Qualcomm’s Shareholders Enjoy 4.7% Dividend Yield (QCOM)

By: Ned Piplovic,

Driven by a recent share price decline and bolstered by the company’s steady stream of rising dividend distributions, Qualcomm Incorporated (NASDAQ:QCOM) currently offers its shareholders a 4.7% dividend yield.

This dividend yield level is significantly higher than the average yield of the entire Technology sector, as well as the average yield of Qualcomm’s communication equipment manufacturing peers. In addition to a high dividend yield, the Qualcomm has boosted its quarterly dividend payout amount every year since the company started paying dividends in 2003.

Qualcomm has failed to collect royalties for the use of its chip technology in Apple (NASDAQ:AAPL) products since mid-2017. The legal resolution of this dispute — as well as a separate case where the Federal Communications Commission (FCC) is questioning whether Qualcomm’s current technology patents constitute a monopoly — is not nowhere near. However, Qualcomm’s management is expecting a favorable outcome and is confident that the company will recover most of its past fees.

However, Qualcomm is in a position to take advantage of the current switch to the 5G network infrastructure to boost its revenues, which should bolster the company’s financial results over the next few quarters. Along with the recent share price decline, the positive revenue outlook, could be an opportunity to take a long position in the Qualcomm stock and collect a significant dividend income while waiting for the share price recovery.

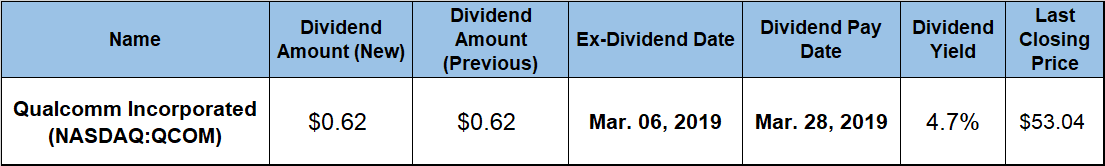

Interested investors should evaluate the Qualcomm investment opportunity against alternative prospects to ensure that investing in Qualcomm’s stock aligns well with their specific portfolio strategy, as well as investment goals and risk tolerances. However, investors who deem Qualcomm as a worthy investment potential should act before the upcoming March 6, 2019 ex-dividend date. All investors that claim stock ownership prior to that date will become eligible to receive the next round of dividend distributions on the company’s March 28, 2019, pay date.

Qualcomm Incorporated (NASDAQ:QCOM)

Founded in 1985 and headquartered in San Diego, California, Qualcomm Incorporated designs, develops, manufactures and markets digital communication products through three business segments — Qualcomm CDMA Technologies (QCT), Qualcomm Technology Licensing (QTL) and Qualcomm Strategic Initiatives (QSI). The QCT segment develops and supplies integrated circuits and other technologies for use in wireless communications, networking and global positioning system products. The QTL segment grants licenses or provides rights to use portions of Qualcomm’s intellectual property portfolio. Finally, the QSI segment invests in early-stage companies in various industries to support the design and development of new communication products and services. The company also licenses chipset technology, as well as related products and services for use in data centers.

Qualcomm’s current $0.62 quarterly dividend payout amount is 8.8% higher than the $0.57 distribution from the first quarter of the previous year. The current payout amount is equivalent to a $2.48 annualized dividend per share and a 4.7% forward dividend yield. The actual total dividend payout for 2019 should be even higher as the company generally hikes its quarterly payout for its June dividend payout. Qualcomm’s current yield is 33.6% higher than the company’s own 3.5% average dividend yield over the past five years.

Furthermore, the current 4.7% dividend yield outperformed the 1.03% average yield of the overall Technology sector by more than 350%. Compared to the 1.73% simple average yield of its peers in the Communications Equipment industry segment, Qualcomm’s current dividend yield is still 170% higher. Even limiting the calculation of the segment’s average yield to just the companies that pay dividends increases the yield average to only 2.71%. Qualcomm’s current 4.7% yield outperforms even that average yield by more than 72%.

Since beginning to pay dividend distributions in 2003, Qualcomm has enhanced its total annual dividend payout amount more than 20-fold. This level of payout advancement corresponds to an average annual growth rate of nearly 21% over the past 16 years. While the share price fluctuations caused double-digit percentage total losses for the 12-month and five-year periods, shareholders enjoyed a 16% total return over the past three years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic