Wells Fargo Boost Quarterly Dividend Distributions 13% (WFC)

By: Ned Piplovic,

Wells Fargo & Company (NYSE:WFC) hiked its quarterly dividend more than 13% for the upcoming round of dividend distributions next month.

This upcoming quarterly dividend payout hike extended Wells Fargo’s streak of annual dividend boosts to nine consecutive years. While distributing dividends since 1939, the company encountered some headwinds in the aftermath of the 2008 financial crisis. However, after a minor retreat, the bank resumed its policy of consecutive annual dividend hikes.

Driven by the overall downward market pressure — especially in the Financial sector — Wells Fargo was forced to cut its dividend distributions significantly after 2008. The bank reduced its quarterly dividend more than 85% from $0.34 in the first quarter of 2009 to $0.05 in the subsequent period.

After this quarterly dividend reduction, the company paid the same $0.05 amount for eight consecutive periods before resuming dividend boosts in the second quarter of 2011. However, after resuming the annual dividend increases, Wells Fargo’s annual dividend payout recovered fully within four years. By 2014, the total annual payout was higher than the $1.30 annual distribution in 2008, the last full year before the dividend cut in first-quarter 2009.

The company’s current dividend payout ratio of 39% indicates that Wells Fargo should be able to maintain its pace of double-digit-percentage annual dividend hikes going forward. The current payout ratio is nearly in the middle between 30% to 50%, which is what most investors generally consider the optimal payout ratio range. Above the lower limit of this range, equities distribute a significant enough share of its earnings to deliver a sufficient level of dividend income to attract income seeking investors. Alternatively, below the 50% upper range limit, equities still retain enough of their earnings to provide sufficient funding for other corporate expenses and capital investments.

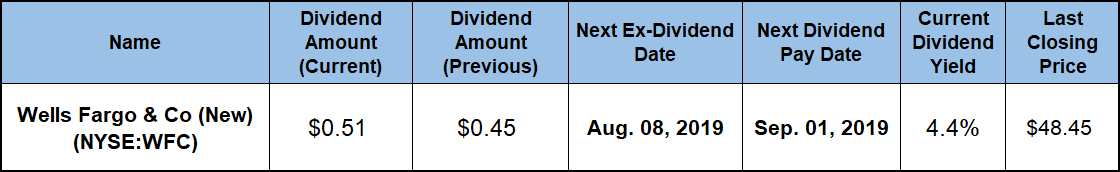

Interested investors must conduct their own analysis to ascertain this stock’s compatibility with their individual portfolio goals. However, investors that decide to take a position in the Wells Fargo stock should act before the upcoming ex-dividend date on August 8, 2019. Claiming stock ownership before this ex-dividend date will ensure eligibility for the next round of dividend distributions on the September 1, 2019, pay date.

Wells Fargo & Company (NYSE:WFC)

Headquartered in San Francisco, California, and founded in 1852, Wells Fargo & Company is a diversified financial services company that provides retail, commercial and corporate banking services. The company’s Community Banking segment offers customary banking products and services, including checking and savings accounts, credit and debit cards, as well as a variety of loans, such as automobile, student, mortgage, home equity and small business loans. Additionally, the bank’s Wholesale Banking segment offers commercial loans, lines and letters of credit, equipment leasing, trade financing, collection, foreign exchange and merchant payment processing, as well as other financial and investment banking services. This segment also provides construction, land-acquisition and development loans, interim financing arrangements, rehabilitation loans and affordable housing loans, as well as real estate and mortgage brokerage services. Lastly, the company’s Wealth and Investment Management segment offers financial planning, private banking, credit, investment, management and fiduciary services, as well as retirement and trust services. With management offices in 42 countries, Wells Fargo & Company offers its products and services through approximately 8,300 locations, 13,000 Automated Teller Machines (ATMs), online banking and mobile apps.

The price entered the trailing 12-month period on a downtrend that began in January 2018 and continued declining through the end of the year. After passing through its 52-week high of $59.19 on August 8, 2019, the share price declined more than 26% before reaching its 52-week low of $43.60 by December 24, 2019.

After bottoming out in late December, the share price reversed direction and regained more than half of those losses by mid-March 2019. However, the share price declined again and fell to less than 2% above the 52-week low by the end of May.

Since the beginning of June, the share price has gained more than 9% to close on July 24, 2019, at $48.45. While still nearly 17% lower than it was one year ago, the July 24, closing price was more than 11% higher since the 52-week low in December 2018.

The company’s most recent quarterly dividend hike increased the payout 13.3% from $0.45 in the third quarter last year, to the upcoming $0.51 payout amount. This new quarterly dividend payout corresponds to a $2.04 annualized distribution and a 4.4% forward dividend yield, which 43% higher than company’s own 2.94% yield average over the past five years.

While outperforming the 3.01% average yield of the entire Financials sector by nearly 40%, Wells Fargo’s current yield outperformed the 1.62% average yield of the Money Center Banks segment by almost 160%. Furthermore, the company’s current yield is nearly 50% higher than the 2.85% simple average yield of the sector’s only dividend-paying companies.

Since resuming its annual dividend boosts in 2011, Wells Fargo enhanced its annual payout amount more than 10-fold, for an average annual growth rate of 29.4%. However, the extremely low annual dividend of just $0.20 is not representative of the company’s real dividend distributions. Therefore, calculating the dividend growth rate against the $0.48 annual dividend from 2011 makes more sense. Since the 2011 $0.48 payout, the total annual dividend advanced 325%, which corresponds to a still impressive average growth rate of nearly 20% over the past eight years. Furthermore, even with the significant cut in 2009 and flat dividend payouts in 2010, Wells Fargo’s annual dividend still increased more than five-fold over the past 20-years. This dividend advancement is equivalent to an average annual growth rate of 8.5% over the past two decades.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic