3 Companies Declare Dividends That Return 6.5%-Plus Yields

By: Ned Piplovic,

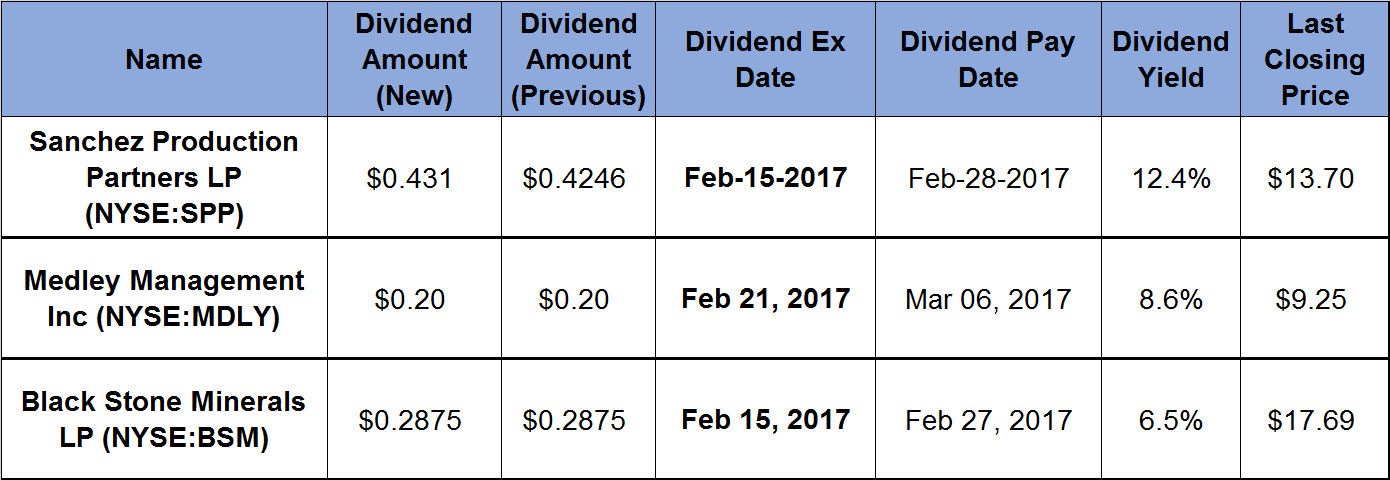

A credit origination firm and two oil and natural gas exploration companies declared quarterly dividends with yields in the 6.5%-12.4% range.

In addition to a double-digit yield, one of the companies boosted its dividend 1.5% from previous period’s payout. In addition to the hefty dividend payouts, share prices of all three companies appreciated at least 44% versus their respective 52-week share-price lows.

The ex-dividend date is February 15, 2017 for all three equities, with pay dates in late February and early March.

Sanchez Production Partners LP (NYSE:SPP)

Sanchez Production Partners acquires, develops, owns and operates midstream and other energy production assets in the United States. The company engages in exploration, production, processing, and transportation of crude oil, natural gas and natural gas liquids.

SPP boosted its quarterly dividend 1.5% from the 0.425 dividend paid in November 2016 to the current $0.431 payout. The annualized payout of $1.72 converts to a hefty 12.4% yield.

Since 2015, the company has increased its payout every quarter. During that period, the company grew its dividend by an average rate of 34% each quarter. Consequently, the quarterly distribution is 330% higher than it was in November 2015 when SPP started paying a dividend.

Sanchez Production Partners’ stock lost a third of its value between February and May 23, 2016, when it reached its 52-week low of $9.51. Beginning in July 2016, the company’s share price fluctuated between $10 and $12 until October 6, 2016. On October, 7, 2016, the share price shot straight up and gained 28% in a single day.

During the following four weeks, the price continued its gains and reached a 52-week high of $15.92 on November 11, 2016. However, the share price dropped 40% over two days of trading starting on November 15, 2016 to hit $10.85, which was just 12% above the 52-week low.

Since November 16, 2016, the company’s share price rebounded back to close at $13.70 on February 9, 2017, which is 14% less than the price’s 52-week high and 44% above the past year’s low from May 2016.

Medley Management Inc (NYSE:MDLY)

Medley Management provides credit-related investment strategies and is a primary originator of senior secured loans to U.S.-based private middle market companies that have revenues between $50 million to $1 billion.

The company held its quarterly dividend payout at $0.20 — the same disbursement MDLY has been paying since initiating dividend payments in 2015. For 2017, the annualized dividend of $0.80 is equivalent to an 8.6% yield.

Medley Management’s share price doubled between its 52-week low in late February and November 17, 2016, when it reached its peak for the year. The price pulled back slightly and it has been fluctuating between $9 and $10 since the November high. As of the most recent close on February 9, 2016 the share price was $9.25. That price level is 13% lower than the price’s November peak and 81% higher than its March low.

Black Stone Minerals LP (NYSE:BSM)

Black Stone Minerals owns oil and natural gas interests in the United States. As of 2016, the company owned mineral interests in approximately 14.6 million acres and nonparticipating royalty interests in an additional 1.3 million acres.

The company’s quarterly dividend of $0.2875 is equivalent to a $1.15 annual payout and a 6.5% yield. After the initial dividend in 2015, the company raised its payout last year and is on track for another annual payout boost in 2017. The annual payout grew at 65% each of the last two years.

Since its 52-week low of $10.95 in February 2016, the company’s share price rose 82%, with minimal volatility, and reached its 52-week high of $19.86 on December 22, 2016. In 2017, the price dropped 11% and closed on February 9, 2016, at $17.69. Even with the minor downward correction since December, BSM’s share price is still 62% higher than its low share price from February 2016.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily.

To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic