RGC Resources Offers 7% Quarterly Dividend Boost (RGCO)

By: Ned Piplovic,

Over the past two decades, RGC Resources, Inc. (NASDAQ:RGCO) failed to hike its annual dividend only once and has boosted its quarterly distribution almost 7%, which makes 2018 the 14th consecutive year that the company has augmented its annual payout.

The current dividend yield fell to just 2.25% because of the rapid share-price growth in the last year. Over the past 12 months, the share price rose more than 60% and shareholders’ total returns exceeded 70% over the same period.

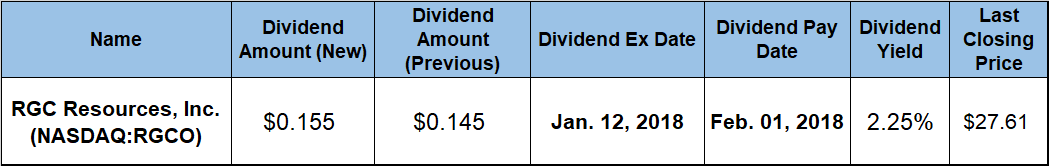

The company’s next ex-dividend date is on January 12, 2018, and the pay date will occur less than three weeks later, on February 1, 2018.

RGC Resources, Inc. (NASDAQ:RGCO)

Founded in 1912 and headquartered in Roanoke, Virginia, RGC Resources, Inc., is a public utility holding company that provides energy and related products. The company sells and distributes natural gas to residential, commercial and industrial customers through its operating subsidiaries – Roanoke Gas Company and RGC Midstream, LLC. Roanoke Gas, which began in 1883, provides natural gas service to more than 60,000 customers in the greater Roanoke Valley region. RGC Midstream operates eight gas metering stations, approximately 1,100 miles of distribution pipelines and a liquefied natural gas storage facility. It also owns 1% interest in the Mountain Valley Pipeline project.

The company boosted its quarterly dividend distribution 6.9% from $0.145 in the previous period to the current $0.155 distribution. This current quarterly payout produces a yield of 2.25% and is equivalent to a $0.62 annualized distribution.

The 60%-plus share price growth in the past year drove the yield down to the current 2.25% level. Just one year ago – prior to this significant share price uptrend – the dividend yield was 3.47%. While the current yield is 4.4% below the average yield of the overall financial sector, the 3.47% yield from one year ago was 48% above the financial sector’s average yield.

Because of the rapidly rising share price, the current yield might not be the best metric to judge this company’s dividend performance. Dividend growth should give a better indication of the long-term growing dividend income that RGC Resources has been offering its shareholders over the past couple of decades. The company hiked its annual dividend distribution for the past 14 consecutive years at an average growth rate of 3.4% per year.

The company has never lowered its annual dividend since it started distributing dividends in 1990 and failed to hike its annual dividend payout only once, when it paid the same $0.38 amount in 2003 as it did the year before. Additionally, RGC Resources keeps enhancing its average growth rate. The 3.4% annual dividend average growth rate over the past 14 consecutive years is 18% higher than the 2.9% average growth rate over the past two decades. Also, the 5.3% five-year average growth rate is 56% above the 3.4% average growth rate over the past 14 consecutive years.

As indicated previously, the company’s share price experienced significant growth over the past 12 months. Almost half of the share-price growth since February 1994 occurred in just the last 12 months. The share price reached its 52-week low of $16.60 on December 30, 2016, which was just two days into the trailing 12-month period.

However, since a December 2013 low, the share price has ascended more than 87% with just one significant drop of 18% and it reached its 52-week high of $31.08 on October 11, 2017. Since the early October peak, the share price has pulled back approximately 11% and closed on December 27, 2017, at $27.61, which was still 65.3% higher than it was one year before, 66.3% higher than the December 2016 low and 123% higher than it was five years earlier.

With the share price surge as the main contributor to total returns, RGC Resources has rewarded its shareholders with a 71.4% total return over the past year, a 105% total return over the past three years and a 152% total return over the past five years.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic