Tri-Continental Corporation Lifts Quarterly Dividend 23% (TY)

By: Ned Piplovic,

The Tri-Continental Corporation enhanced its dividend payout 23.3% this quarter to continue a streak of similar dividend hikes over the past eight successive years.

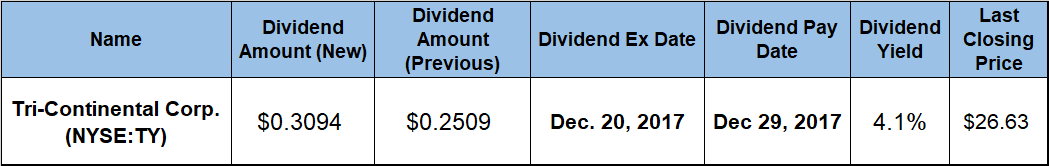

In addition to the extraordinary growth of the annual dividend payouts, the company achieved a 20%-plus asset appreciation over the past year and pays a 4.1% yield, which is above the sector average. The next ex-dividend date for Tri-Continental Corporation’s dividend will be on December 20, 2017, and the pay date will follow less than three weeks later, on December 29, 2017.

Tri-Continental Corp. (NYSE:TY)

Established in 1929, the Tri-Continental Corporation operates as a diversified, closed-end management investment fund. The company’s objective is to provide long-term investment growth balanced between capital growth and rising dividend income. The fund’s favored investment vehicles include preferred and common stocks, convertible securities, debt securities, repurchase agreements, derivatives and securities of foreign issuers, including emerging markets issuers. Currently, the company invests in a range of sectors, which include consumer discretionary, consumer staples, energy, financials, health care, industrials, information technology, materials, real estate, telecommunication services and utilities.

As of October 31, 2017, the Fund had approximately $1.63 billion under management spread across 220 holdings. The fund held 123 equity holdings, which accounted for 68% of assets, and 97 fixed income securities, which accounted for the remaining 32% of fund’s total assets. The top five holdings – Microsoft, Bank of America, Facebook Inc., JP Morgan Chase & Co. and Altria Group Inc. – respectively contributed between 1.63% and 2.08% share of assets each for a combined 9.1% share. The top 10 holdings accounted for just a 16.46% share of total assets, which is a good indication of a well-balanced fund with minimal risk of any single holding causing a significant movement of the fund’s share price. The fund’s current investment manager is Columbia Threadneedle Investments, which was created in 2015 through a merger of London-based Threadneedle Investments and Boston-based Columbia Management Investment Advisers, LLC.

The fund’s share reached its 52-week low very early in its current trailing 12-month period. After dropping 0.7% from $22.08 on December 7, 2016, the share price hit its 52-week low of $21.90 on December 15, 2016. However, after the December 15, 2016, bottom, the share price rose at a steady pace with minimal volatility and only a few small dips along the way towards its new 52-week high of $26.63 on December 6, 2017. On December 8, 2017, the share price closed just $0.02 lower than its high from two days before at $26.61, which is 20.6% higher than it was one year ago and 21.5% higher than the 52-week low from mid-December 2016.

Just the asset appreciation at those levels is sufficient to make this equity an attractive investment. However, the real draw is the dividend growth over the past several years. The fund increased its quarterly dividend 23.3% from $0.2509 in the previous period to the current $0.3094 distribution. This new distribution yields 4.1% and converts to a $1.2376 annualized payout per share. The current 4.1% yield is 25.6% higher than the funds own 3.7% average yield over the past years and 29% higher than the 3.6% average yield of the entire Financials sector.

The fund dropped its dividend several times and paid mostly flat dividends between 1999 and 2009. However, since 2009, the total annual dividend payout grew at an average rate of 26.61% per year for the last eight consecutive years. This extraordinary average growth rate increased the fund’s total annual dividend distribution 540% since 2009.

The shareholder’s total return over the last 12-month, three years and five years was 25.9%, 36.6% and 92%, respectively. The share price’s 50-day Moving Average (MA) is currently 5.6% above the 200-day MA and rising faster than the 200-day MA, which is a fairly reliable indication that the share price should continue to rise in the near future and provide complementary benefits to the finds rising dividend payouts.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic