Tiffany & Co. Boosts Quarterly Dividend Payout 10% (TIF)

By: Ned Piplovic,

Tiffany & Co. (NYSE:TIF) recently raised its quarterly dividend for the 15th straight year by providing a 10% increase for its next round of dividend payouts.

The current quarterly dividend hike is Tiffany’s 19th boost since its stock split in 1997, with the only exception occurring in 2002 when the dividend payout from 2001 was maintained. In addition, the company has rewarded investors with asset appreciation over the past 15 years.

This combination of a rising dividend income and growing share price enhanced Tiffany’s total returns, which soared above 40% for the past 12 months. While the share price currently is trading at all-time peak levels, the technical indicators and recent financial results point towards potential continued growth.

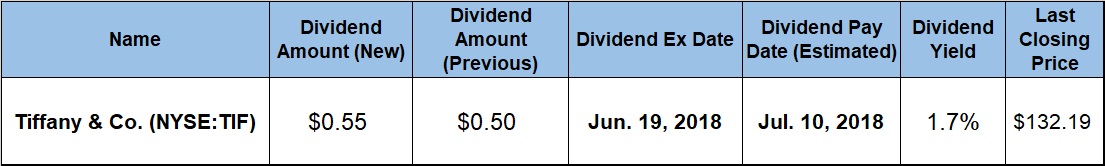

However, interested investors should perform their due diligence swiftly, because the company’s next ex-dividend date on June 19, 2018, is approaching quickly. The company will distribute its upcoming dividend payouts on its July 10, 2018, pay date.

Tiffany & Co. (NYSE:TIF)

Headquartered in New York, New York, and founded in 1837, Tiffany & Co., designs, manufactures and retails jewelry products and accessories. The company operates through five geographically based segments. With a 45% share of global net sales, the Americas region is Tiffany’s largest region. The Asia-Pacific region excludes Japan and accounted for 26% of net sales in fiscal 2017. The Japan market is its own region with a 14% share of net sales. With a 12% share of net sales, the Europe market, which encompasses operations in 12 countries, is smaller than the Japan market. Lastly, the Other segment accounts for just 3% of the company’s net sales from stores operated under a licensing agreement in the United Arab Emirates. As of January 31, 2018, the company operated 315 stores worldwide.

The company’s new $0.55 quarterly dividend payout amount is 10% higher than the previous quarter’s $0.50 dividend distribution. This increased quarterly dividend corresponds to a $2.20 annualized dividend and a 1.7% forward dividend yield. That yield is 7.5% below the company’s 1.8% average yield over the past five years. However, the low dividend yield stems from a recent share-price spike of nearly 30% following the company’s positive financial results for the first quarter of 2018. Tiffany announced a Q1 15% net sales increase and improved operating margins, which combined with a lower effective tax rate to account for a 53% net earnings increase. Just before the share-price spike on May 22, 2018, the $102.24 share price translated to a 2.2% dividend yield, which was nearly 20% higher than the company’s 1.8% five-year average yield.

Likewise, the current 1.7% yield is 12.4% below the 1.9% average yield of the entire Services sector, whereas the 2.2% yield from a few weeks back would have been more than 13% higher than the sector’s average.

Since Tiffany held the line on its dividend payout in 2002, the company advanced its total annual dividend amount nearly 14-fold from a $0.16 annual payout in 2002 to the current $2.20 annual distribution. This level of growth is equivalent to an average growth rate of 17.8% per year.

The share price traded relatively flat during the first half of the trailing 12 month-period, which included a 52-week low of $87.55 on August 24, 2017. After bottoming out at the end of August 2017, the share price rose slowly and gained nearly 17% by May 22, 2018. However, after the positive quarterly results, the share price jumped more than 20% in a single trading session and gained a total of more than 30% over the subsequent two weeks. The share price reached its new all-time high of $133.91 on June 6, 2018, before pulling back 1.3% and closing on June 8, 2018 at $132.19. This closing price was nearly 40% higher than it was one year earlier and 51% above the 52-week low from the end of August 2017.

The company’s steady dividend income growth and the share-price rise combined to reward the company’s investors with a 43.3% total return over the past 12 month, as well as a total return of nearly 50% over the past three years and a 78% total return over the past five years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic