Sysco Corporation’s Dividend Payouts Continue Rising After Five Decades of Annual Dividend Hikes (SYY)

By: Ned Piplovic,

Featured Image Source: Sysco Corporation Corporate Website

The Sysco Corporation (NYSE:SYY) has rewarded its shareholders with a string of 50 consecutive annual dividend hikes and a steady asset appreciation to deliver reliable total returns over extended time horizons.

An S&P 500 Index component with a market capitalization of more than $3 billion and more than 25 consecutive annual dividend hikes, the Sysco Corporation meets the three main criteria to be included as one of the 53 companies designated Dividend Aristocrats. Furthermore, after reaching 50 consecutive annual dividend hikes, the company will also be included in an even more exclusive group of fewer than 20 Dividend Kings.

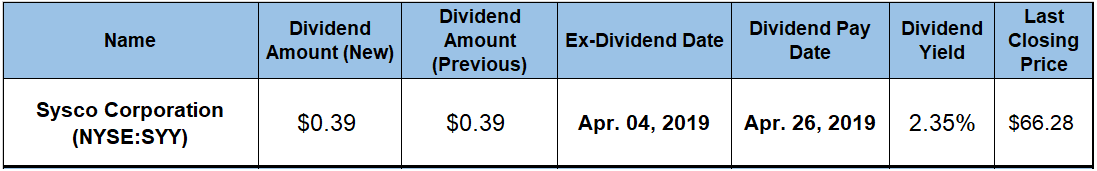

In addition to the long streak of annual dividend hikes, the Sysco Corporation currently offers a 2.35% dividend yield and has delivered a double-digit-percentage total return over the trailing 12 months. The company’s current dividend payout ratio of 53% is just slightly outside of the 30% to 50% sustainable payout ratio range. However, this payout ratio is moving in the right direction as it is currently significantly lower than the 71% average payout ratio over the past five years.

However, before taking a long position in the Sysco Corporation’s stock, interested investors should conduct their own research to confirm that the stock’s characteristics and future outlook align well with their investment portfolio strategy. Any investors that wish to secure eligibility for the next round of dividend distributions on the April 26, 2019, pay date, must claim share ownership prior to the April 4, ex-dividend date.

Sysco Corporation (NYSE:SYY)

Founded in 1969 and headquartered in Houston, Texas, the Sysco Corporation markets, distributes and sells food products to restaurants, health care and educational facilities, lodging establishments and other customers who prepare meals away from home. In addition to food products, the company also offers equipment and supplies for the foodservice and hospitality industries. The company operates through three segments — U.S. Foodservice Operations, International Foodservice Operations and SYGMA — and offers its products and services in the United States, Canada, Bahamas, Mexico, Costa Rica and seven European countries. During fiscal 2017, the company completed the acquisition of the Brakes Group, a leading European foodservice distributor with operations in the United Kingdom, Ireland, France, Sweden, Spain, Belgium and Luxembourg. The Sysco Corporation currently operates 330 distribution facilities in 13 countries that serve approximately 600,000 business customers in 90 countries. For full fiscal year 2018 — which ended on June 30, 2018 — the company’s revenues increased more than 6% year over year to nearly $60 billion.

The most recent of the company’s annual dividend hikes raised the quarterly dividend distribution amount 8.3% from $0.36 in the same period last year to the current $0.39 quarterly dividend payout. This new quarterly distribution is equivalent to an annualized dividend amount of $1.56, which corresponds to a 2.35% forward dividend yield.

Despite a streak of steady annual dividend hikes, the Sysco Corporation’s current dividend yield is 6.6% lower than its own 2.5% average yield over the past five years. However, while lower than its own five year average, Sysco’s current yield is in line with 2.36% average yield of all its peers in the Services sector. Furthermore, Sysco’s current 2.35% yield is more than 75% above the 1.35% simple average yield of the company’s peers in the Wholesale Food industry segment.

The Sysco Corporation delivered its first dividend distribution in 1970, just one year after its formation. Since that first dividend distribution the company has delivered five decades of successive annual dividend hikes. Just over the past two decades, the company has enhanced its annual dividend payout amount nearly tenfold. This growth pace corresponds to a 12.4% average annual growth rate. While growth rates generally decline as the payout amounts increase, Sysco still managed an average annual growth rate of more than 6.7% over the past three years.

Sysco’s rising dividend income combined with the company’s asset appreciation to deliver a combined total return of more than 13% over the last 12 months. The company also rewarded shareholders with a 50% total return over the past three years. Additionally, the shareholders more than doubled their investment over the past five years with a 103% total return.

Related Articles:

5 Best Dividend Aristocrats to Buy Now

The Dividend Aristocrats Investing Strategy and Stocks List

The Best Dividend Aristocrats ETFs

Why Invest in the Dividend Aristocrats?

The S&P 500 Dividend Aristocrats — Everything You Need to Know

What are the Dividend Aristocrats?

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic