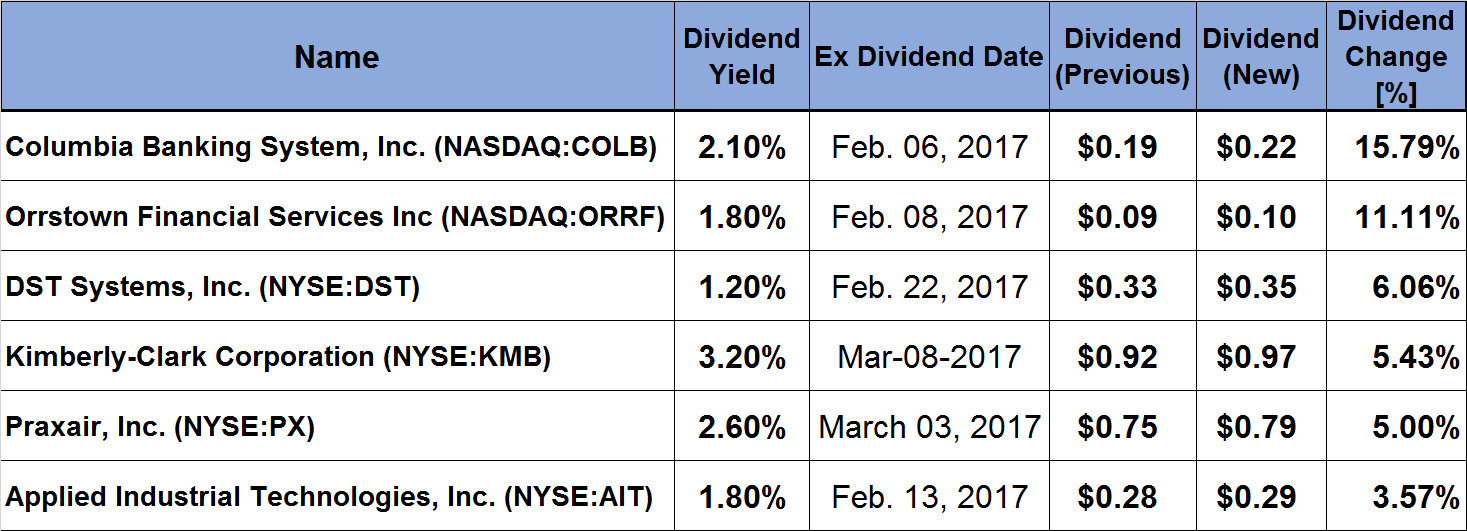

6 Companies Declare Quarterly Dividend Increases

By: Ned Piplovic,

Six public companies announced dividend increases this week that are worth highlighting.

Companies that pay rising dividends typically outperform the market. The management of such companies needs to be especially disciplined to increase such payouts.

Columbia Banking System has increased its annual dividend three-fold since 2013 and this week announced a new 15.8% dividend hike. In addition to the current double-digit percentage increase, its share price increased 40% in 2016 to accompany the strong dividend performance.

Another company that announced a double-digit dividend payout increase this week was Orrstown Financial Services, which boosted its payout 11%. The company has raised its dividends now for two straight years. Its share price closed on January 26, 2017 at $22.85, which is 37% higher than its lowest price in 2016.

DST Systems announced a 6% dividend increase this week. This a second consecutive year of dividend increases that follows three straight years of stagnant payouts. The company’s share price has increased 23% between November 2016 and January 26, 2017, after enduring volatility in early 2016.

Kimberly-Clark, which paid a dividend since 1935, increased its quarterly dividend payout by more than 5%. The company is poised to make 2017 its 43rd year of consecutive dividend increases. Kimberly-Clark’s share price was down 11% over the last year, but has risen 78% over the last five years.

Praxair this week announced its 20th consecutive year of dividend increases, with a 5% hike. The company also rewarded its shareholders with capital appreciation as its share price rose 25% over the last year.

Applied Industrial Technologies this week announced a 3.57% dividend hike. The company has paid a dividend since 1957 and has increased its annual payout for the last seven years. The company’s share price increased 74% since January 2016.

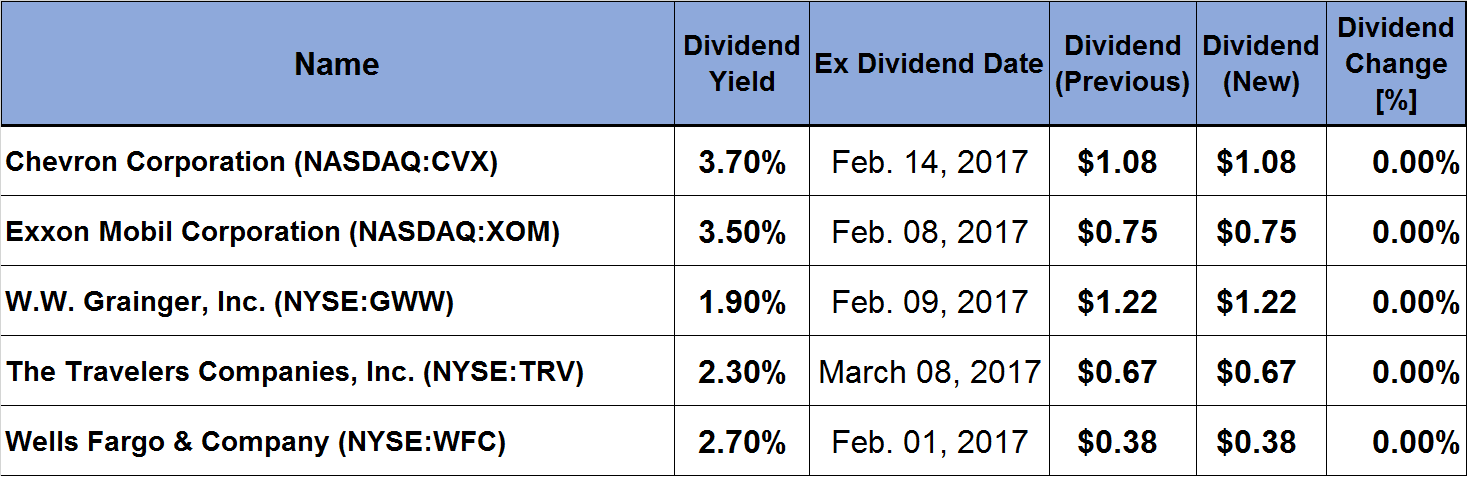

Additionally, here are five major securities that declared dividends earlier this week.

Chevron, which currently offers a 3.7% yield, this week announced that it will keep its quarterly dividend payout steady at $1.08. Chevron started paying a dividend 105 years ago and has increased its annual dividend consecutively for the last 19 years. The company’s stock has remained relatively flat over the last two years with minimal volatility.

After 34 consecutive years of paying rising dividends, Exxon Mobil appears on track for another annual dividend increase. While the current quarterly dividend of $0.75 matches the previous quarter’s payout, the dividend should increase later this year based on company’s past practices. The company’s share price was up 16% in the last 12 months.

Grainger this week announced that it will pay its same $1.22 quarterly dividend as the previous period. The annual dividend for 2017 should be higher than the 2016 annual payout, since the company usually increases its dividend in the second quarter.

Travelers this week announced a $0.67 quarterly dividend, which matches the same payout as previous period. The company usually raises its dividend every year. A dividend increase this year would be the 12th consecutive annual dividend hike since 2005. The share price lost 12% between January and November 2016, but recovered completely and closed on January 26, 2017, at the same price as last January.

Wells Fargo, which currently offers a 2.7% yield, announced this week that it will keep its quarterly dividend steady at $0.38. The company has increased its annual dividend payout for the last six consecutive years and has missed raising its dividend only once since 1997. Wells Fargo’s share price increased 14% since January 2016.

Dividend increases, dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic