2 Companies Offer More Than 40 Years of Consecutive Dividend Hikes

By: Ned Piplovic,

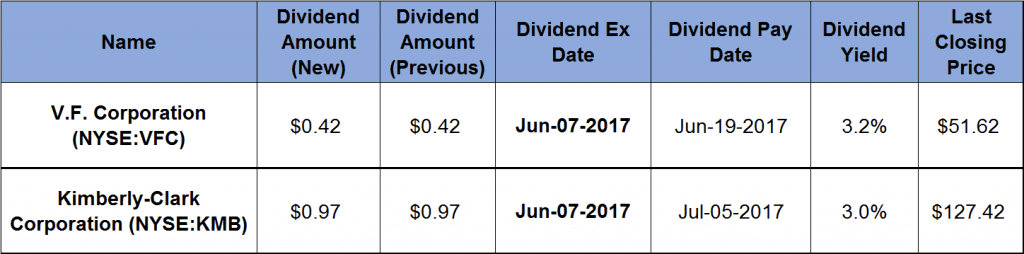

Two companies that have been paying a divided for more than 75 years, have rewarded their shareholders with more than four decades of consecutive annual dividend hikes and yields of 3% or more.

Additionally, these two companies have been complementing the growing dividend income with a steady and stable asset appreciation for decades, increasing 67% and 77% just over the past five years. The ex-dividend date for both companies’ quarterly dividend is on June 7, 2017, with pay dates in mid-June and early July.

V.F. Corporation (NYSE:VFC)

V.F. Corporation designs, produces, markets and distributes branded lifestyle apparel, footwear, and related products in the Americas, Europe and the Asia Pacific. The company operates through four segments: Outdoor & Action Sports, Jeanswear, Imagewear and Sportswear. The North Face, Nautica, Vans, Timberland, JanSport, Eastpak, and Eagle Creek are some the better-known brands that the company uses to offer outdoor apparel, sportswear apparel, footwear and equipment, handbags, luggage, backpacks, totes, accessories, backpacks and travel accessories. Additionally, the company provides denim, casual apparel, footwear and accessories under several brands which include Wrangler, Lee, Lee Casuals, Timber Creek by Wrangler and Rock & Republic. In addition, the company offers occupational, protective occupational, athletic, licensed athletic, and licensed apparel products under the Red Kap, Bulwark, Horace Small, Majestic, MLB, NFL and Harley-Davidson brands. The V.F. Corporation was founded in 1899 and is headquartered in Greensboro, North Carolina.

The current quarterly dividend distribution of $0.42 is equivalent to a $1.68 annual payout and a 3.2% yield. The company has been paying a dividend since 1941 and has hiked its annual distribution amount for the past 44 years at an average annual rate of 13%. Over the past five years, the annual compounding rate exceeded 17%. If recent dividend distribution pattern is any indication, we can expect another $0.42 payout per share in the third quarter and a 13% to 15% dividend boost in the fourth quarter.

The stock price dropped 25% between May 2016 and January 2017. However, the price recovered some of those losses since January. As of closing on May, 17, 2017, the share price is 14% below May 2016 levels and rising. Since dropping below the 200-day moving average (MA) in mid-September 2016, the 50-day MA has reversed trend and has been rising since mid-March 2017. The 50-day MA is currently less than 2% below the 200-day MA. Any additional increase would indicate that the share price could rise in the short and mid-term.

Kimberly-Clark Corporation (NYSE:KMB)

Kimberly-Clark Corporation manufactures and markets personal care, consumer tissue, and professional products worldwide. The company’s Personal Care segment offers disposable diapers, training and youth pants, baby wipes, feminine and incontinence care products, and other related products under the Huggies, Pull-Ups, Little Swimmers, GoodNites, DryNites, Kotex, U by Kotex, Intimus, Depend, Poise and other brands. Through its Consumer Tissue segment, the company provides facial and bathroom tissues, paper towels, napkins and related products under multiple brands that include Kleenex, Scott, Cottonelle, Viva, Andrex, Scottex and Neve. The K-C Professional segment offers wipers, tissues, towels, apparel, soaps, and sanitizers for commercial and janitorial service use under the Kleenex, Scott, WypAll, Kimtech and Jackson Safety brands. Additionally, Kimberly-Clark sells products for away-from-home use through distributors and directly to manufacturing, lodging, office building, food service and public facilities. The Kimberly-Clark Corporation, founded in 1872, is headquartered in Dallas, Texas.

The current annualized dividend of $3.88 is distributed quarterly and yields 3%, which is equal to the five-year running trend, Kimberly-Clark has increased its annual dividend distribution for the last 42 consecutive years. Over the past two decades, the annual dividend amount grew at an average 11% every year, which resulted in an eight-fold increase to the annual dividend payment amount.

The share price experienced a 1.5% drop between May and the end of October 2016. However, since the October 52-week low, the share price recovered fully and is currently trading at same level as it was in May 2016.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic