2 Dividend Stocks Trending on WallStreetBets

By: Jonathan Wolfgram,

WallStreetBets — the Reddit page responsible for the recent Gamestop (NYSE:GME) short squeeze — has grown by more than two million members in the past two weeks in a surge of popularity caused by chaos surrounding highly shorted stocks, such as Gamestop and AMC Entertainment (NYSE:AMC), in which the community purchased shares in an effort to drive up thier stock prices.

The community, whose tagline is “like 4chan found a Bloomberg terminal,” has been able to trigger these massive short squeezes by way of the options market. Members of the community try to force institutional investors to purchase poorly priced call options and lose billions of dollars on their short contracts.

TheWallStreetBets tactic — referred to as a “gamma squeeze” — has proved highly effective and rocketed the web-based investment community into the public eye.

While the community bears a “get rich quick” sentiment and generally prefers high-risk, high-reward investments, there are a number of exceptions to this rule. Although little of their attention is directed towards income investments and reliable growth, there are a few dividend stocks that have captured WallStreetBets’ attention.

2 Dividend Stocks Trending on WallStreetBets Include National Beverage and Apple

Both National Beverage (NASDAQ:FIZZ) and Apple (NASDAQ: AAPL) are often discussed on the Reddit page, and for very different reasons. The former pays a frequent special dividend and is a possible target for another GME-style surge in price, while the latter is a powerful growth stock supplementing its capital gains with regular dividend payouts.

Below are the two dividend stocks tending into hot territory on WallStreetBets right now.

2 Dividend Stocks Trending on WallStreetBets

#1: National Beverage (NASDAQ:FIZZ)

National Beverage (NASDAQ:FIZZ) is one of the top non-alcoholic beverage companies on the market. While it manages a variety of different brands, mostly catering to athletes and those drinking functional beverages, it is anchored by its most popular brand, LaCroix. The company is popular on WallStreetBets largely due to its high short percentage and, despite this, its overall stability.

Institutional investors bet against National Beverage, with over 62.5% of the float shorted. While this would be an immediate red flag under different circumstances, in the eyes of the internet, it’s an opportunity. This high of a short percentage makes the company a possible target for another GME-style short squeeze, and looking at the stock’s returns in the past several days, it has already been targeted on a smaller scale.

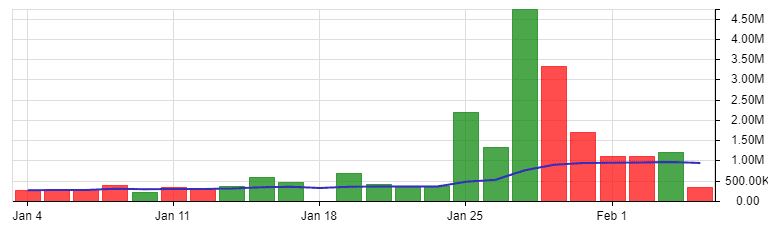

Shown here is the trading volume of FIZZ in the last month, with the sharp change after January 25, 2021 indicative of massive purchases to hike the stock’s value.

Chart provided by StockRover.com, create an account here.

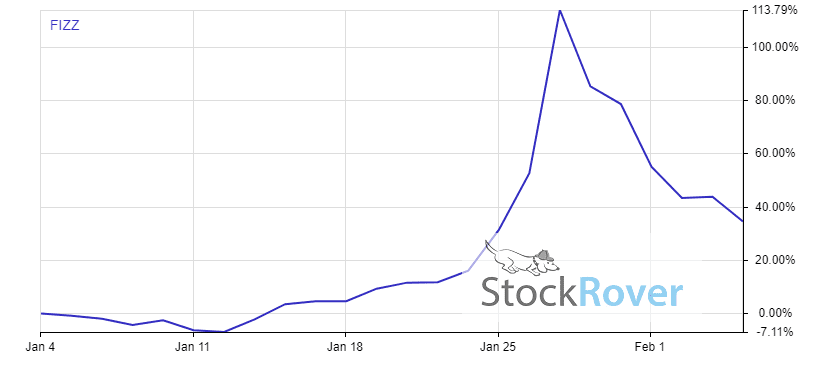

The impact of this on the share price was immediate and corresponds directly to the change in volume.

Chart provided by StockRover.com, create an account here.

National Beverage, however, has considerably more solid fundamentals than the GME and AMC stocks more aggressively targeted as short squeezes. The company is majorly profitable, reporting $4.30 per share in cash flow for 2020, equivalent to just over $200 million. This is a 35% increase from last year, and overall earnings per share have climbed at a similar rate — FIZZ managed to boost its EPS by 26% to its current rate of $3.45.

But the biggest point of attraction — both for income investors and Reddit traders — is the massive dividend just paid out by FIZZ. On January 29, 2021, the company paid out a special dividend of $6.00 per share, equivalent to nearly $280 million dollars in cash and bringing the annual dividend yield to 5.3%.

This points to strong financial health and means bad news for short-sellers. By law, investors holding a short contract must pay the dividend for any borrowed share. Even without Reddit attempting another short-squeeze, as short-sellers lose money and close their contracts, the share price is likely to go up further still.

FIZZ has been a battleground for much of the recent chaos in the stock market, and in turn, has seen its share price increase 33% YTD. However, its most meaningful returns occurred long before, with its value increasing 176.4% in the trailing 12-month period.

2 Dividend Stocks Trending on WallStreetBets

#2: Apple (NASDAQ:AAPL)

Apple (NASDAQ:AAPL) needs little introduction. The company designs consumer electronics of varying kinds, including smartphones, smartwatches, computers, tablets, TV boxes, and numerous other products. Apple has a closed system of devices, incorporating hardware, software and services into its business model and using stellar marketing tactics to dominate the industry.

The company’s recent earnings report shattered analysts’ expectations. Due to a sharp increase in sales — up 21% year over year — the company reported revenue of $111.4 billion, the first time Apple has ever broken $100 billion in a single quarter. This revenue is 58% higher than its third-quarter report of $64.7 billion. Although the difference is partly due to seasonal trends, as Apple always performs its best during the holiday time, this large of a gap is arguably unprecedented.

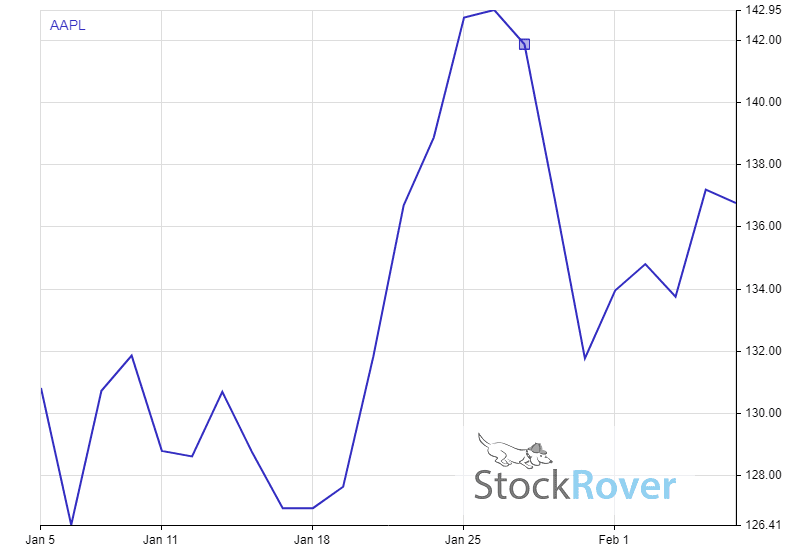

Earnings per share were $1.68, nearly 20% higher than analysts’ estimates of $1.41. A surprise this large, as with many other major Blue Chip stocks, will often cause a major sell-off from institutional investors, causing a temporary share price pullback. The price of AAPL stock for the last month is charted here, with the blue box representing the company’s most recent earnings report.

Chart provided by StockRover.com, create an account here.

But due to the astronomical earnings report, we know Apple is still growing and strengthening itself in the marketplace. It is likely to make a quick recovery and return to the $145.00 range in the coming weeks, a 5.8% increase on the current share price.

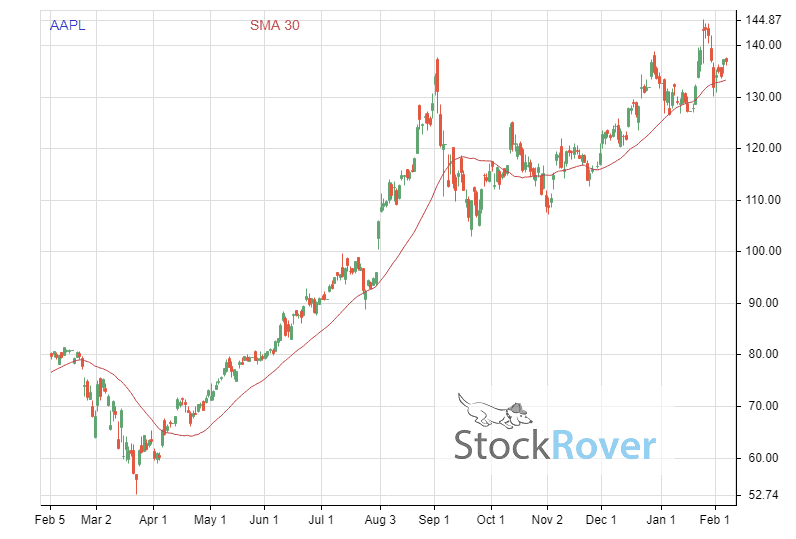

Despite this temporary pullback, the company has grown 73.6% in the trailing 12-month period. Its total returns — adjusted for dividend income — are plotted here, alongside a 30-day moving average to clarify the general upward trend.

Chart provided by StockRover.com, create an account here.

In the trailing three-year period, the company has returned 255.4%, and in the trailing five years, a staggering 509.6%. While it’s the incredible returns that attracted amateur investors frequenting WallStreetBets, the dividend income provided by Apple is nothing to scoff at. The company just announced its latest dividend — a quarterly distribution of $0.20 payable on February 11, 2021. This dividend is identical to the payout from the last three quarters, meaning it is likely to grow again in the next quarter so that Apple can maintain its eight-year streak of consecutive dividend increases.

The dividend yield is 0.6% and the company pays an annual distribution equivalent to $0.82. While this is far from the highest yield on the market, it is more than made up for in the company’s high share price growth.

Related Articles:

3 Best Dividend Stocks to Buy Now

3 Dividend Growth Stocks to Buy Now

Top 10 Best Screening Tools for Investors

25 High Dividend Stocks in 2020 to Consider Buying

10 High Dividend Stocks Under $20

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Jonathan Wolfgram

Connect with Jonathan Wolfgram