Take Your Dividend Investing to the “Pro” Level

Test Drive Dividend Investor for 14 Days (And pay just $1)

Hi, I’m Roger Michalski, publisher of Eagle Financial Publications’ Dividend Investor.

Simply put, we built this site to be the world’s most powerful all-in-one tool for income-seeking investors of every stripe.

Who uses Dividend Investor?

Wall Street pros like Geoff Garbacz of Quantitative Partners, a high-end advisor to institutional money managers. Geoff is a long-time Dividend Investor subscriber, and went out of his way to tell us how great the service has been for him.

Seeking Alpha uses Dividend Investor to sort upcoming ex-dividend dates for their millions of readers. And even more praise for Dividend Investor comes from MarketWatch, Barrons, Yahoo Finance and the American Association of Individual Investors.

And now you, too, can use it… to get the ultimate insider’s edge in your dividend investing…

ALL FOR JUST $1!

- Target and choose the absolute best dividend-paying companies…

- Super-charge your dividend income… and

- Boost your portfolio with wealth-compounding strategies.

Not only is it the world’s biggest database of dividend information, updated 5 times every day… It’s also simple and intuitive, allowing you to find exactly what you want. (You can easily download any of your data into Excel, too.)

Here’s what you’ll get with your 14-day

(no obligation) trial:

8 core tools drive Dividend Investor, designed to quickly give you a leg up in achieving your dividend income goals:

- Comprehensive Quotes: Your quote page delivers extensive dividend and stock details, conveniently compiled into a single page.

- Powerful Dividend Calendar: It’s not enough to know details about dividend-paying securities. Pros dig in to get each play’s history and projected future payouts, as well as key dates for investing.

- Screeners & Directories: Easily categorize and sort every kind of dividend-paying investment available today: REITs (real estate investment trusts), closed-end funds, DRIPs (dividend reinvestment plans), Royalty Trusts, ETFs (exchange traded funds), MLPS (master limited partnerships), BDCs (Business Development Companies), and more.

- Timely Email Alerts: Get notified instantly whenever important market or financial events happen that may have a direct impact on your stocks, dividends and funds.

- The “Dividend Detector”: this tool allows you to get summaries summaries and displays information for any dividend-paying stock, ETF, BDC, DRIP, REIT,– all at the click of a mouse.

- Handy Dividend History Page: This time-saving resource lays out all 20 years of a security’s dividend history, including specific yields, special distributions, splits and much more… and it’s downloadable to Excel.

- Your Own Personalized Dividend Scorecard: this feature allows you to create up to five personalized portfolios letting you track the dividends of stocks you already own…

- Hi-Powered Dividend Calculator: this powerful tool allows you to project your dividend income up to 20 years into the future, so you can know exactly where your income or growth will take you.

Ready To Try Out Dividend Investor for $1?

For a deeper dive into the power of Dividend Investor’s proprietary tools, let’s begin with your Dividend Quote Page.

You get there by clicking on the first item in the Menu Bar: “Quote.”

With the click of your mouse, you get instant play on the yield of any specific. Simply zoom-in on dividend growth rates, yields, payout ratios and 20 years of rolling dividend payout data.

To show you just how great this tool is I’ll lead you through a real-life example. Go to the left of the page, where you see a search box.

Simply enter the name or ticker symbol of a dividend paying security.

For our example, we’ll use the U.S. pipeline company: Enterprise Products Partners… ticker symbol EPD. (Enterprise has been a long-time favorite recommendation of our own Dr. Mark Skousen in his award-winning Forecasts & Strategies newsletter.)

Instantly you get all the vital information you need on EPD, in two columns. The first column is filled with details on the security’s dividends. The second offers details on the security itself.

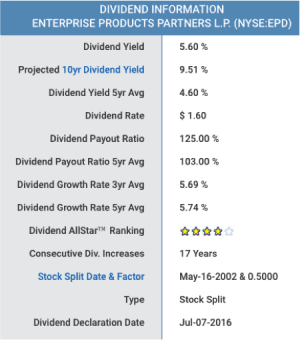

Let’s look at EPD’s Dividend Information column.

The first item in the left-hand column is the current Dividend Yield – what the yield is now, which today, stands at a robust 5.6%.

Below it is the Projected 10-year Dividend Yield, where the site calculates the dividend rate to be 9.51% in 10 years from now.

Next you get the Dividend Yield 5-year Average , which means EPD has averaged 4.6% in the past 5 years… and you get its current Dividend Rate in dollars and cents (which today stands at $1.60 per share). You also get its Dividend Payout Ratio, its Dividend Payout Ratio 5-year Average, and its Dividend Growth Rate’s 3 and 5-year Avg.

Next is our exclusive Dividend AllStar™ Ranking.

This may be one of the most important benefits of this site. It reflects our proprietary rank of any dividend-paying investment at a glance… and find the top performers for your portfolio.

The ranking system is simple

- 3 stars is equal to 5 years of dividend increases.

- To earn 4 stars, it takes 10 years of dividend increases.

- And for the highly-coveted 5-star Dividend AllStar™ Ranking, an investment must have 20 years of dividend increases.

Notice that Dr. Skousen’s EPD pick scored a 4-star Rating, with 17 consecutive years of dividend raises.

As you continue to scroll down the Dividend Investor page, you’ll continue to find a wealth of dividend information about your stock, including:

The Dividend Declaration Date — that’s the date on which the next dividend payment is announced by the directors of a company… and

The Dividend Ex Date — the time period between the announcement and payment of a dividend.

Towards the bottom of the page, you get a chart of the stock’s dividend payment history. It’s a clear visual aid to show dividend performance for specific years. EPD’s performance, as you can see, goes back to 1998.

There is also a quick summary of useful information on your stock in the box labeled “Other Details.”

Ready To Try Out Dividend Investor for $1? (14-day trial)

Now, let’s go back up towards the top of the Dividend Investor page.

To the right, you’ll see a column giving you important statistics on the stock itself. At a single glance, you get the latest close price, its 52-week range, and – this is very important – the shares held by big institutional investors. You know if the big money is invested, it should be a good bet for you too.

Here you can also see an investment’s revenue, net-income, and cash flow.

Next is its earnings-per-share, market cap, price-to-earnings ratio, price-to-earnings ratio to its industry, its debt/equity ratio, and its debt-to-equity ratio of its industry.

Then we wrap up things on this page with this investment’s total return in the last 12 months, the last 3 years, the last 5 years, and its latest trade date.

Returning to the top of the page, I’d like to point out something important on its right-hand side. You can see a label that says “Highest Dividend Yield.” Below it are listed several securities with the highest current yield. And beside that is a button labeled “More.”

Clicking that button will show you many of the highest yield investments available today. And selecting any one of these will populate the page below with details on that investment.

We will select one right now, so we can see the new data flow into both columns below.

Now, before you leave this page, let’s look at the upper right-hand corner.

This feature stays here on nearly every page on this site. It’s very useful to check any quote by immediately bringing you back to this page.

Let’s try a couple of quick examples.

Our income investing expert Bryan Perry recently recommended PPL Corporation, ticker symbol PPL. How did it do?

As of the date of this filming, it has a solid dividend yield of 4%, and a projected 10-year yield growth to 4.49%. There are many other noteworthy statistics, but here’s the one that jumps out at me:

The Dividend AllStar Ranking of four stars. That’s a great ranking.

By the way, this page is also good for other investments besides stocks… like Exchange Traded Funds, or ETFs, for example.

Our in-house ETF expert Jim Woods recently played an ETF that tracks the S&P 500, ticker symbol SPY.

Now, SPY is usually thought of as a growth fund, not necessarily invested in for dividends. Yet it did better than many other income investments, clocking in at a safe, solid 2% yield last year.

But keep in mind, the S&P 500 has an annual average compound rate of return of 9.8%… much higher than its 2% dividend.

And the SPY ETF has a Dividend AllStar Ranking of 3 stars.

This is just one reason why Jim Woods is known as an ETF expert. He gives his readers the best of both the income and growth worlds.

Ready To Try Out Dividend Investor for $1? (14-day trial)

The next tab is the page used by SeekingAlpha.com. It’s the Dividend Calendar.

This section gives you calendar searches for ex-dividend, dividend record, and dividend payment dates for thousands of stocks. The calendar searches through the NYSE®, NASDAQ®, AMEX® and OTCBB® exchanges… giving you all the available stocks in your date range.

By the way…. your calendar search can comb through up to 20 years of dividend stock data by selecting a custom date range, market cap, dividend yield and Exchange of your choice.

It’s easy to use… simply set a date range. Then, once you enter your dates and press submit, you’ll get the stocks for that period, in our proprietary Ex-Dividend Tracker™.

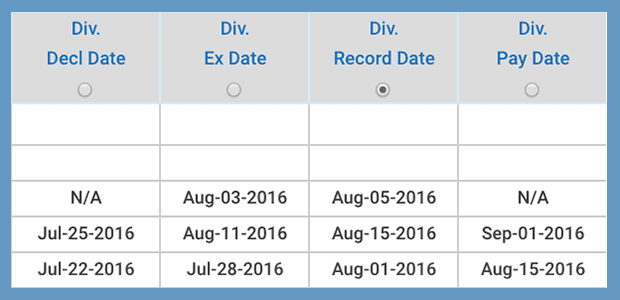

Note that you can sort your data by each column. Especially powerful are the columns to the right which you can see below, giving you four ways to view your results.

- Dividend Declaration Date.

- Ex-Dividend Date

- Dividend Record Date

- Dividend Payment Date

Now, once you have the information you want for the dividend stocks your tracking, you can have it sorted in a way that you want. Then you can either view it online, or download it into an Excel spreadsheet.

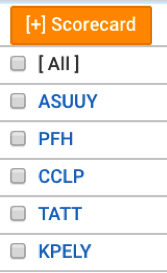

You also have the option of picking different stocks from your search, and saving them into a scorecard. To create your own scorecard, simply check the box next to the ticker symbol (like you see in the image below), then click the orange + Scorecard button.

Ready To Try Out Dividend Investor for $1? (14-day trial)

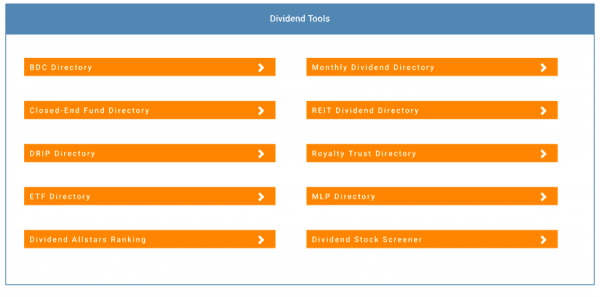

Let’s move up to the upper-right portion of the site, where you’ll find a section called Dividend Tools.

Below, you can see what that section looks like.

These are mostly quick links to what you will find under the upper menu tab Screeners & Alerts (which is represented below).

Underneath this tab, you will find:

Each of these links will take you to a screen with detailed information on whichever choice you select.

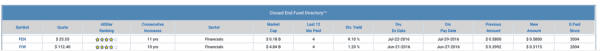

For example, the “Close End Fund Directory” will show you a comprehensive list of closed-end funds.

And it gives you valuable insights to help you pick the strongest income-building investments

You get comprehensive information on each fund, starting with its ticker symbol… then its latest quote.

Next you get the level each fund has achieved in our proprietary AllStar Ranking system. After that you’ll see how many consecutive years it has increased its dividends.

You’ll also clearly see the sector, the fund’s market capitalization, and how many dividends paid in the last 12 months… followed by dividend yield and ex-dividend date.

Perhaps most importantly, you get the date the dividend was (or will be) paid, the previous amount of the last dividend, the new amount of the latest divided… and the date dividends have been paid.

For convenience, you can sort this list by each column. Simply click on the column’s name, and it will sort it by that criteria.

For example, if you want to find close end funds paid from the longest historical time, just click on the “D. Paid Since “column, and the funds will order themselves in terms of historical dividend payment dates.

The same is true if you click AllStar Rankings. You can click the column heading once, and it will sort your list of funds in order from the top-ranking funds. Click it again, and Dividend Investor will sort your list of funds in order from the lowest-ranking funds.

You’ll find navigation is similar in the DRIP Directory (dividend reinvestment plans), the ETF Directory (exchange traded funds), and so-on.

Each directory has column after column of powerful, wealth-building research you can use to maximize your dividend investing dollars.

Ready To Try Out Dividend Investor for $1? (14-day trial)

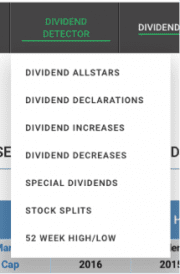

Another helpful section is under the Dividend Detector tab. This is great for drilling-down for specific data on a broad number of investments.

For example, clicking on Dividend AllStars lists investments by their AllStar Ranking.

Dividend Data gives you important information on dividend yields and dates.

Dividend Increases tells you which companies are increasing their dividends, and by how much, by both dollar amount and percent.

Dividend Decreases shows you the exact opposites.

Dividend Alert is an excellent source for finding both increases, decreases, suspended dividends, and special dividends.

Stock Splits show you the split type, and the factor by which it split.

And finally, you get a 52 Week High/Low Dividend Scanner, that lets you see highs and lows for the past 12 months.

And remember, the results from each of these can be downloaded into Excel.

Next up is the Dividend History tab, where you can research up to 20 years of a company’s dividend history.

More Dividend Investor Benefits

You can also set up helpful Email Alerts, whenever there’s a dividend event coming up for your dividend stocks. You can also set up your own Scorecards where you can add your favorite stocks and track them.

What’s more, you’ll have two powerful Dividend Calculators to project 20 years into the future for growth, reinvestment, and income potential.

Bottom line: The more you use Dividend Investor, the more you’ll get out of it.

I’m certain each time you use this site, you will get closer to achieving your dividend income goals.

To get started using Dividend Investor for 14 days (all for just $1, and with no further obligation), simply fill in the information below for immediate access.

As an added bonus, we’ll also give you access to 5 exclusive Dividend Research Reports, written by our esteemed analysts at Eagle Financial Publications.

Kind regards,

Roger Michalski

Publisher, Eagle Financial Publications