Warren Buffett’s Top 10 Dividend Stocks

By: Ned Piplovic,

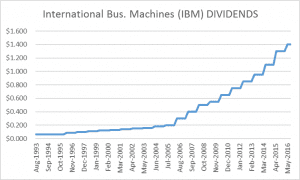

4. International Business Machines (NYSE: IBM)

This stock has a 3.53 percent dividend yield and has increased steadily since 2000, with a more accelerated growth starting in 2006.

The share price is down 27 percent from the all-time of $213 in 2013 and is trading at $158.85 as of September 30, 2016 — only 4 percent lower than the 52-week high.

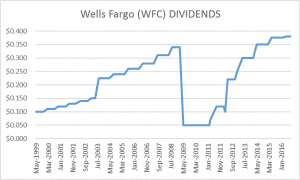

5. Wells Fargo (NYSE: WFC)

Its dividend payout plunged 85 percent after the 2008 financial crash and remained flat for eight consecutive quarters before starting to increase again in 2011. By May 2014, its dividend payout returned to the 2008 level and increased another 11.8 percent by September 2016.

Wells Fargo’s share price is down 21 percent from the all-time high in July 2015. The stock is also 10 percent lower since the beginning of September 2016, when news about overly aggressive Wells Fargo sales practices emerged. Some employees were opening unauthorized customer accounts to meet sales goals and reach bonus targets. Since CEO John Stumpf’s appearance before the Senate Banking Committee on September 19, 2016, the stock price has continued a slow decline and ended September 30, 2016, at $44.28 – only 0.4 percent above its lowest closing price in the last 52 weeks of $44.10.

Connect with Ned Piplovic

Connect with Ned Piplovic