Three Dividend-Paying Pharmaceutical Equities Offer Hope Amid COVID-19 Crisis

By: Paul Dykewicz,

Three dividend-paying pharmaceutical equities to purchase during the COVID-19 crisis include two industry giants and an exchange-traded fund (ETF) that gives exposure to stocks that are pursuing vaccines to fend off the novel coronavirus.

Three dividend-paying pharmaceutical investments to purchase amid the COVID-19 crisis avoid focusing solely on the top contenders for developing vaccines to protect against the dreaded novel coronavirus, since the share price of many of those stocks already have rocketed. However, an exchange-traded fund (ETF) offers exposure to promising vaccine makers as they pursue testing that may result in obtaining approval from the Food and Drug Administration (FDA) within months rather than years.

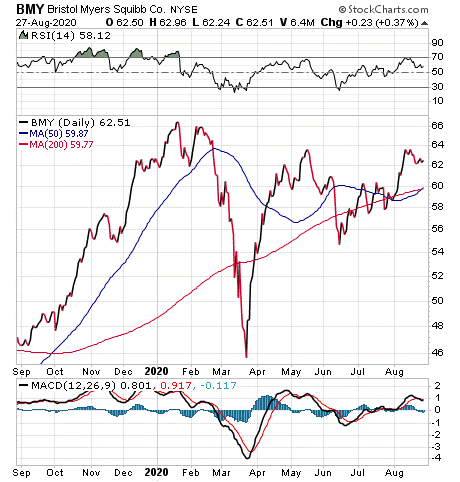

Bristol Myers Squibb Gains Spot Among 3 Dividend-Paying Pharmaceutical Equities Offering Hope

Bob Carlson, leader of the Retirement Watch investment newsletter, said he firmly recommends Bristol Myers Squibb (NYSE:BMY). He first advised buying the stock on June 29 and it since has risen $57.80 to $62.51, while also paying a $0.45 per share dividend on July 2.

Carlson, chairman of the Board of Trustees of Virginia’s Fairfax County Employees’ Retirement System with more than $4 billion in assets, said Bristol Myers Squibb faced some recent challenges, such as the loss of patents. The company also absorbed huge debt last year to acquire Celgene in a $74 billion transaction.

The debt contributed to a drop in Bristol Myers Squibb’s share price and caused it to sell at a substantial discount to its value. Income investors, however, will appreciate that Bristol Myers Squibb pays a “high dividend yield” of around 2.9% that appears safe, even after required debt payments from the Celgene deal are taken into account, Carlson said.

“S&P continued to give the company’s debt an A+ rating after the deal,” Carlson said. “The company is selling other assets and reducing expenses to increase cash flow. BMY made deleveraging and improving its balance sheet a priority.”

Celgene Acquisition Debt Affects 3 Dividend-Paying Pharmaceutical Equities During COVID-19 Crisis

Carlson, who tries to protect the money of investors with equities that tend to pay dividends, said Bristol Myers Squibb has a history of managing mergers and acquisitions well, so it likely will achieve the cost savings and benefits it projects from the Celgene purchase. Plus, Bristol Myers Squibb has a “good portfolio of profitable drugs and a solid pipeline” of others on the way, Carlson added.

The company has at least maintained its dividend for more than 35 years and boosted it each of the last 13 years. Key risks to buying Bristol Myers Squibb include the challenge of executing its merger plan successfully and handling the debt from the Celgene deal, Carlson opined.

“The risk has a low probability of being realized given the company’s history of successfully executing mergers,” Carlson said.

Chart courtesy of www.stockcharts.com

Assessing 3 Dividend-Paying Pharmaceutical Equities amid COVID-19 Crisis

Bristol Myers Squibb’s trailing 12-month price-to-earnings (P/E) ratio is 10.87 times its earnings, compared to the Medical — Biomedical and Genetics industry’s ratio of 25.78 times earnings, according to Zacks. As a result, Bristol Myers Squibb trades at a big discount compared to its industry peers as it tries to absorb Celgene.

In addition, Bristol Myers Squibb announced on Aug. 24 that it agreed to acquire privately held Forbius, a clinical-stage protein engineering company that designs and develops biotherapeutics for the treatment of cancer and fibrotic diseases to add a TGF-beta asset. Bristol Myers Squibb reported on Aug. 17 an exclusive global license for Dragonfly’s interleukin-12 (IL-12) investigational immunotherapy program intended to achieve potent anti-tumor efficacy for patients with advanced stages of cancer. But that alliance still needs regulatory clearance under the Hart-Scott-Rodino Antitrust Improvements Act of 1976.

Pension fund Chairman Bob Carlson answers questions from Paul Dykewicz in an interview before social distancing became the norm after the outbreak of COVID-19.

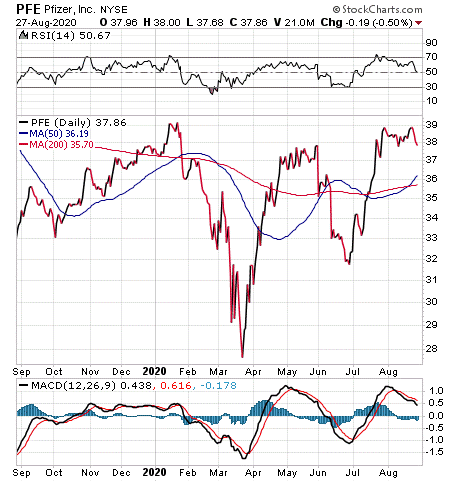

Pfizer Is 1 of 3 Dividend-Paying Pharmaceutical Equities Offering Hope in COVID-19 Crisis

Pfizer Inc (NYSE:PFE), a New York City-based multinational pharmaceutical company, offers a current dividend yield of 3.99% and trades at a P/E ratio of 14.99. That P/E ratio tops Bristol Myers Squibb’s P/E ratio but is much lower than the 25.78 times earnings of the Medical – Biomedical and Genetics industry.

Pfizer’s large size poses a challenge in achieving more than modest growth but it has financial resources needed to partner with other pharmaceutical developers. One recent example is its partnership with Mainz, Germany-based BioNTech.

Chart courtesy of www.stockcharts.com

Mark Skousen, PhD, a Presidential fellow in economics at Chapman University who has led the Forecasts & Strategies investment newsletter for more than 40 years, features Pfizer in his five favorite Dow Jones stocks that have the lowest price among the index’s 10 highest-yielding equities. Skousen changes the list each year in the August issue of his newsletter. Since the financial crisis of 2008, his Flying Five stocks outperformed the Dow 30 Industrial Stock Index (DJIA) annually until this year.

Between August 2019 and July 2020, the Flying Five fell an average of 3%, compared to the Dow Jones Industrial Average’s 2%-plus gain. Skousen, who also leads the Home Run Trader, Five Star Trader, TNT Trader and Fast Money Alert advisory services, said during a crisis, such as those in 2008-09 and 2019-20, the Flying Five strategy has underperformed the DJIA. But when Wall Street returns to normal, the strategy beats the market and typically does so significantly.

Mark Skousen, a descendant of Benjamin Franklin, meets with Paul Dykewicz.

Kramer Favors 1 of 3 Dividend-Paying Pharmaceutical Equities Amid the COVID-19 Crisis

Pfizer also is favored by Hilary Kramer, host of a national radio program called “Millionaire Maker” and leader of the GameChangers and Value Authority advisory services. The stock’s dividend yield offers income investors a place for a portion of their money to earn much higher returns than the low rates that banks pay depositors.

Capital appreciation of 6% annually would give Pfizer investors a pre-tax return of roughly 10%. Faster-growing pharmaceutical stocks potentially can offer superior returns, but they also carry heightened risk.

Kramer eschews the idea of buying shares in pharmaceutical stocks that already have soared in price due to investors bidding up such shares in hopes of finding the ultimate winners in the race to market effective COVID-19 vaccines before competitors can do so.

Columnist and author Paul Dykewicz interviews money manager Hilary Kramer, whose premium advisory services include 2-Day Trader, IPO Edge, Turbo Trader, High Octane Trader and Inner Circle.

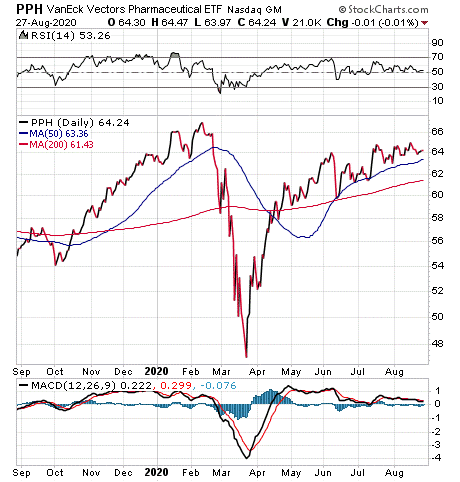

PPH ETF Rates as 1 of 3 Dividend-Paying Pharmaceutical Equities Amid the COVID-19 Crisis

Jim Woods, editor of Successful Investing, Intelligence Report and Bullseye Stock Trader, told me two key catalysts to propel stocks would be 1) The passing of a substantive stimulus deal by Congress, and 2) A game-changing vaccine/therapeutic to combat coronavirus. The NASDAQ Composite and the S&P 500 already have “extricated” themselves from the shortest bear market in history, rebounding from roughly a 30% drop.

A danger for investors to watch is whether a substantive new stimulus bill of about $1.5 trillion gains Congressional passage. Another risk hinges on if the much-needed vaccine/therapeutic treatment is developed as quickly as hoped. President Trump’s “warp-speed” project is aimed at producing the desired results in record time with an expedited regulatory review but there is no guarantee.

Woods expressed concern that the process of creating, supplying and administering pharmaceuticals that can solve a deadly problem such as COVID-19 is complex and “fraught with obstacles.”

Paul Dykewicz meets with Jim Woods before COVID-19 to discuss investment opportunities.

As the U.S. economy reopens state by state, stocks keep rising. To seize among the momentum and gain exposure to promising drug company stocks, Woods recently recommended an exchange-traded fund, VanEck Pharmaceutical ETF (NASDAQ:PPH), in both his Successful Investing and Intelligence Report investment newsletters. The ETF went into the Successful Investing Growth Portfolio, but he put it in his Intelligence Report service’s Tactical Trends Portfolio. The fund offers a trailing 12-month dividend yield of 1.64%.

Chart courtesy of www.stockcharts.com

Certain pharmaceutical stocks have the potential to rise significantly due to treat many serious health problems that include COVID-19, which Johns Hopkins University reports has caused 24,454,344 cases and 831,615 deaths worldwide, along with 5,869,032 cases and 180,844 lives lost in the United States, as of Aug. 28. America has faced the grim reality of having the most COVID-19 cases and deaths of any country, including China, where COVID-19 first originated.

The three dividend-paying pharmaceutical equities to consider amid the COVID-19 crisis each provide promising potential. Investors who want exposure to the industry may find any of the three dividend-paying pharmaceutical equities worth adding to their personal portfolios to benefit from the development of cutting-edge COVID-19 treatments.

Connect with Paul Dykewicz

Connect with Paul Dykewicz