Toronto Dominion Bank Offers 11.7% Quarterly Dividend Boost (TD)

By: Ned Piplovic,

Featured Image Source: Wikimedia Commons; Author: Matthew Bisanz

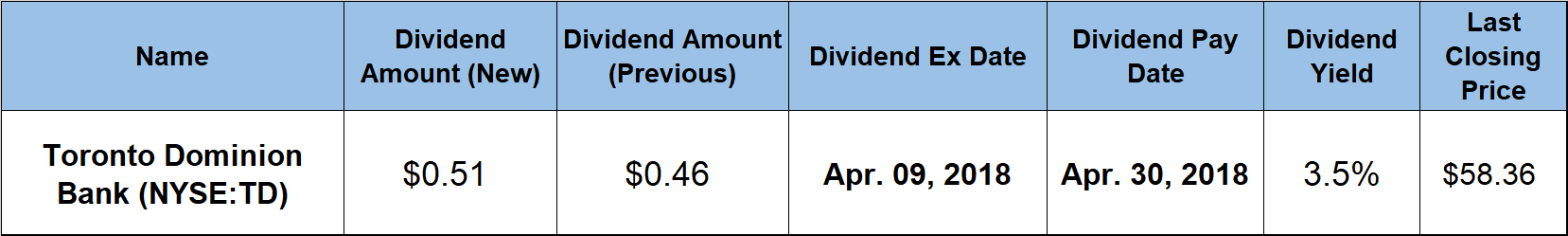

The Toronto Dominion Bank (NYSE:TD) recently continued its long-standing history of dividend distributions with an 11.7% hike to its quarterly dividend, which currently yields 3.5%.

The company has been distributing dividends for more than a century and a half and it has missed a dividend hike only once in the past two decades. In addition to providing a reliable dividend income to its shareholders, the bank also grew its share price, which rose by a double-digit percentage to combine with the dividend income for a total return on investment of more than 22% over the past 12 months.

The company has set its next pay date for April 30, 2018, when it will distribute its next dividend to all its shareholders of record prior to the April 9, 2018 ex-dividend date.

Toronto Dominion Bank (NYSE:TD)

Headquartered in Toronto, Canada, and founded in 1855, the Toronto-Dominion Bank, together with its subsidiaries, provides various personal and commercial banking products and services in Canada and the United States. The company provides its products and services through three business segments – Canadian Retail, U.S. Retail and Wholesale Banking. In addition to standard personal banking services like personal deposit accounts, the bank offers financing, investment, cash management, international trade, and day-to-day banking services to small, medium and large businesses.

Furthermore, the bank offers financing options to customers at point of sale for automotive and recreational vehicle purchases through auto dealer networks, as well as credit cards, asset management services to retail and institutional clients and several types of insurance products. The company further offers its products and services under the TD Canada Trust, TD Bank and America’s Most Convenient Bank brand names. The bank’s network of approximately 1,300 branch locations and almost 3,200 automated teller machines throughout the Northeast, Mid-Atlantic, Metro D.C., the Carolinas and Florida provides services to 15 million customers.

The company hiked its quarterly dividend distribution 11.7% from last period’s $0.46 (CA$0.60) to the current $0.51 (CA$0.67) quarterly payout. This current quarterly dividend amount translates to $2.04 (CA$2.68) annual distribution and a 3.5% forward yield.

That current yield is within 5% of the 3.7% simple average yield of the entire Financials sector. The bank started paying dividends in 1857. In addition to its long history of paying dividends, the company also has boosted its annual period reliably year-after-year. In the past 20 years, the bank had no dividend cuts and failed to raise its annual dividend only once. In the aftermath of the 2008-2009 financial crisis, when many financial institutions were forced to cut drastically or even eliminate their dividends, the Toronto-Dominion Bank merely paid the same $1.22 annual dividend in 2010 as it did in 2009 and resumed hiking its annual dividends in 2011.

Since resuming dividend hikes, the bank boosted its annual dividend amount for eight consecutive years at an average growth rate of 10.3% per year and enhanced its total annual payout amount more than 120% above the 2011 amount. Even with the missed hike in 2009, the company’s annual dividend growth rate averages 11.3% per year over the past two decades and the annualized payout amount rose more than 750% from $0.24 (CA$0.32) in 1998 to the current annualized payout of $2.04 (CA$2.68) for 2018.

The company’s share price entered the trailing 12 months (TTM) on a minor declining trend and dropped 7.6% between March 17, 2017, and May 17, 2017, when the share price reached its 52-week low of $45.74. However, after bottoming out in mid-May, the share price reversed direction and advanced just short of 33% to achieve its new all-time high of $60.80 by February 1, 2018.

Unfortunately, the overall market sell-off in the first week of February interrupted the bank stock’s rise as its share price lost 7.5% by February 9, 2018. However, after that brief drop, the share price recovered 45% of its losses to close on March 20, 2018, at $58.38. This closing price was just 4% below the price peak from February 1, 2018, 17.9% above its own level from one year earlier and 27.6% higher than the 52-week low from mid-May 2017.

Dividend increases and decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic