How Are Dividends Taxed?

By: Ned Piplovic,

“How are dividends taxed?” might seem like a major priority compared to other dividend selection considerations, but all dividends are not created equal in the eyes of the taxman.

Qualified dividends incur lower tax rates than their ordinary dividend counterparts, which can significantly increase the total return on shareholder investment over a long-term horizon. Dividends are payments that distribute a portion of a company’s assets to the shareholders either at set intervals or as occasional special dividend distributions.

Investors must evaluate many characteristics to select the dividend-paying stocks best suited for their investment goals. While usually not a primary selection criterion, tax treatment of dividends can be a tie breaker when finalizing stock selection.

Before we dive into answering the “How are dividends taxed?” question, we must consider how the type and distribution form of dividend payouts affect their tax liability status. The first differentiation is between cash dividend distribution and stock dividends that are distributed in the form of additional company shares.

Because additional company shares do not generate any income in the applicable tax year, this type of dividends carries no tax liability. The Internal Revenue Service (IRS) code treats stock dividends as stock splits. Therefore, stock dividends receive the same treatment as unrealized gains, which are only taxed at the capital gains rates when investors sell the shares.

However, cash dividends incur standard tax liability at ordinary income tax rates for the year in which the dividends are paid. An exception to this rule applies for dividends distributed by mutual funds, exchange-traded funds (ETFs), unit investment trusts (UIT) or other regulated investment companies (RICs). Dividends distributed in January by these investment entities can be included in a prior year’s taxable income with an assumed Dec. 31 pay date. However, to be treated as part of the previous year’s taxable income, the security must declare these dividends with a Date of Record in the fourth quarter of the previous year – October, November or December.

The information presented so far provides only a partial answer to the question of “how are dividends taxed?” In addition, cash dividends are taxed at the rates of ordinary income. However, that rule applies only for ordinary dividends.

Qualified dividends are taxed at the same tax rates as capital gains, which are lower than ordinary income tax rates Investors usually can identify the type of dividend received by looking at the tax form they are sent at the end of the year from their broker – box 1b on the 1099-DIV tax form. However, there are a few exceptions that must be identified.

How Are Dividends Taxed? – Qualified Dividends

To meet the requirement for taxation at the reduced, capital gain tax rates, must meet all of the criteria listed below.

1. A U.S. corporation or a qualified foreign corporation must be the legal entity distributing the dividends. The Internal Revenue Service (IRS) defines a Qualified Foreign Corporation as any company that meets all three of the following conditions:

a. The corporation is incorporated in a U.S. possession.

b. The corporation is eligible for the benefits of a comprehensive income tax treaty with the United States that the Department of the Treasury determines is satisfactory for this purpose and that includes an exchange of information program. The IRS website contains the full list of eligible treaties in Table 3. List of Income Tax Treaties.

c. The corporation does not meet (a) or (b) above, but the stock for which the dividend is paid is a readily tradable stock on one of the established National Security Exchanges in the United States. These securities markets must be registered under Section 6 of the Securities Exchange Act of 1934 or on the Nasdaq Stock Market.

2. The dividends are not of the type listed by the IRS as “Dividends that are not qualified dividends.” The dividends listed below are not qualified dividends even if they are listed in box 1b of Form 1099-DIV,

a. Capital gain distributions.

b. Dividends paid on deposits with mutual savings banks, cooperative banks, credit unions, U.S. building and loan associations, U.S. savings and loan associations, federal savings and loan associations and similar financial institutions. Dividends from these institutions are interest income.

c. Dividends from a corporation that is a tax-exempt organization or farmer’s cooperative during the corporation’s tax year in which the dividends were paid or during the corporation’s previous tax year.

d. Dividends paid by a corporation on employer securities held on the date of record by an employee stock ownership plan (ESOP) maintained by that corporation.

e. Dividends on which the investor must make related payments for positions in substantially similar or related property.

f. Payments in lieu of dividends, but only if the shareholder knows or has a reason to know the payments are not qualified dividends.

g. Payments shown on Form 1099-DIV, box 1b, from a foreign corporation, which the shareholder knows or has a reason to know that the payments are not qualified dividends.

3. The investor owns the shares for a specific amount of time to satisfy the holding period requirement. Specifically, to meet the holding period condition for qualifying dividends, investors must own common shares for more than 60 days during a 121-day period, which starts 60 days prior to a declared ex-dividend date. The same requirement applies for dividends paid on preferred shares that are due for periods of less than 367 days. However, dividends on preferred shares that are due for periods totaling more than 366 days have a slightly longer holding period requirement. To achieve eligibility for qualified dividend status for this second category of preferred shares, investors must own the shares for more than 90 days during a 181-day period that starts 90 days ahead of the ex-dividend date. When shares change ownership, the transaction date counts towards the seller’s holding period. The buyer’s holding period begins the day after the transaction.

How Are Dividends Taxed? – Ordinary Dividends

- In most cases, the amount in box 1a of the 1099-DIV for will designate ordinary dividends paid on common and preferred shares.

- Even if they meet all the qualifying eligibility requirements listed in section above, certain types of dividends will be qualified as ordinary dividends. For instance, dividend distributions from real estate investment trusts (REITs), tax-exempt companies or master limited partnerships (MLPs) and are treated and taxed as ordinary dividends. Additional dividend types that fall into this category are one-time dividends, special dividends and dividends on employee stock options.

- Dividend distributions from money market accounts must be reported as ordinary income because these distributions are technically interest distributions. Furthermore, all dividend distributions form sources related to hedging can not have a “qualified” status and must pay ordinary income tax rates. Some examples are short sales, as well as call options and put options, etc.

How Are Dividends Taxed? – Tax Rates

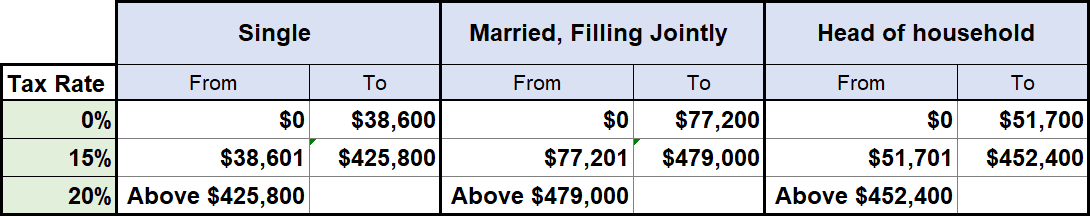

The tax rate brackets for qualified dividends used to be aligned the three rate brackets for capital gains – 0%, 15% and 20%. Investors had no qualified dividends tax liability if they paid a 10% or 15% rate on their ordinary income bracket. The taxpayers in the top bracket of 39.6% used to pay a 20% tax rate on qualified dividend income. Lastly, investors that were in the four middle brackets – 25%, 28%, 33% or 35% – paid a 15% tax rate for their income derived from qualified dividends.

However, the Tax Cuts and Jobs Act (TCJA) passed by Congress on December 22, 2017, changed the ordinary income tax brackets. Therefore, starting with the 2018 tax year qualified dividends income brackets are as shown in the table below.

Investors will generally disregard tax implications and evaluate securities based on other characteristics, such as history of dividend payments, number of consecutive dividend hikes, the company’s financial results, the stock’s share price history or moving average to select equities best-suited to achieve their investment goals. However, among securities with similar characteristics, investors might consider tax implications to achieve higher total returns. In these cases, investors generally will select securities that distribute qualified dividends because of their preferential tax treatment.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic