5 Dividend Growth Stocks to Buy Now

By: Ned Piplovic,

As a secondary goal to the main target of identifying equities that pay high dividend yields, income investors also seek dividend growth stocks.

While stocks with high dividend yields offer substantial income distributions, dividend growth stocks provide the necessary dividend increases to keep up with the rising share price, which maintains the yield level and protects against inflation losses. The five dividend growth stocks below meet the criteria.

Listed in ascending order by dividend yield, all of the dividend growth stocks have positive total returns over the past few years, yields of more than 4%, several years of consecutive annual dividend hikes and average annual dividend growth rates of at least 10%.

5 Dividend Growth Stocks to Buy Now #5

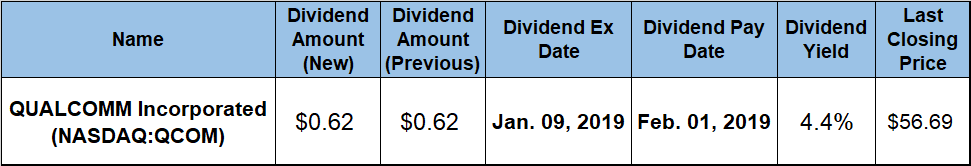

QUALCOMM Incorporated (NASDAQ:QCOM)

After dipping more than 20% towards its 52-week low of $49.75 on April 25, 2018, QCOM’s share price rose more than 50% to peak above $75.00 in mid-September. However, the share price gave back almost 85% of those gains over the subsequent 60 days. The price regained some ground since mid-November and closed on December 19, 2018, at $56.69 – 13% above the April low.

The company’s current $0.62 quarterly dividend payout is 8.8% above its $0.57 distribution from the same period last year. This new amount is equal to $2.48 annualized payout and yields 4.4%, which is almost 38% higher than the company’s own 3.17% five-year average. Additionally, QCOM’s current yield outperformed the Technology sector’s 1.25% yield average by nearly 250% and the 1.97% simple average yield of all the companies in the Communication Equipment industry segment by nearly 100%. Since introducing its first dividend distribution in 2003, the company has advanced its total annual dividend distribution amount more than 20-fold with 15 consecutive annual dividend hikes, which corresponds to an average dividend growth rate of 25.7% per year.

5 Dividend Growth Stocks to Buy Now #4

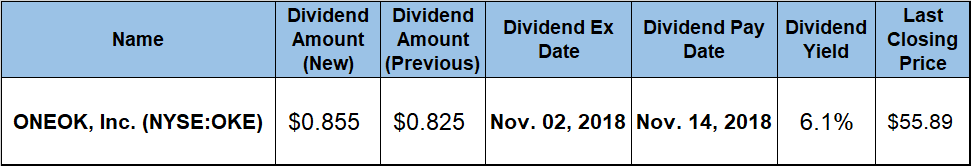

ONEOK, Inc. (NYSE:OKE)

The share price of this Midwest natural gas utility company started the trailing 12 months from its 52-week low of $51.51 and advanced nearly 40% before peaking at $71.74 on July 13, 2018. However, after the July peak, the share price shed nearly 80% of those gains and closed on Dec. 19 at $55.89, which was 8.5% higher than its 52-week low from one year earlier. Despite the decline in the second half of 2018, the share price has gained more than 175% since the beginning of 2016. While a 65% price decline in 2014 and 2015, kept the five-year total return of 17% just slightly above the 14% total return over the past 12 months, the three-year total return was 243%.

The company’s current $0.855 quarterly dividend is 3.6% above the $0.825 payout from the previous period and nearly 15% higher than the $0.745 quarterly payout from the same period last year. The new quarterly amount corresponds to a $3.42 annualized distribution and yields 6.1%. OKE’s current yield is approximately 240% above the 2.57% average yield of the overall Utilities sector. Additionally, the current yield is more than 85% above the 3.3% simple average of the Gas Utilities industry segment and 15% higher than the 5.32% average yield of the segment’s only dividend-paying companies. After 15 consecutive annual hikes, the company’s total annual dividend payout amount is 11-fold higher than it was in 2002. This level of growth corresponds to an average growth rate of more than 16% per year.

5 Dividend Growth Stocks to Buy Now #3

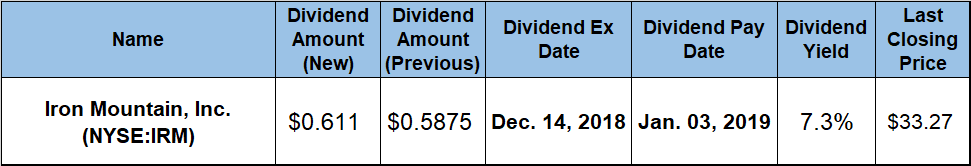

Iron Mountain, Inc. (NYSE:IRM)

While the volatility has increased since 2008, the company’s share price has been on an overall uptrend and advanced more than 13-fold since the company’s initial public offering (IPO) in 1997. The share price declined nearly 20% from its 52-week high of $37.98 in late December 2017 towards its 52-week low of $30.48 in late October 2018. However, since bottoming out in October, the share price recovered some of those losses and closed on Dec. 19 at $33.27, which was 9.2% above the October low and 18% higher than it was five years ago.

Iron Mountain boosted its quarterly payout amount 4% from $0.5875 in the previous period to the current $0.611 payout. This new quarterly amount corresponds to a $2.44 annualized payout and yields 7.3%. While the share-price decline suppressed the current yield 8.1% below the company’s own five-year average yield, IRM’s current yield is 230% higher than the 1.93% average yield of the entire Services sector. Additionally, IRM’s current yield is also more than fourfold higher than the 1.56% simple average yield of all the companies in the Business Services industry segment and triple the 2.16% average yield of the segment’s dividend-paying companies.

The company tripled its annual dividend payout amount over the past seven consecutive years to produce an average annual growth rate of more than 17%. Because the share price declined early in the year, the company delivered a total loss of approximately 4%. However, the three-and five-year total returns came in at 51% and 63%, respectively.

5 Dividend Growth Stocks to Buy Now #2

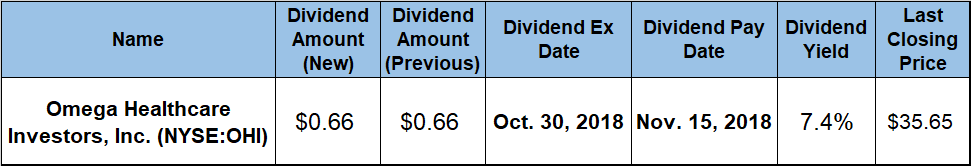

Omega Healthcare Investors, Inc. (NYSE:OHI)

OHI’s current $0.66 quarterly dividend payout corresponds to a $2.64 annualized payout and a 7.4% forward yield, which is 3.6% higher than the company’s own 3.2% five-year average yield. Furthermore, the company’s current 7.4% yield is more than double the Financials sector average of 3.52%, as well as 70% above the 4.33% simple average yield of all the companies in the health care facilities REIT’s market segment and 30% higher than the 5.67% average of the market segment’s only dividend-paying companies. The company enhanced its total annual dividend 340% through 15 consecutive annual dividend hikes, which is equivalent to an average annual growth rate of 10.4%.

After a slow 8% decline in the first third of 2018, the share price reached its 52-week low of $25.36 on April 20, 2018. However, the price reversed trend and gained more than 50% before peaking at $38.21 on December 3, 2018. The share price pulled back and closed on Dec. 19 at $35.65, which was nearly 30% higher than one year earlier and more than 40% above the 52-week low from April 2018. The combination of asset appreciation and dividend growth rewarded OHI’s shareholders with a 35.3% total return over the past 12 months. The share-price pullback between 2016 and 2018 kept the three-year total return below 28% but the five-year total return was 55.6%.

5 Dividend Growth Stocks to Buy Now #1

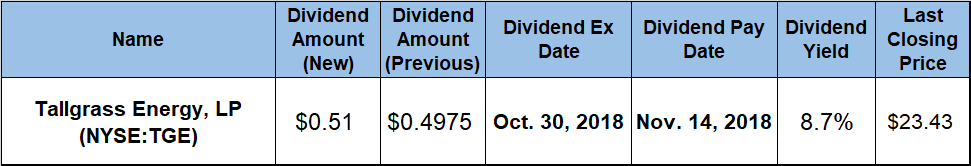

Tallgrass Energy, LP (NYSE:TGE)

The share price of this Kansas-based crude oil transportation company gained more than 18% early in the trailing 12-month period to reach its 52-week high of $26.24 on August 20, 2018. Since the August peak, the price reversed direction, shed all those gains and fell to its 52-week low of $20.59 by November 26, 2018. After languishing slightly above its low for more than three weeks, the share price spiked on potential acquisition news to close on Dec. 19 at $23.43 – 5.7% higher than 12 months earlier and nearly 14% above the November low.

The current $0.51 quarterly distribution is 2.5% above the previous quarter’s $0.4975 payout and 43.7% higher than the $0.355 dividend from the same period last year. This new payout amount is equivalent to a $2.04 annualized payout and currently yields 8.7%. The current yield is more than triple the 2.78% average yield of the entire Basic Materials sector and 32% higher than the 6.57% simple average yield of all the companies in the Oil, Gas & Marketing industry segment.

TGE boosted its dividend payout seven-fold through 13 consecutive quarterly hikes, which is equivalent to an average growth rate of 16% per quarter or 63.5% per year. The company delivered a 14% one-year total return and a three-year total return of more than 80%.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic