TELUS Corporation Offers 4.3% Yield, 14 Years of Annual Dividend Hikes (TU)

By: Ned Piplovic,

The TELUS Corporation (NYSE: TU) — a Canadian telecommunications company — has rewarded shareholders with annual dividend hikes for the past 14 consecutive years and currently pays a 4.3% dividend yield.

Interestingly, the company has also been hiking its dividend twice per year for the past nine years, rather than going for the more typical one-time yearly increase. As a result, TELUS Corporation has managed to maintain an average growth rate of nearly 10% per year over the past five years.

After a steep drop in 2015 and early 2016, the company has been providing steady asset appreciation ever since, with TU’s share price advancing 50% in the last two years. The company’s financial results for the second-quarter 2018 showed steady growth compared to the same period last year and beat analysts’ estimates in terms of total revenue and earnings per share (EPS).

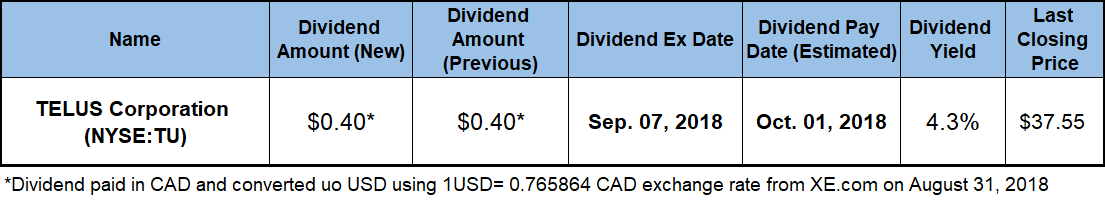

TELUS shares pulled back about 10% early this year, but the share price has regained most of its losses and technical indicators suggest that rising trend might continue for at least a few more periods. Currently trading about 3.5% off its 52-week high, investors can still buy shares with some overhead and take advantage of the streak of annual dividend hikes to boost returns. Interested investors should take a long position in the stock prior to the company’s next ex-dividend date on September 7, 2018, which will ensure eligibility for the next round of dividend distributions on the Oct.1 pay date.

TELUS Corporation (NYSE:TU)

Based in Vancouver, Canada and founded in 1993, the TELUS Corporation provides a range of telecommunications products and services in Canada. The company provides its services via two primary business segments — Wireless and Wireline. Currently, the company’s telecommunications products and services comprise wireless and wireline voice and data services, as well as other data services including internet protocol (IP), television services and hosting. Additionally, the company provides managed information technology, security and cloud-based services, healthcare solutions, business process outsourcing and security solutions.

TELUS is Canada’s fastest-growing national telecommunications company, with $13.3 billion of annual revenue and 13.1 million subscriber connections, including 8.9 million wireless subscribers, 1.7 million high-speed Internet subscribers, 1.3 million residential network access lines and 1.1 million TELUS TV® customers. Furthermore, TELUS is Canada’s leading healthcare information technology (IT) provider. Formerly known as TELUS Communications Inc., the company changed its name to TELUS Corporation in February 2005.

After rising 4.7% early in the trailing 12-month period, the company’s share price reached its 52-week high of $38.25 on October 10, 2017. However, after the October peak, the share price declined 10% towards its 52-week low of $34.47 on March 26, 2018. The share price resumed its uptrend and has regained more than 80% of its losses from the October peak as of the closing price on Aug. 30 at $37.55. This closing price was just 1.8% short of its 52-week high, 3.8% higher than it was one year earlier and 17% higher than it was five years ago.

The company’s current $0.40 (CAD 0.525) quarterly dividend is a result of a 6.5% dividend hike over the $0.378 (CAD 0.493) quarterly payout from the same period last year. This current quarterly payout corresponds to a $1.61 (CAD 2.10) annualized distribution and a 4.3% yield. This yield is nearly three times higher than the 1.08% average yield of the overall Technology sector, as well as 56% higher than the 2.74% simple average yield of all the companies in the Wireless Communications industry segment. After 14 consecutive years of annual dividend hikes at an average annual growth rate of nearly 15%, the company’s current total annual dividend payout is seven times higher than it was in 2004, when the annual dividend hikes streak began.

As a result of more than a decade of annual dividend hikes and steady asset appreciation, shareholders enjoyed an 8% total return over the past 12 months, as well as total returns of 28.7% and 37.6% over the past three and five years, respectively.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic