5 Health Care REITs to Buy Now

By: Ned Piplovic,

Real estate investment trusts (REITs) generally deliver dividend yields above market averages, and health care REITs offer the additional benefit of better potential long-term returns with the expanding demand for health and long-term care facilities driven by an aging population.

Given current expectations that health care spending could account to as much as 20% of gross domestic product (GDP) by 2024, medical and health care might have a better long-term outlook for stable growth and robust total returns than many other sectors. Furthermore, Health Care REITs have the additional advantage that they are required to distribute most of their earnings to shareholders as dividend distributions, which means a steady flow of income for investors.

In addition to delivering above-average dividend yields, all but one of these health care REITs have ex-dividend yields occurring over the next three weeks. Therefore, investors interested in taking advantage of the robust dividend income distributions should not delay their own stock analysis.

5 Health Care REITs to Buy Now: #5

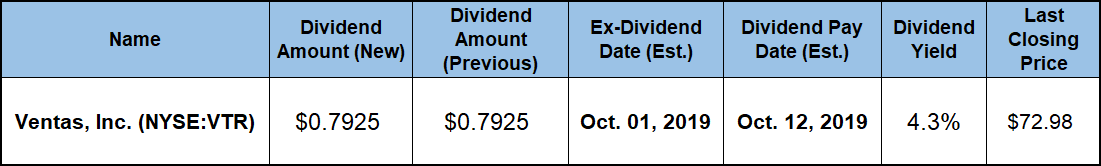

Ventas, Inc. (NYSE:VTR)

Ventas, Inc., a REIT and a component of the S&P 500 Index, owns and operates a diversified portfolio of approximately 1,200 health care facilities in the United States, Canada and the United Kingdom.

The REIT’s current $0.7925 quarterly distribution is equivalent to a $3.17 annual payout amount and yields 4.34%, which has dropped 10% below the company’s own 4.82% five-year average because of a 26% share price bump over the trailing 12 months. However, the REIT’s current yield is still 54% above the 2.82% simple average yield of the overall Financial sector, as well as almost 30% higher than the 3.35% yield average of the company’s peers in the Health Care Facilities REITs industry segment.

While cutting its quarterly dividend payout amount 6% in the last-quarter 2016, the REIT’s distribution has recovered and currently exceeds the pre-cut payout level of $0.775. Over the past decade, the REIT has enhanced its annual payout amount 55%, which corresponds to an average annual growth rate of 4.5%. While share price volatility limited three-year total returns to less than 20%, total returns over the past year exceeded 30%. Over the past five years, total returns were more than 61%.

5 Health Care REITs to Buy Now: #4

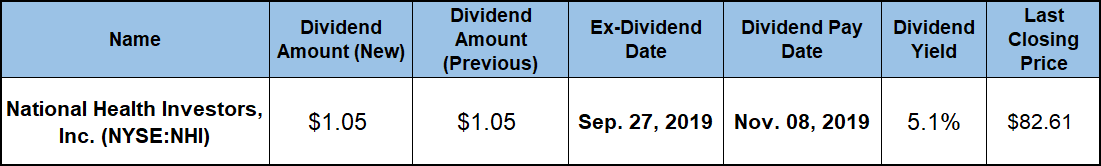

National Health Investors, Inc. (NYSE:NHI)

National Health Investors is a real estate investment trust (REIT) specializing in sale-leaseback, joint-venture, mortgage and mezzanine financing for senior care communities, entrance-fee retirement communities, skilled nursing facilities, medical office buildings and specialty hospitals.

The REIT’s current $1.05 quarterly dividend is 5% higher than the $1.00 payout from the same period last year. The current quarterly payout corresponds to a $4.20 annualized distribution and currently yields 5.1%, which is 2.4% higher than the REIT’s own five-year average yield of 4.98%.

Furthermore, the current 5.1% yield is also more than 80% above the Financial sector’s 2.82% current average yield. Additionally, the REIT’s current yield also outperformed the 3.4% average of the company’s peers in the Health Care Facilities REITs industry segment by 50%.

As required to maintain its favorable tax status, National Health Investors began dividend distributions in 1991. The company suspended payouts and did not pay any dividends in 2001. However, after resuming dividend distributions in 2002, the REIT has boosted its annual dividend payout every year. Over the past 17 years, the company has enhanced its total annual payout amount nearly three-fold, which corresponds to an average growth rate of 6.2% per year.

The REIT combined its share price growth and dividend distributions for a 13.5% total return over the past 12 months. The three-year return came in at 23% and the total return was nearly 68% over the last five years.

5 Health Care REITs to Buy Now: #3

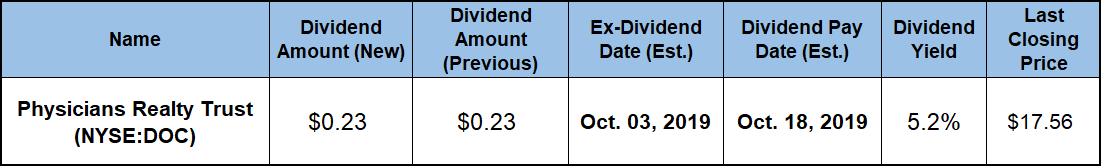

Physicians Realty Trust (NYSE:DOC)

Physicians Realty Trust is a self-managed health care REIT organized to conduct its business through an UPREIT structure in which its properties are owned by Physicians Realty L.P., a Delaware limited partnership, as an operating partnership. The Operating partnership owns the properties directly or through limited partnerships, limited liability companies or other subsidiaries.

The REIT’s current $0.23 quarterly distribution amount is equivalent to a $0.92 annualized dividend distribution and a 5.24% forward dividend yield. This yield is 1.3% above the company’s own 5.17% average yield over the last five years.

While only slightly higher than its own five-year average, Physicians Realty’s current yield fares significantly better compared to industry averages. Compared to the 2.82% average of the overall Financial sector, Physicians Realty’s current yield is 86% higher, as well as more than 55% above the 3.35% average yield of the company’s peers in the Health Care Facilities REITs industry segment. Furthermore, the REIT’s current yield is nearly 2% higher than the 5.14% yield average of the segment’s only dividend-paying companies.

A share price decline in 2017 erased all dividend income distributions and delivered no gains over the past three years. However, the share price has recovered to combine with dividend income for total returns of 7.3% over the past 12 months. Long-term shareholders enjoyed total returns of nearly 60% over the last five years.

5 Health Care REITs to Buy Now: #2

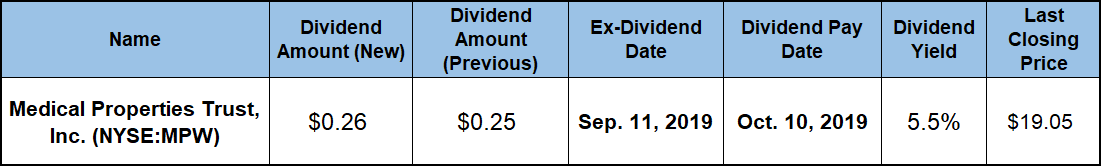

Medical Properties Trust, Inc. (NYSE:MPW)

Based in Birmingham, Alabama, and founded in 2003, Medical Properties Trust, Inc. focuses exclusively on providing capital to acute health and medical care facilities through long-term leases of multiple facility types.

The REIT boosted quarterly dividend distribution from $0.25 last year to the current $0.26 payout amount, which corresponds to a $1.04 annualized payout and a 5.5% forward dividend yield. Robust asset appreciation over the past 12 months has pushed the current yield more than 18% below the REIT’s own 6.68% five-year average.

While trailing its own average, the Medical Properties Trust’s current yield is nearly double the 2.82% yield average of the entire Financial sector, as well as 63% higher than the 3.35% average yield of the Health Care Facilities REITs industry segment. Furthermore, the REIT’s current yield is even 6.2% higher than the 5.14% average yield of the segment’s only dividend-paying companies.

Since resuming annual dividend hikes in 2014, the trust has enhanced its annual dividend payout amount 30%, which is equivalent to an average annual growth rate of 4.5%. The combination of asset appreciation and rising dividend distributions delivered total returns of 37% over the trailing 12 months. Over the past three years, shareholders enjoyed total returns of more than 56%. Lastly, total returns were nearly 82% over the last five years.

5 Health Care REITs to Buy Now: #1

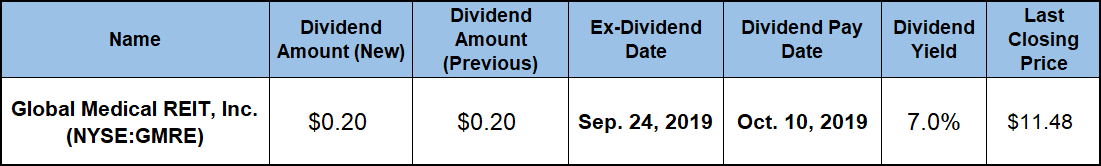

Global Medical REIT, Inc. (NYSE:GMRE)

Global Medical REIT Inc. engages primarily in the acquisition of licensed, purpose-built health care facilities and the leasing of these facilities to clinical operators. As requires by its REIT status, Global Medical REIT, Inc. began dividend distributions upon its formation in late 2014. The REIT initially made its distributions monthly, before switching to a quarterly distribution schedule in the second quarter of 2016.

The current quarterly payout of $0.20 is the same amount that the REIT distributed over the past three years. This quarterly payout amount corresponds to an annualized distribution of $0.80 and currently yields 7%. This current yield level is nearly 150% higher than the $2.82 simple average yield of the overall Financial sector.

Additionally, Global Medical’s current yield is also more than twice the 3.35% yield average of the company’s peers in the Health Care Facilities REITs industry subsegment. Furthermore, even within the segment, the current 7% yield is also 36% higher than the 5.14% average yield of the segment’s only dividend-paying companies.

In addition to the high dividend yield, the REIT also delivered robust asset appreciation, which combined for a 24% total return over the last 12 months. The total return over the past three years exceeded 37%.

Want more? Read our related articles:

The Ultimate Guide to Investing in REITs

Why Do REITs Have High Dividend Payout Ratios?

The 13 Types of REIT Stocks and How to Invest in Them

Investing in REITs: Pros and Cons

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

Connect with Ned Piplovic

Connect with Ned Piplovic