Rockwell Automation Increases Quarterly Dividend Payout 10% (ROK)

By: Ned Piplovic,

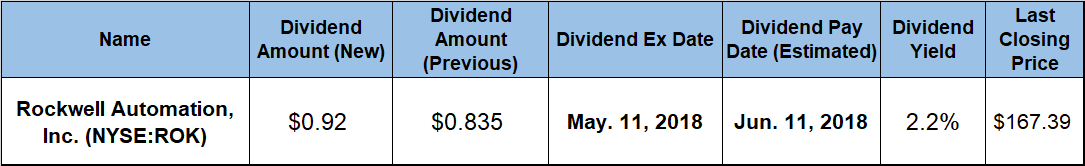

Rockwell Automation, Inc. (NYSE:ROK) hiked its quarterly dividend 10.2% for the second quarter of 2018, which marks the company’s ninth consecutive year of dividend boosts.

The company’s 2.2% dividend yield is relatively low in comparison to average yields in some other sectors. However, Rockwell’s current yield is substantially higher than average industry yields in the capital-intensive Industrial Goods sector, which is known for profit margins that are lower than margins in sectors like Financials or Utilities. Additionally, the company’s strong asset appreciation manages to compensate for the moderate yield levels to reward Rockwell’s shareholders with a one-year total return of nearly 10% and double-digit percentage total returns for the past three and five years.

Investors seeking to diversify their portfolio holdings into the industrial sector that are interested in adding Rockwell Automation should complete their own research and act before the May 11, 2018, ex-dividend date. The company will distribute cash dividends to all shareholders of record prior to the ex-dividend date on the next pay date of June 11, 2018.

Rockwell Automation, Inc. (NYSE:ROK)

Headquartered in Milwaukee, Wisconsin, and founded in 1903, Rockwell Automation, Inc. provides industrial automation and information solutions. The company operates through two business segments. The Architecture & Software segment provides control platforms, electronic input/output devices, industrial computers, configuration software and other products comprising sensors, machine safety components and linear motion control products. The Control Products & Solutions segment offers low and medium voltage electro-mechanical and electronic motor starters, motor and circuit protection devices, AC/DC variable frequency drives, push buttons, signaling devices, termination and protection devices, relays and timers. Additionally, this segment offers life-cycle support services, such as technical support, repair, asset management, training, maintenance and safety consulting services. The company markets its products and services under the Allen-Bradley and Rockwell Software brand names

The company boosted its quarterly dividend payout 10.2% from $0.835 in the previous period to the current $0.92 dividend distribution. This new quarterly amount converts to a total annualized dividend payout amount of $3.68, which is equivalent to a 2.2% forward dividend yield. While this current yield rate might seem low, it is 10% higher than Rockwell Automation’s own 2% dividend average during the past five years. Additionally, the current 2.2% dividend yield outperformed the 1.17% average yield of the entire Industrial Goods sector by 88%. Furthermore, Rockwell Automation’s current yield is 56% above the simple average yield of the broad Industrial Electrical Equipment market segment and 33% higher than the 1.65% average yield of the segment’s only dividend-paying companies.

For the last 20 years, the company reduced its annual dividend only twice and failed to raise its annual dividend five additional times. Nine out of the 13 annual dividend hikes over the past two decades happened during the current streak of consecutive dividend hikes since 2009. Over those nine years, Rockwell Automation advanced its total annual dividend amount 217% by raising its dividend at an average annual growth rate of 13.7%.

In addition to the reliable dividend income, the company compensated its investors with noteworthy capital growth. While the share price rise in the past year came with a little more volatility than comfortable for most investors, the return was still positive, and the slight pullback might be an opportunity for risk-averse investors to take advantage. The share price started the current 12-month period from its 52-week low price of $15.54. From there, the share price ascended nearly 35% before it reached the 52-week high of $207.92 on January 12, 2018. Unfortunately for existing shareholders, the share price declined nearly 20% from its mid-January peak to close on May 2, 2018, at $167.39, which was 8.3% above the 52-week low from 12 months earlier and 90% higher than it was five years ago.

Even with the double-digit-percentage share price drop late in the trailing 12-month period and a merely adequate dividend yield, the company managed to provide its shareholders with a total return of nearly 10% over the past year. The total returns were even better over longer periods. Over the past three years, the company’s shareholders enjoyed a 46% total return and a 120% total return over the past five years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic