Williams-Sonoma Boosts Quarterly Dividend Distribution 10% (WSM)

By: Ned Piplovic,

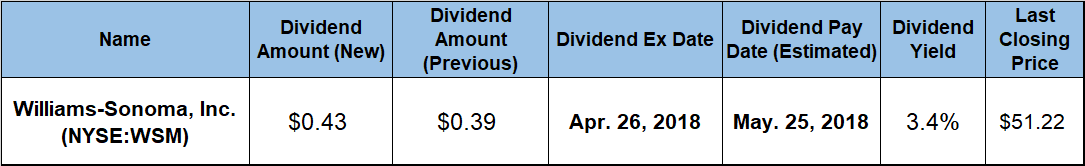

Williams-Sonoma, Inc. (NYSE:WSM) rewarded its shareholders with its 12th consecutive annual dividend increase, hiking its upcoming quarterly distribution amount 10.3%, and offers a 3.4% dividend yield.

The company’s share price lost half of its value between its $87.50 all-time high in August 2015 and its recent 52-week low in late August 2017. However, since the 52-week low, the share price has rewarded shareholders with a double-digit-percentage growth. This recent uptrend might be an early indication that the share price has reversed its downward trend and that it could continue to advance higher over the next couple of periods.

A share price increase would assist the rising dividend income towards converting total losses over the past few years into positive total returns on shareholders’ investment. So far, the moderate share price gain managed to reduce the 31% total loss over the past three years into a total loss of just a little above 3% over the past 12 months.

Interested investors should perform their own due diligence prior to taking a position in this stock. However, investors who decide to proceed and take a long position should do so prior to the company’s next April 26, 2018, ex-dividend date to guarantee eligibility for the company’s next round of dividend distributions on the May 15, 2018, pay date.

Williams-Sonoma, Inc. (NYSE:WSM)

Williams-Sonoma, Inc. operates as a multi-channel specialty retailer of various products for home. The company offers cooking tools, dining implements, entertaining products and a library of cookbooks under the Williams-Sonoma brand, as well as home furnishings and decorative accessories under the Williams-Sonoma Home brand. Additionally, the company sells furniture, bedding, rugs, curtains, lighting and tabletop and decorative accessories under the Pottery Barn, Pottery Barn Kids, PBteen and West Elm brands. Founded in 1956 and headquartered in San Francisco, Williams-Sonoma, Inc. operates approximately 630 stores in 43 U.S. states, Canada, Australia and the United Kingdom. Additionally, the company operates 66 franchised stores and e-commerce websites in the Philippines, Mexico and the Middle East.

The company’s current quarterly $0.43 dividend is 10.3% higher than the $0.39 distribution amount from the previous quarter. This new quarterly payout amount converts to a $1.72 annualized dividend amount for 2018 and a 3.4% forward yield, which is almost 40% above the company’s own 2.4% average yield over the past five years.

Additionally, Williams-Sonoma’s current dividend fares much better than those of its sector peers. While the company’s current dividend yield is 62% higher than the 1.95% average yield in the services sector, it is 82.65% above the 1.73% average yield for the companies in the Specialty Retail segment.

The company started paying dividends in 2006 and has increased its annual distribution amount every year since then. Over the past 12 consecutive years, the company has more than quadrupled its total annual dividend by compounding the annual dividend amount at an average rate of 12.9% per year.

The share price’s 52-week high of $55.59 occurred at the beginning of the trailing 12-month period, on April 11, 2017. After that peak, the share price declined nearly 23% before reaching its 52-week low of $42.85 on August 22, 2017. After bottoming out in August, the price experienced moderate volatility, but recovered all its losses by mid-January 2018 and rose to within 0.2% of the 52-week high from April 2017. Since the mid-January near-peak, the share price pulled back nearly 8% and closed on April 4, 2018, at $51.22. This closing price was less than 6% below the price from 12 months earlier and nearly 20% higher than the 52-week low from August 2017.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic