The Coca-Cola Company Offers 3.2% Dividend Yield, 8.6% Asset Appreciation (KO)

By: Ned Piplovic,

While Technology stocks continue to lead the overall market lower, the Coca-Cola Company (NYSE:KO) has advanced its share price more than 10% since mid-October and complements this asset appreciation with a 3.2% dividend yield.

In addition to the recent share price surge, the company has rewarded its shareholders with a combination of steady capital gains and dividend income growth for decades. The Coca-Cola Company has distributed quarterly dividend since 1920 and has hiked its annual dividend income payout for the past 55 consecutive years.

This record of consecutive annual dividend boosts places the company among the elite dividend-paying companies in the Dividend Aristocrats group. As an exclusive group, the Dividend Aristocrats currently contains just 52 companies that meet the requirements of being a part of the S&P 500 Index with a market capitalization of at least $3 billion and a record of at least 25 consecutive annual dividend hikes. Furthermore, the Coca-Cola Company even exceeds the minimum requirement of at least 50 consecutive annual dividend boosts for inclusion in an even more exclusive company of 16 Dividend Kings.

In addition to reliable long-term dividend distributions, the company currently offers shareholders a 3.2% dividend yield, as well as a moderate but steady shareprice growth. Despite mild volatility in the first half of 2018, KO’s share price gained 8.6% over the past 12 months and nearly 25% over the past two years. After a pullback in early 2018, the share price recovered all those losses by the first week of November and advanced further to reach its new all-time high on November 19, 2018.

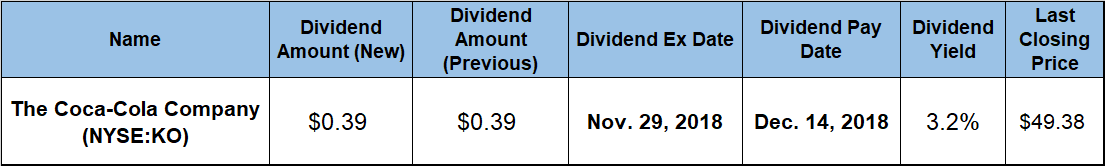

Investors seeking refuge from the troubled Technology sector and who are convinced that this share price might continue its ascent, should do their research and act prior to the company’s next ex-dividend date on November 29, 2018. All shareholders of records prior to that ex-dividend date will be eligible for the next round of dividend distributions on the December 14, 2018, pay date.

The Coca-Cola Company (NYSE:KO)

Headquartered in Atlanta, Georgia, and founded in 1886, The Coca-Cola Company manufactures and distributes various nonalcoholic beverages. The company offers finished products for market distribution, such as bottled water, sports drinks, juices, teas, coffee and energy drinks. Additionally, the company provides concentrates, syrups, beverage bases, source waters and powders, as well as fountain syrups to fountain retailers, such as restaurants and convenience stores. The company sells its products in more than 200 countries under more than 350 different brands, including Coca-Cola/Coke, Fanta, Sprite, Minute Maid, Georgia, Powerade, Schweppes, Aquarius, Dasani, Simply, Glacéau, Gold Peak and FUZE TEA.

The company’s current $0.39 quarterly dividend is 5.4% above the $0.37 distribution amount from the same period last year. This new quarterly amount corresponds to a $1.56 annualized distribution and a 3.2% forward dividend yield, which is approximately 3% higher than the company’s own 3.06% five-year yield average.

Furthermore, Coca-Cola’s current 3.2% dividend yield is nearly 50% higher than the 2.15% average yield of the overall Consumer Goods sector, as well as almost 130% above the 1.38% simple average yield of all the companies in the Beverages – Soft Drinks industry segment. Coca-Cola has the highest dividend yield in this segment. As such, the 3.2% yield is nearly 40% above the 2.26% yield average of the segment’s only dividend-paying companies.

In addition to having the highest dividend yield in the segment, the Coca-Cola Company also has a minority ownership stake in the companies with the next two highest dividend yields – Coca-Cola FEMSA, S.A.B. de C.V (NYSE:KOF) and Coca-Cola European Partners plc (NYSE:CCE). Actually, seven out of the top nine dividend yields in this sector belong to the Coca-Cola Company or its bottlers and distributors.

In addition to offering the top yield among its peers, KO has enhanced its annual dividend payout more than five-fold over the past two decades, which corresponds to an average growth rate of 8.6% per year.

After spiking briefly in January 2018, the share price fell to its 52-week low of $41.55 on May 16, 2018. However, the share price reversed direction and gained almost 22% before reaching its new all-time high of $50.51 on November 19, 2018. The share price closed on November 20, 2018 at $49.38, which was 8.6% higher than it was one year earlier and almost 19% above the 52-low from May 2018.

The combined benefit of rising dividends and asset appreciation delivered a total return of more than 12% over the past 12 months, as well as total returns of 27.5% and 43.2% over the past three and five years, respectively.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic