3 Investments Increase Dividend Payouts and Offer 5%-Plus Yields

By: Ned Piplovic,

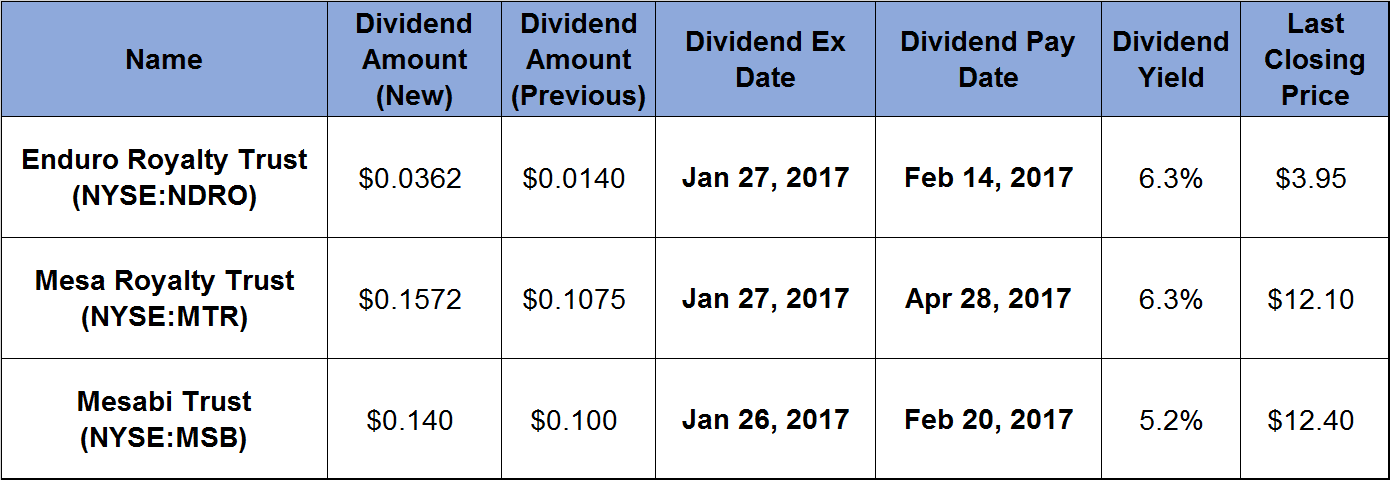

Dividend increases of 40%, 46% and 159%, with yields exceeding 5%, make these three investments attractive to investors looking to boost income streams.

All three trusts announced increased dividends last week, with ex-dividend dates later this week. Share prices and dividend payouts for all three trusts fluctuated over the last two years with mixed results but President Donald Trump’s initiatives to trim regulatory burdens on energy production and mining may aid the performance of these investments.

With ex-dividend dates on January 26, 2017 and January 27, 2017, you must act fast if you wish to take advantage of these opportunities. Investors must purchase shares before the ex-dividend date to receive the related dividend payment.

Enduro Royalty Trust (NYSE:NDRO)

Enduro Royalty is a statutory trust formed to own rights to receive 80% of the net profits from the sale of oil and natural gas production from certain properties in Texas, Louisiana and New Mexico.

The fund has paid a dividend since 2011, with a current monthly dividend payout of $0.0362. That monthly dividend is a 159% increase over the previous month’s payout. The trust’s current annualized dividend is $0.25 and yields 6.3%. The total dividend for the trailing 12 months is $0.22, which translates to a 5.6% dividend yield.

As of January 23, 2017, the fund’s share price was $3.95. This price is only 13% below its 52-week high on December 12, 2016. However, the current share price is 90% higher than the 52-week low that occurred last year on January 26, 2016.

Mesa Royalty Trust (NYSE:MTR)

Founded in 1979 and based in Texas, Mesa Royalty Trust holds royalty interests in various oil and gas properties in the United States.

The trust’s dividend history goes back to 1997. Total dividend for 2016 was 60% lower than in 2015. However, MTR’s year-to-date dividend payout for fiscal 2017 — which started in October 2016 — is 79% higher than the same period last year. If the trend continues for the rest of the year, the total dividend payout for 2017 could return to the 2015 level. The current annualized dividend of $0.76 converts to 6.3% yield at the current share price of $12.10.

MTR’s share price lost more than 70% in 2015, but has performed much better in 2016. The trust’s share price fluctuated in the beginning of the year and reached a 52-week low in March before rising 107% to reach a 52-week high in October. After the high, its share price pulled back 25% before resuming the rise. As of the January 23, 2017, its share price is only 5.8% short of matching the 52-week high. The current price is 95% higher than the 52-week low in March 2016.

Mesabi Trust (NYSE:MSB)

Mesabi Trust is a royalty trust organized to derive income from iron ore mining operations in two mining sites in Minnesota operated by the Northshore Mining Company — a subsidiary of Cleveland-Cliffs Inc. (NYSE: CLF).

For 2017, the first quarterly dividend of $0.14 is 40% higher than the most recent quarterly dividend paid in November 2016. However, compared to the first quarter of 2016, the current dividend is 180% higher.

After experiencing a 52-week low early in the year, MSB’s share price performed best out of these three investments. Its share price reached a low of $3.70 on January 25, 2016. Since then, the price rose 235% with minimal volatility and reached a 52-week high during trading on January 12, 2017. Its share price traded as high as $13.05, but settled at $12.55 at the end of trading on that day. As of January 23, 2017, its share price was 5% lower than the 52-week high. However, at $2.66, it is the highest closing price over the past year.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily.

To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic