Six Dividend-Paying Semiconductor Investments to Purchase While They Trade at Discounts

By: Paul Dykewicz,

Six dividend-paying semiconductor investments to purchase while they are trading at discounts compared to slower-growing industrial stocks have been recommended by BoA Global Research.

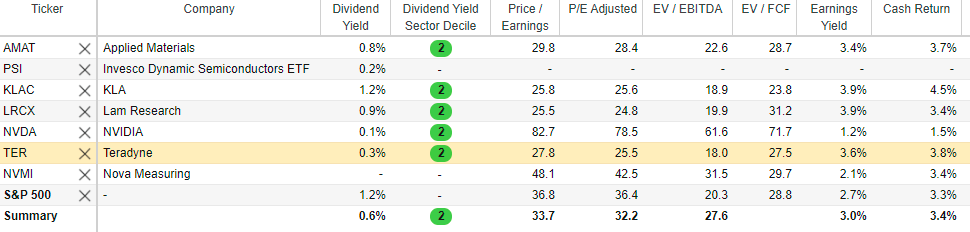

S&P 500 semiconductor investments trade at an average of 19x 2022 price-to-earnings (P/E) estimates, nearly 20% below the S&P 500 Industrials, despite free cash flow (FCF) margins 1,500-2,000 basis points (bps) above and 400-500 bp faster sales growth than the industrials, according to a May 11 BoA Global Research note. The six dividend-paying semiconductor investments to purchase share attributes with high-quality industrial stocks, with the current relative weakness in the semiconductor sector shown by the SOX index vs. industrials (XLI) differential that signals market rotation rather than trading based on fundamentals, BoA reported.

The investment firm found that dividend-paying semiconductor investments are not expensive, since SPX industrials are trading at 27x 2021 estimated P/E vs. just 21x with semiconductor stocks, despite the latter generating 29% FCF margins or 2.4x that of industrials at 12% FCF. And the impact of the ongoing chip shortage is not limited to semiconductor stocks, since it extends to their industrial and auto customers that disproportionately are affected by the current cycle, BoA continued.

Six Dividend-paying Semiconductor Investments to Purchase Gain Lift from 5G, Broadband and U.S. Chip Manufacturing

Similar to industrials, semiconductor stocks and funds benefit from U.S. infrastructure stimulus in 5G, broadband and domestic chip manufacturing. Even though double-ordering risks exist in semiconductor stocks, they are offset by “solid visibility” that is driven by non-cancellable orders, product customization and broad-based demand, according to BoA.

Plus, the recent upside in gross margins indicates that semiconductor companies are “very effective” in passing along rising input costs to turn inflation into a positive driver for the sector, BoA noted. As a result, the SOX index historically has ascended amid rising rates.

“Over the past five years, chip stocks have been among the best-performing NASDAQ stocks, with the Philadelphia Semiconductor Index (SOXX) up 4X, while the NASDAQ 100 (QQQ) is up 3X,” said Hilary Kramer, who hosts the nationally aired “Millionaire Maker” radio program and leads the GameChangers and Value Authority advisory services.

Valuations of Six Dividend-paying Semiconductor Investments to Purchase Gain Money Manager’s Attention

Value investments had been trouncing growth stocks heading into trading on May 11, with the Russell 3000 Value Index up 19.1% in 2021, compared to a gain of 4.3% for the Russell 3000 Growth Index. Kramer wrote to her Value Authority subscribers that she expects value stocks to keep outperforming growth stocks, but added “a rest” would be overdue and healthy for the market.

The six dividend-paying semiconductor investments to purchase are trading at more than 20X earnings estimates, suggesting the market growth will last beyond 2022, Kramer commented. But it is interesting to note that even with the recent chip shortage, semiconductor stocks have not performed well since early April.

Source: Stock Rover. Click here to sign up for a free, two-week trial for Stock Rover charts and analytics.

Overall, risk-reward characteristics of the semiconductor stocks are “not great,” but can describe the NASDAQ as well, Kramer counseled. End markets and earnings should be healthy if the economy remains firm, she added.

Paul Dykewicz conducts a pre-COVID-19 interview with Hilary Kramer, whose premium advisory services include IPO Edge, 2-Day Trader, Turbo Trader and Inner Circle.

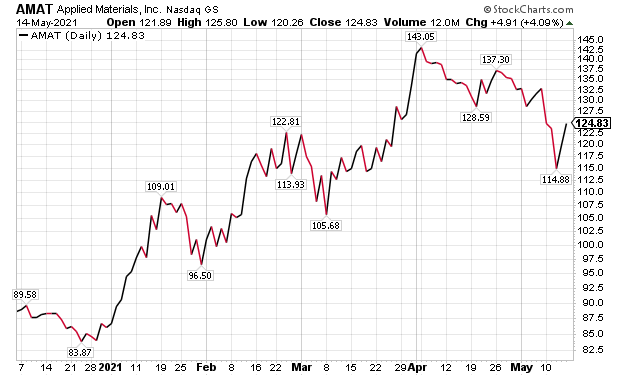

Applied Materials Ranks First Among Six Dividend-paying Semiconductor Investments to Purchase

The top recommendation of BoA among the six dividend-paying semiconductor investments to purchase is Applied Materials, Inc. (NASDAQ: AMAT), a Santa Clara, California-based provider of materials engineering for computer chips and advanced displays. BoA’s price objective of $170 for AMAT is based on 25x 2022 estimated earnings per share (EPS), above the high end of a historical range of 8x-23x, but in line with the 1x-2x historical discount to more profitable peers.

Potential catalysts for AMAT’s share price include longer-than-expected electronics demand that would tighten semiconductor capacity, lift semiconductor equipment sales and lift market share. Downside risks to the price target for AMAT could come from a slower-than-expected capital spending cycle, a delay in memory capacity upgrades, market share loss in key segments, merger & integrations risk and macro-economic headwinds, BoA reported.

Chart courtesy of www.StockCharts.com

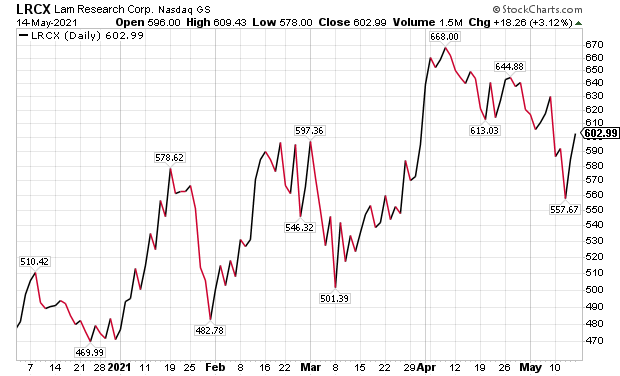

AMAT and two other large U.S.-based semiconductor vendors — Lam Research Corporation (NASDAQ:LRCX), a Fremont, California-based provider of wafer fabrication equipment and services to help chipmakers build smaller and faster electronic devices, and KLA Corp. (NASDAQ:KLAC), a semiconductor capital equipment company in Milpitas, California, trade at 20x average forward P/E. That P/E is two turns below the broad market, despite solid multi-year visibility, strong balance sheets and projected double-digit-percentage sales and EPS compound annual growth rate (CAGR) for the next 3-5 years, BoA noted.

Lam Research Ranks Among Six Dividend-paying Semiconductor Investments to Purchase

BoA assigned Lam Research a $725 price target, based on 20x cash adjusted 2022 estimated P/E, within the stock’s historical range of 8x-24x and based on LRCX’s 20%-plus EPS growth rate. Amid a multi-year wafer fabrication equipment growth cycle, LRCX is well positioned to benefit, the investment firm wrote.

Potential upside catalysts to Lam Research’s price objective are stronger-than-expected electronics demand that could tighten semiconductor capacity, increased semiconductor equipment sales and improved market share. Downside risks are a slower-than-expected capital spending cycle, a delay in memory capacity additions and a market share loss.

Chart courtesy of www.StockCharts.com

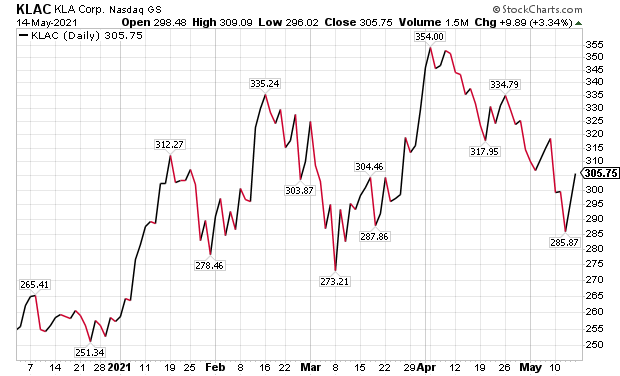

Six Dividend-paying Semiconductor Investments to Purchase Include U.S.-based KLA Corp.

KLA Corp. gained a $400 price objective from BoA based on 22x 2022 estimated P/E, within KLAC’s historical range of 10x-26x. The investment firm envisions KLAC as an enabler of semiconductor manufacturing technology, offering a less cyclical topline, industry leading profit margins and best-in-class shareholder returns.

Risks to BoA’s price objective for KLAC are the cyclical nature of semiconductor capital spending and its impact on earnings, as well as price and market share competition, particularly against Applied Materials. Another vulnerability would occur if problems arose in bringing new products and technologies to market, BoA cautioned.

Chart courtesy of www.StockCharts.com

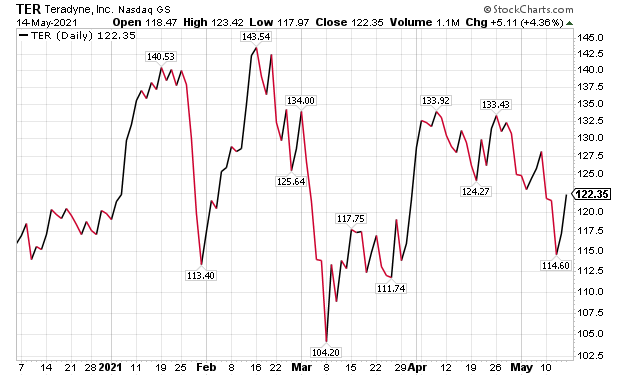

Six Dividend-paying Semiconductor Investments to Purchase Feature Teradyne

Another of the six dividend-paying semiconductor investments to purchase is Teradyne, Inc. (NASDAQ:TER), a North Reading, Massachusetts-based maker of automatic test equipment. BoA’s $155 price objective on TER is based on 25x P/E, applied to a fiscal year 2022 estimated Non-GAAP EPS.

The expected P/E is at the high end of Teradyne’s long-term trading range of 12x-26x, given TER’s recent and unique exposure to 5G/automation, cyclical recovery in auto and industrial markets and market share gains in core semiconductor testing. Downside risks to BoA’s price objective are cyclicality and potential loss of market share in the core semiconductor test market, along with mounting competition in the robotics segment, BoA cautioned.

Chart courtesy of www.StockCharts.com

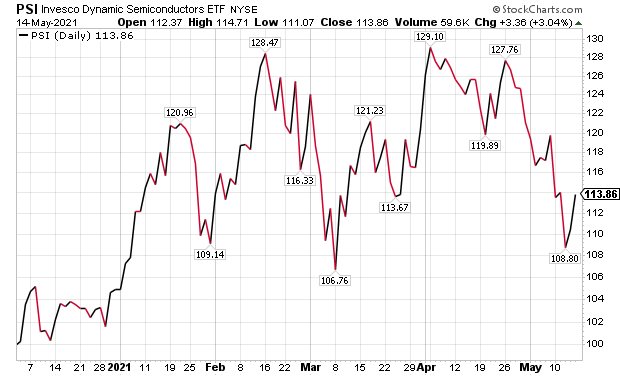

Penson Fund Chairman Picks Semiconductor ETF as One of Six Dividend-paying Semiconductor Investments to Purchase

“The semiconductor industry is going through major changes that are related more to politics and national security than technology,” said Bob Carlson, chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets. “Asian companies have dominated the industry for a while. But the United States is concerned about national security, competition with China and supply chain problems. A heavy dependence on Asian semiconductor manufacturers presents the potential for geopolitical tensions to trigger restrictions on semiconductor supply.”

The semiconductor stocks have slid from their highs due to such concerns, coupled with revenue and earnings declines that are likely to be caused by the global semiconductor shortage, said Carlson, who also heads the Retirement Watch investment newsletter. Now is a good time to invest in the stocks, particularly with a diversified portfolio through an exchange-traded fund (ETF), such as Invesco Dynamic Semiconductors ETF (NYSE Arca:PSI), Carlson added.

Chart courtesy of www.StockCharts.com

The top holdings in PSI recently were Applied Materials (NASDAQ:AMAT), Lam Research Corporation (NASDAQ:LRCX), Texas Instruments (NASDAQTXN), Analog Devices (NASDAQ:ADI) and Qualcomm (NASDAQ:QCOM), Carlson said.

Pension fund and Retirement Watch leader Bob Carlson answers questions from Paul Dykewicz before COVID-19-related social distancing.

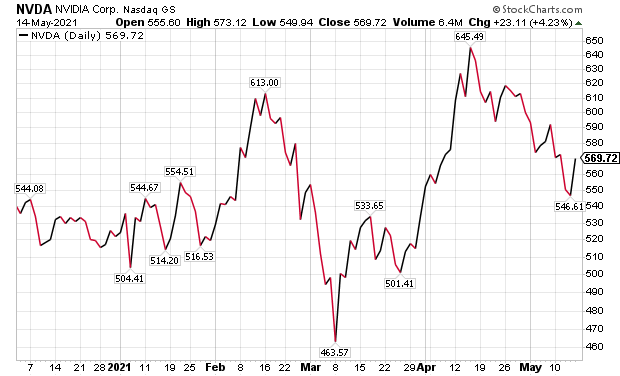

NVDA Joins Six Dividend-paying Semiconductor Investments to Purchase

A low-dividend-paying BoA buy recommendation, NVIDIA Corporation (NASDAQ:NVDA), is a Santa Clara, California-based designer of graphics processing units for the gaming and professional markets, as well as chip units for the mobile computing and automotive markets. BoA highlighted trends among cloud companies and noted NVDA showed solid data center visibility at its recent analyst day, with 2021 forecast to be a strong year with year-to-year growth of about 30%.

In addition, BoA described NVDA as having momentum that could accelerate after its introduction of its Grace-Arm-based server processor in 2023 to focus on the Giant AI/HPC portion of the market. NVDA is poised to take advantage of its scale, data center presence and complementary silicon (GPU and DPU), as well as its software and development ecosystem, BoA added.

Further easing of cloud digestion and positive capital expenditure upside positive for NVDA led BoA to give the stock a $700 price target, based on 44x 2022 estimated P/E, excluding cash, at the higher-end of NVDA’s historical 20x-54x P/E range, showing NVIDIA’s superior long-term growth profile in large, underpenetrated markets, according to BoA.

Risks to achieving BoA’s price objective include NVDA’s exposure to the personal computer market, as well as competition in accelerated computing markets and among auto vendors, “lumpy and unpredictable sales” in new enterprise, data center and auto markets, potential reduced capital returns, possible auto sales slowdown until advance driver-assistance systems (ADAS) become more meaningful and increased operational expenditures.

Chart courtesy of www.StockCharts.com

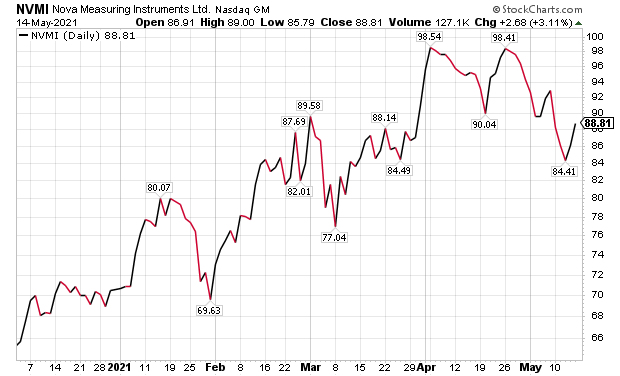

Nova Measuring Instruments Offers a Non-dividend-paying Pivot Away from Dividend-paying Semiconductor Investments to Purchase

Nova Measuring Instruments (NASDAQ:NVMI), a non-dividend-paying, Rehovot, Israel-based provider of metrology devices for advanced process control in semiconductor manufacturing, gained a $108 price objective from BoA, based on 34x 2022 estimated non-GAAP EPS that includes stock compensation and adjustments for net cash. The valuation is within its peer range of 20x-40x and is justified, BoA noted, due to Nova’s superior gross margin profile and its potential to outgrow the market in the next three years.

Downside risks for NVMI could include an inability to earn share in the new X-Ray metrology market, stiff competition from large rivals such as KLA Corp. and historically cyclical semiconductor capital spending, according to BoA. Nonetheless, the investment firm lists NVMI among six dividend-paying semiconductor investments to purchase.

Chart courtesy of www.StockCharts.com

Six Dividend-paying Semiconductor Investments to Purchase Avert Worst of COVID-19 Crisis

COVID-19 vaccination progress in recent weeks offers optimism that new cases and deaths due to the virus will keep slowing. Additional hope comes from the Food and Drug Administration (FDA) approving a third COVID-19 vaccine to be put to use.

Worldwide, COVID-19 cases have reached 161,390,677, with deaths of 3,349,187, as of May 14, according to Johns Hopkins University. U.S. COVID-19 cases have totaled 32,778,621 and led to 582,845 deaths, also as of May 14. America has the dreaded distinction as the nation with the most COVID-19 cases and deaths.

The six dividend-paying semiconductor investments to purchae offer investors ways to pursue profits from a $1.9 trillion federal stimulus package, expanded COVID-19 vaccine availability and the ongoing economic reopening. Those catalysts seem able to spur momentum for the six semiconductor investments to purchase.

Connect with Paul Dykewicz

Connect with Paul Dykewicz