and distribution system of the Long Island Power Authority for 1.1 million customers. PEG’s current assets of more than $47 billion include more than 24,000 miles of electric circuit miles of distribution network, four electric distribution headquarters, five sub-headquarters and almost 250 substations, as well as 12 gas distribution headquarters, 18,000 miles of gas mains and 58 natural gas metering and regulating stations. In addition to its power generation and distribution operations, the company also runs energy efficiency programs and offers appliance maintenance and repairs services to customers through its PSEG Services Corporation subsidiary. In 2017, the company’s total revenues exceeded $9 billion.

The company’s asset appreciation has been on a rising trend with only minor fluctuations for nearly a decade. The share price started the trailing 12 months with a 4.3% drop during the first three weeks and declined towards its 52-week low of $45.23 on September 20, 2017. However, the share price reversed course immediately, fully reversed the 4.3% loss by the first week of October and rose above $53 by the beginning of December 2017.

With the overall markets downturn on interest hike fears in early 2018, the share price pulled back as well below $47 by early March 2018 — just 2.5% above the September low. However, after that pullback, the share price shook off any interest rate hike concerns and rose almost 17% towards its 52-week high of $54.24 by June 25, 2018. Since peaking in late June, the share price leveled off and pulled back 3.3% to close on August 27, 2018, at $52.44. This closing price marked an 11% rise above its level from one year earlier, a 16% increase over the September 2017 low and a 62% growth over the past five years.

The company’s current $0.45 quarterly dividend amount is 4.7% above the $0.43 distribution from the same period last year. Over the past seven consecutive years, the company increased its total annual dividend amount 31%, which corresponds to a 4.0% average annual dividend growth rate.

The current $0.45 quarterly dividend amount is equivalent to a $1.80 annualized payout and a 3.4% forward dividend yield. Because the company’s annual dividend payout growth rate trails the share price growth rate over the past few years, the current 3.4% dividend yield is 4.6% lower than the company’s own five-year average of 3.6%. However, the current 3.4% dividend yield is nearly 36% above the 2.53% simple average yield of the overall Utilities sector.

Just over the past year, the share price growth and the rising dividend income combined for a 16.4% total return. Additionally, the company rewarded shareholders with 43% and 87% total returns over the past three and five years, respectively.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic