Realty Income Corporation Rewards Shareholders With 21 Years of Rising Annual Dividend Payouts (O)

By: Ned Piplovic,

Featured Image Source: https://www.realtyincome.com

The Realty Income Corporation (NYSE:O) has boosted its annual dividends for 21 consecutive years and continues to distribute its monthly dividends with a current 5% dividend yield.

While the company has hiked its annual dividend for a little more than two decades, it has not missed a monthly dividend payment in nearly 49 years. The company’s share price declined along with the rest of the markets during the early February selloff but has been rising since then and recovered to close just 3.4% below its price from 12 months ago.

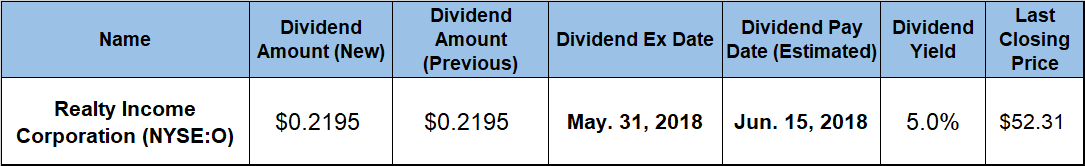

The company set its next ex-dividend date for May 31, 2018. On the company’s upcoming June 15, 2018, pay date, the Realty Income Corporation will distribute its next monthly dividend to all shareholders of record prior to the May 31, 2018, ex-dividend date.

Realty Income Corporation (NYSE:O)

Headquartered in San Diego, California, and founded in 1969, the Realty Income Corporation is a Real Estate Investment Trust (REIT) that focuses primarily on acquiring, developing and leasing retail and commercial real estate facilities. As of March 31, 2018, the company had more than 5,300 properties under long-term net lease agreements in 49 U.S. states and Puerto Rico with more than 90 million square feet of total leasable space. The company’s largest presence is in Texas, where the REIT has 588 properties — 11% of its total properties — that generate 9.4% of the company’s total annual income. More than 250 commercial tenants across 47 industries currently occupy Realty Income Corporation’s properties. The top five tenants in terms of location count are Dollar General (532), Dollar Tree/Family Dollar (468), Circle K (298), 7-Eleven (224) and Walgreens (221). However, despite being only fifth in number of properties, Walgreens-leased properties generate 6.7% of REITs total revenue. FedEx (5.00%), Dollar General (3.80%), LA Fitness (3.80%) and 7-Eleven (3.60%) round out the top five tenants in terms of total revenue generated. Since its founding, the company has paid 572 consecutive monthly dividends and increased the dividend 95 times since Realty Income’s public listing in 1994.

While the company distributes its dividends monthly, it has boosted its dividend payout for the past 82 consecutive quarters. Over the past two decades the company enhanced its total annual dividend payout nearly 170% by growing the annual payout amount at an average rate of 5% per year. Affected by the 2008 financial crisis, the dividend growth slowed between 2008 and 2012, which brought the average annual dividend growth rate down to 4.7% for the past 10 years. However, the growth rate over the past three years is back to 5% and exceeds 6% for the most recent five-year period.

The REIT’s current $0.2195 monthly dividend payout is equivalent to a $2.634 annualized distribution and a 5% forward dividend yield, which is 9.5% higher than the company’s own 4.6% five-year average yield. Additionally, Realty Income Corporation’s current 5% dividend yield outperforms the 3.16% simple average yield of the entire Financials sector by nearly 60% and is 16.6% above the 4.32% average yield of the Retail REIT market subsegment.

The company’s share price experienced more-than-usual volatility and declined more than 25% since reaching its all-time high in July 2016. Entering the trailing 12-month period on that downtrend, the share price experienced a brief trend reversal and rose 12% between May 22, 2017, and September 15, 2017, when it reached its 52-week high of $59.90. However, the share price immediately pulled back from its high and continued to trade generally in the $55 to $57 range until late January 2018. In the last week of January and first week of February 2018, the share price followed the overall market direction, tumbled more than 12.5% in just 10 trading days and closed on February 8, 2018, at its 52-week low of $47.56.

Since bottoming out at the beginning of February, the share price regained nearly 70% of those recent losses and closed on May 18, 2018, at $52.31. This closing price was 3.4% short of its own price level from one year earlier and 10% higher than the 52-week low from early February 2018.

The REIT’s total dividend distribution over the past year managed to overcome the marginal share price drop prevent a total loss for the year. Over the past 12 months, the total return was 1.2%, with longer-term total returns over the past three and five years coming in at 15.5% and 24.7%, respectively.

Dividend increases and decreases, new dividend announcements, dividend suspensions and other changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic