Four paths for income investors to profit from fine art could be put into play by privately owned Treasure Investments Corporation as it seeks to offer its shareholders ways to monetize their holdings.

The company has four viable paths for income investors to profit from fine art using precious metals, including the potential payment of a dividend when one of its Renaissance art masterpieces in silver or gold is sold for a princely sum. Other ways for shareholders of the private company to cash out would be if the entire company was sold, a major share buyback occurred or outside investors procured significant stakes in elite sculptures via the Michelangelo art collection.

“We own the single, largest master mold collection in the world, consisting of over 2,600 original plaster molds from 230 different artists,” said Mark Russo, founder and chairman of Treasure Investments Corporation and Museo (Foundry) Michelangelo, of Battle Ground, Washington, not far from Portland, Oregon. “A plaster mold, or a mold of an artwork, is the negative of a positive and allows us to recreate the image, or any image, as an original in either one to the edition or as many as 10,000.”

At the recent FreedomFest Conference in Las Vegas, Russo unveiled a pure silver head of the famed “David” monument designed by Michelangelo. The molds used by Treasure Investments primarily are cast in bronze as the main medium, as well as precious metals such as silver, gold and platinum, cold cast resin and stainless steel.

The array of molds are used to depict wildlife, patriotic images, along with biblical, cultural, western and Renaissance art, Russo said FreedomFest Conference on July 11. The size of the fine art works can be as small as two inches to as large as the biggest monumental statuary art in the world, Russo said.

Four Paths for Income Investors to Profit from Fine Art: Dividend Payouts

The first of four paths for income investors to from fine art with Treasure Investments is for the company to sell one or more of its massive monuments for a royal reward. One extraordinary silver monument that has the potential to be sold for a huge amount that could top $100 million, based on appraisals, is the Pieta,

Paul Dykewicz stands next to the Pieta in pure silver.

Michelangelo’s famed Pieta shows Jesus after his crucifixion and death on a giant cross at Golgotha, a hill outside the walls of Jerusalem. His body shown held by the Virgin Mary, his grieving mother.

The quality of the company’s art is impressive, said Mark Skousen, PhD, who has invested in paintings himself and later donated some of them to charity. Skousen, who heads the Forecasts & Strategies investment newsletter and is an economist who serves as a Presidential Fellow at Chapman University, also heads the FreedomFest Conference every year and gives Treasure Investments the most visible booth space in front of the entrance to the exhibit hall.

Mark Russo and Mark Skousen, head of Forecasts & Strategies, meet at FreedomFest.

Treasure Investments also is using a valuable mold to build a “David” monument in pure silver. The head of the “David” attracted strong interest at FreedomFest where it was unveiled in a special ceremony.

Four Paths for Income Investors to Profit from Fine Art: Sale of Company

A possible sale of the entire company would be another way for its shareholders to monetize their investments. One such offer was proposed but at a price far lower than directors of the company considered adequate.

One problem in receiving what Russo and the company directors would regard as a fair price is the company’s unique business model. As a result, the value of its molds and the related art work that comes form them has no comparable examples to help set its price.

Meanwhile, the company has five distinct profit centers. It also is looking to add a sixth profitable business to enhance its growing value.

Four Paths for Income Investors to Profit from Fine Art: Share Buyback

The third of the four paths for income investors to profit from Fine Art through Treasure Investments is with a major share buyback. Such an action by the company would reduce the number of shares outstanding and enhance the value of each.

Whether that patch is chosen remains uncertain. A main mission of a business, whether it involves a public company or a privately held entity like Treasure Investments, is to enhance shareholder value.

Russo and his fellow leaders at the company need to weigh any offers against alternative opportunities for the shareholders. So far, Russo told me the best move appears to keep growing and adding to the company’s profitable business lines.

Four Paths for Income Investors to Profit from Fine Art: Sell Stakes in Michelangelo Art

The exclusive rights that Treasure Investments has obtained to use precious molds to create monuments in precious metals like silver and gold could could enhance the company’s value immensely. Prospective investors have expressed interest in procuring significant stakes in elite sculptures via the company’s Michelangelo art collection.

By selling high-value monuments, Treasure Investments has the potential to produce powerful profits. With molds of Michelangelo masterpieces, the shareholder returns could be massive.

However, every business requires building step-by-step. Russo is a seasoned seaman in the world of special sculptures.

Strategies to Invest in Fine Art Profitably: 1. Supply Charity Auction Statues

Among the five profit centers of Treasure Investments, the longest-standing one launched by Russo is a charity auction business platform. Developed in 1998, that business line is “most endearing” of the bunch, Russo said.

“It’s an amazing story,” Russo said about his 1998 brainchild. “I sold a sculpture of two eagles to a neurosurgeon in town, and he asked me to put some materials together because he was going to put it up for a fundraising auction event. I had a chance and opportunity to go to the fundraiser where I saw the eagle sell for an astounding amount of money. But in that moment, I realized by watching all the bidders in the audience, it was incredible. It was a frenzy. I thought, ‘Oh my gosh.’ The piece sold for $63,000 ultimately.”

The production cost at the time was only $1,000. The huge profit margin led Russo to explore using that same business model to help other charities raise money. Nine months later, Russo said he had hired 172 employees who were creating millions of dollars of revenue, as well as generating millions of dollars for non-profits.

“That was a successful business model,” Russo said. “And I didn’t know how big it was at the time.”

It turned out there were more than 11,000 fundraising auctions in the country. His company was the only business at the time that was providing statuary to the charities with no strings attached. Russo said he ended up selling that business model two separate times. He now is using the same strategy again without a competitor in the space, he told me.

With more than 20,000 fundraising charities, Treasure Investments supplies them with the needed fine art to sell at auction. It is a “phenomenal opportunity,” he added.

“I love it because we participate and raise money for causes that truly need those resources, and it’s been an anchor for us,” Russo continued. “We love that.”

“We are continuing to scale that model,” Russo said.

Strategies to Invest in Fine Art Profitably: 2. Trade Show Sales

The second profit center for Treasure Investments is the sales it produces at trade conferences such as FreedomFest, which Russo called one of his favorites. He added that his company also participates in the New Orleans Investment Conference that attracts gold investors.

Treasure Investments also has found it worthwhile to exhibit at other trade shows. They include hard asset mineral conferences, bullion events and Barrett-Jackson’s “World’s Greatest Collector Car Auctions in Scottsdale, Arizona, and Palm Beach, Florida,” Russo added.

“We like to go to trade shows,” Russo said.

This American eagle sculpture is part of the company’s patriotic art collection.

Going to a trade show is like doing field research to interact and gain immediate feedback from prospective buyers, Russo said.

Treasure Investments amassed nearly $2 million in art sales from events held earlier this year, Russo recalled. The company’s gallery partners also can be invited to display art pieces that they want to offer at their locations away from trade shows, he added.

The management of Treasure Investments expects to sell its fine art at 14 to 15 trades shows this year and likely will expand to 20 events for 2025, Russo said. Other pluses with the trade shows are that they provide “instant revenue,” allowing the company’s management to identify what is hot and what is not, as well as respond quickly to bring an increasing number of the best-selling products to the market within just a few weeks, he added.

“No one in the world has the speed or capacity that we do,” Russo said.

Strategies to Invest in Fine Art Profitably: 3. Monument Division

The third of the five strategies to invest in fine art profitably with Treasure Investments is through its monument division. This business features large art pieces, such as a nine-foot, six-inch rearing stallion that the Ferrari Corporation commissioned in 1999. Monuments as large as 40-feet tall Eagle for Seven Feathers Casino Resort in Canyonville, Oregon, have been produced at the fine art company’s foundry. The company also produces twice-life-sized elephant monuments for parks, zoos and corporations throughout the world, he added.

Mark Russo shows Lorenzo’s Rearing Stallion, created by sculptor Lorenzo Ghiglieri.

“We have the ability to do those pieces very, very quickly from the inception of a design from somebody’s idea or we can provide access or help to design those pieces for somebody,” Russo said.

Strategies to Invest in Fine Art Profitably: 4. Gallery Networks

Treasure Investments has more than 97 gallery relationships, consisting of the top art galleries and dealers in the United States, Russo said.

The company places art pieces in the galleries on consignment and shares revenues for any sales with the gallery on a 50-50% basis, Russo said. For example, the company has six gallery relationships in Las Vegas, as well as in Lake Tahoe, California; Aspen, Vale and Beaver Creek, Colorado; Key West, Florida; and Tucson and Scottsdale, Arizona.

“It is a very strong leg to the table for our company,” which is continuing to expand those relationships, Russo said.

“It’s a great part of the business model and it brings in a lot of revenue,” Russo said. “It’s very exciting because we have the best relationships with the highest-end galleries in the entire world.”

Strategies to Invest in Fine Art Profitably: 5. Precious Metals

“We have been casting pure silver pieces for decades,” Russo said. “We didn’t really realize it, but we were the No. 1 producer of silver sculptures in the world.”

Other castings of Treasure Investments have been produced in pure gold.

Russo showed a 1,000-ounce pure silver casting of a bull and bear at 1,300 ounces. Silver is elegant looking and radiates energy as the most conductive metal in the world, while also offering healing properties, Russo said.

The Bull and Bear statute showcases the tussle of investors through powerful animals.

“The second you pour a piece into silver, it is not live spot value anymore,” Russo said. “The second you transpose a 1,000-ounce bullion bar worth $25,000 into one of our master molds… it becomes a $200,000 statue — in this case.”

A Potential Sixth Strategy: Art Leasing

A potential sixth profit center for the company is fine art leasing.

Many museums have art-leasing divisions for their paintings that bring in millions of dollars a year from artwork that originally was donated, Russo said. For example, the Portland Art Museum collected $2.3 million in revenue last year by loaning out donated paintings.

“We believe that our platform for leasing sculptures could be extraordinary as we would be the only ones in the world leasing million-dollar collections for a few thousand dollars a month,” Russo said.

The return on investment (ROI) for that business would be achieved in the fourth month, Russo said.

Imagine all the locations from designers to law offices to dental offices that could have a collection of statues worth a million dollars that they are literally renting “very inexpensively” and have the bragging rights to showcase on their premises, Russo continued.

The money from the rental income alone pays for the product cost, Russo said. In fact, Treasure Investments would be the only ones in the world doing it, he added.

Plus, Treasure Investments would own the inventory and collect rent, Russo said. That business is expected to launch in just months later this year, he added.

Another masterpiece sculpture of Treasure Investments is a bronze casting of Michelangelo’s Battle of the Centaurs, a relief by the Italian Renaissance artist created around 1492. It is the second sculpture ever produced by Michelangelo.

Yet one more bronze statue is Farnese Hercules. It is the only bronze statue made from the original mold, Russo said. The marble version of the statute is in the National Archeological Museum in Naples, Italy.

It is a unique way to enhance the value of bullion by turning it into a work of art, Russo said. That transformation holds especially true if the mold comes from a creation of a great artist, he added.

“It’s an exciting part of our business model,” Russo said.

Even though Treasure Investments is a private company, its shares can be purchased by “qualified” investors. Anyone interested in considering purchasing shares in the private company can contact a company official by emailing michael@foundrymichelangelo.com or invest@treasureinvestmentcorp.com, as well as by calling 1-360-954-5453.

Shares are priced by the private company at $5.00 each, but Treasure Investments offered them at $2.50 for a 50% discount at FreedomFest and agreed to extend the promotional pricing to readers of my column who qualify and commit soon. The Regulation D offering of Treasure Investments allows the sale of private company shares without needing to register the offering with the Securities and Exchange Commission (SEC). A Regulation D offering provides access to the capital markets for small companies that otherwise would face increased costs to register with the SEC.

The four paths for income investors to profit from fine art are possible exit strategies for shareholders of Treasure Investments, according to its founder, Mark Russo. With plans for a sixth profitable revenue stream, the outlook for income investors appears to be ascending.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, Guru Focus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Special Sale for Graduation Season! Paul is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The uplifting book is great gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for reduced pricing on multiple-book purchases.

Regardless of any specific portfolio needs, investors must be able to identify the top dividend stocks for their specific investment strategy. Equity analysis became quite complex with the use of computer analysis and the introduction of artificial intelligence modeling. However, even with just a few basic performance metrics, investors can relatively easily narrow their selection of top dividend stocks from tens of thousands of available equities to just a handful of potential investment options.

Before focusing specifically on dividend distribution, investors should narrow the selection of potential top dividend stocks by identifying high quality stocks with a positive long-term horizon outlook. No single indicator or financial metric can identify the absolutely best candidates that could be top dividend stocks. Furthermore, equities that qualify as top dividend stocks for one investor’s specific portfolio strategy, might not fulfill another investor’s distinctive portfolio goals. Therefore, investors should use several of the financial metrics below, as well as additional indicators, to craft a specific set of analytical insights for identifying and selecting top dividend stocks that have the potential to deliver reliable and steadily rising income flow accompanied by moderate asset appreciation.

10 Ways for Identifying Top Dividend Stocks: #1

Stable revenue and revenue growth outlook

Investors should indeed seek investment opportunities that offer high potential for overall returns. However, high returns generally carry a high level of risk, and a lower percentage of high-risk investment deliver returns. While investors can allocate a small fraction of their funds for investing in high-risk investment vehicles, the majority of their portfolio should comprise a sturdy base of securities that offer relatively reliable returns. Therefore, companies that offer stable revenues, and have a good outlook for revenue growth, should be the main focus of investors seeking top dividend stocks.

10 Ways for Identifying Top Dividend Stocks: #2

Profitability

While certainly important characteristics of equities that can potentially offer substantial and reliable income payouts, stable and rising revenues are just one side of the equation. For overall stability and growth, companies must provide strong profitability. Therefore, in conjunction with steady and rising revenues, equities must minimize their costs. Only after establishing reliable net earnings can equities even consider distributing dividends to their stakeholders.

10 Ways for Identifying Top Dividend Stocks: #3

Dividend Payout Amount

Once an equity has the earnings to support dividend payouts, investors should obviously seek high distribution amounts. High distribution payouts translate to high cash flows, which is important to all, but especially income-focused investors. Equities pay distributions at different frequencies — monthly, quarterly, semi-annually or annually. Therefore, instead of evaluating equities on their dividend payout amounts for each period, investors must make the comparison on a total-annualized-payout basis.

10 Ways for Identifying Top Dividend Stocks: #4

Dividend Yield

While the absolute dividend payout amount indicates the total dividends distribution, the dividend yield is a better indicator for conveying return on an investment. With a simple ratio of the equity’s total annual dividend distribution amount and the equity’s current share price, the dividend yield is easy to calculate, and is readily available from most sources of information on investment markets.

While higher yields are obviously better, investors must make sure that the high yield stems from rising dividend payouts and not declining share prices. A sudden share price drop will result in a yield spike, which can make the equity appear more desirable than it actually is. Also, a share price spike will push the yield lower.

Therefore, investors must use the dividend yield in conjunction with other metrics to discover the top dividend stocks for their portfolio. The total return over the trailing 12-month period is an easy metric to use in these situations. As long as the one-year total return exceeds the yield, the equity has managed to provide at least minimal asset appreciation to accompany the dividend distributions.

10 Ways for Identifying Top Dividend Stocks: #5

Dividend Payout Ratio

Another simple metric is the Dividend Payout Ratio. This ratio indicates the share of net earnings that an equity distributes as dividend income. Investors generally consider a payout ratio in the 30% to 50% range to be optimal. Dividend payout ratios below 30% indicate that the share of earnings, which is distributed as dividends, is not substantial enough to make the equity desirable to income investors.

Alternatively, equities might not be able to sustain dividend payouts that exceed half of their net income and could end up announcing dividend cuts, or even the outright elimination of dividend distributions. However, certain types of companies, such as real estate investment trusts (REITs), pay higher payout ratios by design. Some equities must distribute at least 90% of their earnings as dividends to achieve and maintain special IRS requirements that exempt them from paying corporate taxes.

10 Ways for Identifying Top Dividend Stocks: #6

Dividend Coverage Ratio

The dividend coverage ratio indicates how many times an equity can pay a dividend from its current net earnings. Calculated as the inverse of the payout ratio, the coverage ratio is derived by dividing the annual earnings per share by the total annual dividend distribution. Alternatively, the coverage ratio also can be calculated by dividing net income — minus dividend payouts to preferred shareholders — by dividends applicable to common shares. Unlike the payout ratio, where lower levels are generally more desirable, investors seek a higher-dividend-coverage ratio.

10 Ways for Identifying Top Dividend Stocks: #7

Dividend Payout Frequency

Considering that most dividend metrics use the total annualized payout amount, some investors might overlook distribution frequency as an important metric to identify top dividend stocks. Even with identical payouts for the full year, monthly dividend payouts can deliver higher total returns over extended periods. However, to achieve these additional returns, investors must reinvest the monthly dividend distributions immediately.

The advantage of reinvesting monthly dividends, versus annual payouts, to enjoy the benefits of the compounding effect, should be obvious. However, even compared to quarterly payouts, reinvested monthly distributions offer additional returns. Assuming a total return rate of just 6% annually, monthly compounding delivers an additional 6.23% in returns, above the returns generated by reinvesting quarterly payouts.

This advantage compounds to an even greater advantage over an extended time horizon. The two-year advantage of compounding monthly dividend payouts is more than 13% and reaches 50% after just six years. Furthermore, compounding reinvested monthly payouts delivers two and five time returns over 10 and 20 years, respectively.

10 Ways for Identifying Top Dividend Stocks: #8

Rising Dividends

As important as all these previous metrics are, another crucial indicator is rising dividend payouts. As an equity’s share price increases, flat dividend payouts will decrease the dividend yield, which will make that equity less desirable to income investors. Alternatively, rising dividend payouts generally indicate which equities tend to outperform overall markets over the extended horizon. However, share prices tend to grow faster during bull markets, which suppresses the yield. While generally unable to keep pace with share price uptrends, rising dividend payouts can at least minimize the yield deterioration.

10 Ways for Identifying Top Dividend Stocks: #9

Dividend Growth Rate

Not all rising dividends are created equal. Another important indicator is the rate at which dividend payouts increase. For instance, W.P. Carey, Inc. (NYSE:WPC), boosted its dividend payout amount each quarter, for 28 consecutive hikes over the past seven years. In addition to this dividend growth streak, W.P. Carey currently offers a 5%-plus dividend yield and total returns on shareholders’ investment of more than 55% over the last five years. However, despite the long streak of consecutive quarterly dividend hikes and robust returns, which makes WPC a desirable income stock, the company’s small incremental dividend growth translates to an annualized growth rate of just 1.5%.

Alternatively, AbbVie, Inc. (NYSE:ABBV), offers a dividend yield of slightly above 5% just like W.P. Carey currently does. However, AbbVie has boosted its annual dividend payout only nine times over the past seven years. Yet, AbbVie looks like a better choice for income investors as its dividend growth rate is nearly 20% over the same period. AbbVie’s share price did outperform WPC’s asset appreciation by six percentage points (30% versus 24%) over the last five years. However, driven by the faster rising dividend payouts, AbbVie’s total return from dividend income and asset appreciation share price of nearly 90% outpaced WPC’s total return over the same period by 35 percentage points, or nearly two-thirds.

10 Ways for Identifying Top Dividend Stocks: #10

Debt

Even if all the metrics listed above look positive, investors should be cautious of companies that hold high levels of debt. While most mid- and large-cap companies can still deliver stable gains over short periods, even with higher-than-average debt levels, excessive leverage over extended periods can lead to diminished earnings growth, lower dividend boosts or even dividend cuts.

The debt-to-equity ratio is a good basic measure of any company’s leverage level. To determine the debt-to-equity ratio, we divide an equity’s total liabilities by its total shareholders’ equity. Because of different portfolio strategies, different risk tolerances and other unique factors, individual investors will have different notions of what constitutes acceptable debt-to-risk ratio.

Ideally, investors would seek equities with debt-to-equity ratios below one. This indicates that the shareholders’ equity exceeds total debt. However, companies that are investing in growth and expansion will generally have more leverage. Therefore, as long as other indicators are positive and the company’s overall fundamentals are sound, it is acceptable for debt to exceed equity. However, most investors looking at a long-term investment horizon should generally avoid companies with debt-to-equity ratios above two.

Investors use many more performance indicators to analyze equities in search of the ones best suited for the individual portfolio strategy and goals. However, the indicators on the list above are adequate enough for even novice investors to identify a few top dividend stocks suitable for building a well-balanced portfolio with steady income distributions, and a good potential for robust capital gains.

Related Articles:

Best Strategies for Finding Top Dividend Stocks

5 Top Dividend Stocks to Buy Now

3 Top Dividend Stocks Yielding 5%-Plus

Top Dividend-Paying Stocks to Buy If ‘Risk-Off’ Concerns Cause a Market Retreat

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Seven strategies to achieve successful investing start with a good plan and ideally include dividend payouts.

One particularly good plan has proven its mettle during the past 46 years to signal investors when to be in the market and when to sidestep it. The technical indicator used in this proven plan helps to protect investment gains and reduce the risk of large losses.

As of July 19, 21 of the 27 current Successful Investing recommendations in its three portfolios, Income, Growth and Tactical Trends, are profitable. Many of them are up by double-digit percentages. Multinational technology company Nvidia Corp. (NASDAQ: NVDA), of Santa Clara, California, is the undisputed standout by soaring 205.15% since its recommendation in Successful Investing.

Chart courtesy of www.stockcharts.com

Seven Strategies to Achieve Successful Investing: 1. Seek Dividends

One of the seven strategies to achieve successful investing is to seek dividends. Companies that pay dividends need to be wise about spending money to ensure the cash required to reward their loyal investors is available.

One of the newest additions to the Successful Investing newsletter led by Jim Woods is the Income Multipliers portfolio. Until recently, that portfolio had been part of a different newsletter that now is a new feature in Successful Investing.

The Income Multipliers consists of 20 stocks split between 12 industries. The industries are Consumer Discretionary, Consumer Staples, Energy, Financial, Healthcare, Industrial, Information Technology, Materials, Real Estate, Telecommunication Services and Special Situations. Each stock currently is listed as a buy and all pay dividends. The highest dividend yield of 5% is paid by Verizon Communications (NYSE: VZ), while the lowest dividend yield among the 20 recommended positions is 0.77% by Zimmer Biomet (NYSE: ZBH).

Seven Strategies to Achieve Successful Investing: 2. Use a Good Plan

The second of the seven strategies to achieve successful investing requires having a good plan and sticking to it, said Jim Woods, who heads the investment newsletter of the same name. As a featured presenter at the Global Financial Summit at last week’s FreedomFest conference in Las Vegas, Wood recommended that investors ask themselves the following questions.

- What’s your plan?

- What’s your plan to get into the market?

- What’s your plan to get out of the market?

- Do you just buy randomly?

- Do you sell randomly out of fear?

“We don’t do any of these things, because we have a proven plan,” Woods said.

Jim Woods leads the Successful Investing newsletter.

Seven Strategies to Achieve Successful Investing: 3. Proven Plan Patterns

The third of the seven strategies to achieve successful investing is to follow a proven plan like the one he uses. The plan that Woods recommends is the Successful Investing newsletter’s trend-following strategy.

Not only does the plan’s track record span more than 46 years, but it clearly signals when investors should be in the market, as well as out of it. By following a specific timeline with a specialized measurement tool, investors can be guided in how to navigate the market’s vagaries.

Seven Strategies to Achieve Successful Investing: 4. 40-Plus Years of ‘Genius’

The fourth strategy to invest successfully is to use a proven plan that has maneuvered within the markets well enough to conjure up thoughts of tapping the expertise of a “genius.” That genius, Woods said, began with Dick Fabian, founder of the Successful Investing newsletter. Dick Fabian identified the market-following strategy and used it effectively before turning the newsletter over to his son Doug Fabian, who ultimately handed the reins to Jim Woods.

The Successful Investing Plan Signaled These Prescient Moves:

- October 15, 1987, Pre-Black Monday Sell

- January 1995 Bull Market Buy

- April 2000 Sell

- January 2008 Great Recession Sell

- March 2009 Buy

- February 28, 2020, Sell

- June 2, 2020, Buy

- January 21, 2022, Sell

- December 2, 2022, Buy

- October 25, 2023, Sell

- November 15, 2023, Buy

Seven Strategies to Achieve Successful Investing: 5. Track the DFC

The Domestic Fund Composite (DFC) is used to provide a current snapshot of U.S. stock markets. To do so, the following funds are tracked to determine the direction of those markets.

- iShares Select Dividend ETF (DVY)

- iShares Core S&P Small-Cap ETF (IJR)

- iShares Core S&P US Value (IUSV)

- iShares Russell 1000 Growth ETF (IWF)

- SPDR S&P 500 ETF (SPY)

“The five funds that comprise the Domestic Fund Composite (DFC) represent a much better, and more accurate, measurement tool than merely using the S&P 500 or Dow,” Woods said. “By incorporating small caps, value, growth and dividend stocks, we are able to better assess the movement of the markets in relation to their key, long-term moving averages.”

Seven Strategies to Achieve Successful Investing: 6. The Key is Moving Averages

Woods, a music lover, uses the word key not only to explain its vital role in the market-trend signal plan he champions, but as an indicator of the right note to keep the market in perfect pitch. Woods elaborated accordingly:

- What key are we in?

DFC: 39-Week Moving Average

- The Key of “Buy” or “Sell”

- The Key is to Listen to the Charts…

- We are in the key of “BUY” in domestic stocks when the DFC is trending ABOVE its 39-week moving average.

- We are in the key of “SELL” in domestic stocks when the DFC is trending BELOW its 39-week moving average.

- It is when the DFC is below this key moving average that you know it is time to sell.

Seven Strategies to Achieve Successful Investing: 7. Successful Investing Portfolios

Current favorite recommendations touted by Woods in his Successful Investing portfolios are:

Income Portfolio:

iShares Core High Dividend ETF (HDV), +15.08%

VanEck BDC Income ETF (BIZD), +6.59%

SPDR Gold Shares (GLD), +25.27%

iShares Floating Rate Bond ETF (FLOT), +4.99%

Growth Portfolio:

Invesco QQQ Trust (QQQ), +28.60%

Vanguard S&P 500 ETF (VOO), +25.50%

Vanguard Total Intl Stock Index Fund ETF Shares (VXUS), +11.07%

iShares Core S&P Small-Cap ETF (IJR), +20.55%

Tactical Trends Portfolio:

VanEck Pharmaceutical ETF (PPH), +51.63%

Global X US Infrastructure ETF (PAVE), +49.98%

Communication Services Select Sector SPDR ETF (XLC), +22.09%

CrowdStrike Holdings Inc (CRWD), +49.11%

NVIDIA Corp, (NVDA), +205.15%

CrowdStrike’s shares fell 11.1% on Friday, July 19, after the company attempted a software update that caused what may have been the biggest information technology (IT) outage in history. The fallout affected major airlines and caused the cancellation of flights, broadcasting stations and many other businesses that use the Microsoft (NASDAQ: MSFT) Windows operating system.

Chart courtesy of www.stockcharts.com

Woods told me he viewed the CrowdStrike’s double-digit-percentage drop as a “buy the news” signal. Goldman Sachs also reiterated its “buy” recommendation on the stock and wrote in a research note that the IT problem would not trigger a “material” impairment in the stock.

To simplify using the Successful Investing plan, Woods provided the following cheat sheet for investors to follow.

Successful Investing ‘Cheat Sheet’

- Be IN the market when the trend is bullish

- Be OUT of the market when the trend is bearish

- Track the market with a more complete tool

- Use the Domestic Fund Composite

- Think Musically

- Know the “Key” of the markets (Bull or Bear)

- Follow the 39-week moving average

- Follow the Growth, Income and Aggressive/Tactical Trends Portfolio recommendations

- Rely on Woods to track the trend each week in his Successful Investing hotline.

- Follow the Plan’s Buy and Sell Signals

Seven Strategies to Achieve Successful Investing: Skousen’s Forecast

Mark Skousen, PhD, who heads the Forecasts & Strategies investment newsletter, served as chairman of FreedomFest and offered his own outlook about the market. He predicted that bitcoin investments could “skyrocket.”

Skousen also asserted that the technology sector is still a “very exciting area,” especially in artificial intelligence (AI).

In addition, Skousen said he generally favors the stock market. Specifically, Skousen spoke of a bright landscape for mining stocks. He singled out uranium as a “long-term” play, and also praised the prospects for copper.

The “best-performing commodity” right now is gold, Skousen said.

Mark Skousen, scion of Ben Franklin and Forecasts & Strategies head, talks to Paul Dykewicz.

Seven Strategies to Achieve Successful Investing: Gilder’s Guidance

The investment opportunities in technology are “larger than ever before,” said George Gilder, another FreedomFest speaker, Gilder, who heads the Gilder’s Technology Report investment newsletter, is a huge fan of graphene. Gilder is predicting that the unique material will spur the world economies.

Graphene is a “foundation” for a whole new economy, he added.

Paul Dykewicz meets with George Gilder at COSM 2023.

Geopolitical Risk Includes Assassination Attempt Against Former President Trump

Geopolitical risk rose with an assassination attempt on Saturday, July 13, against former U.S. President Donald Trump, who was shot in the right ear by a gunman during a campaign rally in Butler, Pennsylvania, near Pittsburgh. The shooter killed one attendee who dove to cover his wife and daughters. A bullet from the would-be assassin struck the head of Corey Comperatore, 50, a former volunteer fire chief, who died heroically protecting his family.

Two other attendees were seriously wounded. A Secret Service agent shot the gunman in the head from another rooftop and killed him.

Former President Trump showed resilience by appearing two days later on Monday, July 15, at the Republican National Convention with a bandage covering his right ear. Trump returned to give a 92-minute speech on Thursday, July 18, to accept his nomination as the Republican Party’s presidential candidate.

Sen. J.D, Vance, R-Ohio, accepted an offer from President Trump to run on the same ticket as the vice-presidential candidate. Sen. Vance, once a critic of President Trump, subsequently became a staunch supporter. Both have criticized U.S. government funding to help Ukraine defend itself against the invasion of its sovereign territory by Russia, contrary to President Biden’s steadfast support for the American ally.

Former President Trump also took a call of congratulations on becoming the Republican Party’s nominee from Ukraine President Volodymyr Zelensky on Friday, July 19. Trump described it as a “very good phone call.” Zelensky condemned the “shocking assassination” attempt against Trump.

Trump has expressed confidence that he will be able to bring peace to the world and end the war in Ukraine that has “cost so many lives” and devastated innocent families.

The seven strategies to invest successfully start with a good plan, include dividend payouts and consistent adherence to when to enter and exit the market. The rewards for investors can be strong total returns, regular dividend payouts and sharply reduced risk.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, Guru Focus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Special Sale for Graduation Season! Paul is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The uplifting book is great gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for reduced pricing on multiple-book purchases.

Cash dividends are the most common method used to distribute an equity’s earnings or assets to stakeholders in the form of cash equivalents — generally checks or direct money transfers.

Types of Dividend Distributions

Cash dividends are one of the two primary dividend distribution categories. In addition to cash dividends, equities occasionally distribute in-kind dividends. These in-kind distributions include stock dividends — the most common method of in-kind dividends — as well as property dividends, bonds of the company distributing dividends, bonds of a different corporation, government bonds, accounts receivables, promissory notes, etc.

In-kind dividends have certain advantages, especially on the equities cash flow and the investor’s tax liability. However, due to their simplicity of distribution, accounting and management, the most common type of dividend payouts are cash dividends.

Some equities make their decision regarding dividend payouts based on the financial results for every individual period. However, well-established companies with extensive historical records of dividend distributions will generally have a set dividend policy that will define the guidelines and targets for dividend distributions. Companies with defined dividend policies attract income-seeking investors more easily than equities with sporadic dividend payouts. Therefore, companies with dividend policies generally can reliably raise funding for current operations and capital expenditures, which are two important factors for long-term sustained profitability.

Advantages and Disadvantages of Cash Dividends

The main advantages of cash dividends are ease of distribution and ease of accounting for corporate and individual investor taxation purposes. Investors — especially those that rely on a steady inflow of dividend income to cover living expenses — enjoy the liquidity of cash dividends, which can easily be used for immediate spending, reinvesting or other purposes. Another advantage is that cash distributions do not dilute the current stock of shares, which makes the share price level relatively unaffected by the dividend payouts. The only impact is share price’s adjustment lower by the cash dividend per share amount on the ex-dividend date.

The downside of cash dividends for the distributing equity is that it affects the company’s cash position. Therefore, a company that has even a temporary cash flow problem might have to reach to other resources — such as a sale of assets or short-term borrowing — to cover the funds needed to fully cover the cash dividend distribution. Alternatively, the company might have to cut the amount of the cash dividend payout or outright cancel that period’s round of dividend distributions.

Furthermore, the drawback for investors is that cash dividend distributions are generally subject to taxation at ordinary income tax rates. These rates are usually higher than capital gains tax rates applicable to some in-kind dividends like stock dividends.

Distribution Frequency

Most equities’ dividend distribution schedules follow their financial reporting calendar. This alignment allows for more streamlined and simplified accounting procedures. North American companies are currently subject to quarterly financial reporting and most dividend-paying companies distribute their dividends four times per year. However, many mutual funds, Master Limited Partnerships (MLPs), Exchange-Traded Funds (ETFs), Real Estate Investment Trusts (REITs) and similar investment vehicles, opt for monthly cash dividend payouts. Furthermore, because of the local requirement to report financial results only once every six months, many companies that are based in the European Union and Japan disseminate their cash dividend distributions only twice per year. Finally, some companies also distribute their cash dividend payouts only once per year — following their year-end financial results.

Measuring Cash Dividends

To determine the best source of cash dividend income for their portfolio strategy, investors must evaluate several dividend metrics before making their final selection. The dividend yield is generally the first dividend metric that investors consider. This measure is a simple ratio of the company’s total annual cash dividend payout amount and the company’s share price at the time. Expressed as percentage, the dividend yield shows the total dividend income that can be expected on an investment over a one year period.

The actual total dividend payout amount over the previous year and the current share price give a trailing dividend yield figure. Alternatively, using the current period’s dividend payout amount to estimate the total annualized dividend amount expected over the subsequent 12 months indicates a forward yield.

However, while simple to calculate from two easily-accessible pieces of information, the dividend yield can be misleading, especially when using dividend yield trends for equity selection. The dividend yield and the equity’s share price are inversely proportional. Therefore, a sudden drop or a steady share price decline will result in a dividend yield increase. A higher yield generated by falling share prices means higher income returns for new investors. However, existing investors that took a position in the company’s stock at higher prices will lose much more on the asset depreciation than the gains received from cash dividend income. Therefore, additional metrics must accompany the dividend yield for a more complete equity evaluation.

One of the additional metrics is the dividend payout ratio. This ratio represents the share of net earnings that a company distributed as dividend payouts. The payout ratio is also the ratio of the annual dividend per share and the earnings per share (EPS). Investors generally consider as sustainable, over the long-term, a payout ratio in the 30% to 50% range.

A dividend payout in that range indicates that a company distributed a portion of its earnings that is sufficient to provide investors with a robust dividend income. Additionally, the payout ratio below the upper limit of that range implies that the company distributes no more than half of its earnings as dividends, which leaves enough funds for supporting other business operations.

Additional Considerations

Another important point of concern for equity selection is dividend growth. Even dividend distributions that increase every year generally grow slower than the share price, which results in diminished income returns. Additionally, back-tested data suggests that equities with long records of rising dividends tend to offer higher total returns over extended time horizons than their non-dividend peers.

Also, while not a quantitative measure of cash dividend performance, investors should pay attention to the important dividend dates to maximize their cash dividend income distributions.

Taxation of Cash Dividends

Most cash dividend distributions are subject to ordinary income tax rates. However, the Internal Revenue Service (IRS) provides a specific set of requirements that an equity must meet to enjoy taxation at the lower capital gain rates. Generally, only a U.S. corporation or a qualified foreign corporation that is not of the type listed by the IRS as “Dividends that are not qualified dividends,” are eligible for capital gains rates. Additionally, to claim qualified status for dividend distributions investors must meet a specific stock holding period outlined by the IRS.

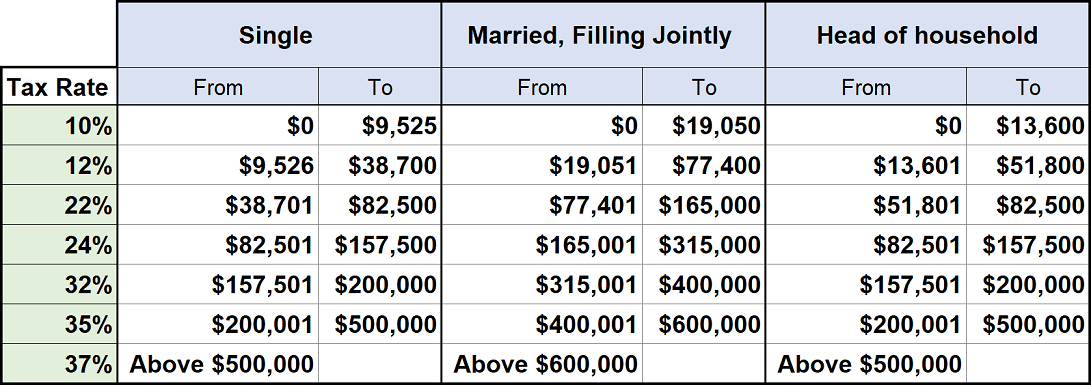

As defined in the Tax Cuts and Jobs Act (TCJA) passed by Congress on December 22, 2017, the following tax rates are currently in effect for all cash dividend earnings starting with the 2018 tax year.

Tax rates for ordinary cash dividends:

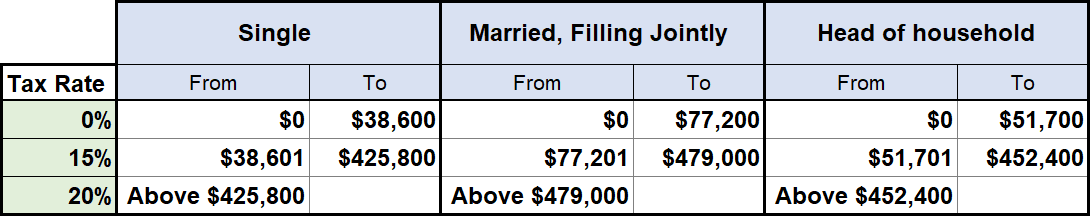

However, the cash dividend distributions that manage to attain the qualified dividend status enjoy lower rates and only three tax brackets.

Hopefully, this article provided a few of the basic cash dividend principles that even novice investors can use as a foundation to build their understanding of cash dividends. An extensive understanding of cash dividend nuances will allow knowledgeable investors to sidestep any potential hazards and build a robust income-generating portfolio.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Three dividend-paying cryptocurrency funds to purchase as Bitcoin begins a rebound can capitalize on a budding price recovery.

The three dividend-paying cryptocurrency funds to purchase could especially appeal to investors who are drawn to such investments in the wake of Bitcoin’s price plunging 27.16% from a high of $73,750.07 on March 14 to a low of $53,717.38 on July 5. The drop caused a five-month low in the price of Bitcoin, but the cryptocurrency has begun to rise again.

A key reason for the recent slump in Bitcoin prices stems from the return of about $8 billion in the cryptocurrency to creditors of a defunct Japanese cryptocurrency exchange called Mt. Gox. Also pressuring the price of Bitcoin downward is that the German and U.S. governments liquidated some of their holdings in the cryptocurrency.

Three Dividend-paying Cryptocurrency Funds to Purchase: BITO

One way to invest in Bitcoin without buying the cryptocurrency directly is through an exchange-traded fund (ETF) like ProShares Bitcoin Strategy ETF (NASDAQ: BITO). The ETF announced its monthly dividend, and it was another “whopping” $1.50 per share, according to the TNT Trader investment newsletter of Mark Skousen, PhD, a presidential fellow in economics at Chapman University, and his son Tim Skousen.

The elder Skousen, named one of the top 20 most influential living economists by SuperScholar.org, heads the monthly Forecasts & Strategies investment newsletter that focuses on stocks and funds. The TNT Trader advisory service that he runs with his son Tim provides both stock and option recommendations, as well as cryptocurrency investments.

“This has been an unexpected benefit of owning BITO at this time period, as we never intended to find a Bitcoin income play like this,” according to TNT Trader. “But since our recommendation, we have collected $6.82 a share in five months with a buy-in price of $26.91.”

Courtesy of www.StockRover.com. Learn about Stock Rover by clicking here.

If BITO sustains these kinds of payouts, it will have a dividend yield of 60%, according to the July 2 edition of TNT Trader. Even if the dividend payouts are suspended, BITO would end the year with a yield of 25%, the advisory service wrote.

“That’s a mind-blowing yield for any ETF,” according to TNT Trader.

Ben Franklin scion Mark Skousen, who leads TNT Trader, talks to Paul Dykewicz.

The U.S. government contributed to the slide in Bitcoin’s price when it announced plans to sell nearly 4,000 bitcoins that were seized due to the conviction of a drug dealer, TNT Trader informed its subscribers. However, Bitcoin has absorbed that added volume and is poised to rise again, TNT Trader wrote.

Chart courtesy of www.stockcharts.com.

Three Dividend-paying Cryptocurrency Funds to Purchase: BITO Backers

The Micro-Cap Stock Trader advisory service, led by seasoned Wall Street veteran Bryan Perry, is another advisory service that is recommending BITO. The fund invests in Bitcoin futures and not the coins themselves, he explained.

“Though BITO doesn’t track Bitcoin exactly, and the market cap of $2.95 billion is the smallest and most liquid asset that fits into our micro-cap universe, the correlation is surprisingly good and worthy of a long-side trade,” Perry advised his Micro-Cap Stock Trader subscribers.

In addition, because BITO trades futures on Bitcoin, the fund is able to generate sizeable monthly dividends from the spread it captures from its trades. Micro-Cap Stock Trader subscribers and other investors in BITO have been collecting the monthly dividend payouts since entering the trade. The enticing dividend yield has become a compelling reason to stick with the fund amid the ups and downs of Bitcoin’s price.

Bryan Perry leads the Micro-Cap Stock Trader advisory service.

Another backer of BITO is Jim Woods, a former Army paratrooper who recommends it in the Income Multipliers portfolio for his Successful Investing newsletter subscribers. As a seasoned investment guide, Woods has developed a special interest in cryptocurrency investing and follows BITO closely for his Successful Investing subscribers.

Jim Woods leads Successful Investing and co-heads Fast Money Alert.

Three Dividend-paying Cryptocurrency Funds to Purchase: BLOK

In the July 8 weekly update of Mark Skousen’s Forecasts & Strategies investment newsletter, he updated his recommendation of a crypto/blockchain exchange-traded fund (ETF), dividend-paying Amplify Transformational Data Fund (BLOK). The fund has “survived the storm” much better than Bitcoin and is up more than 21% this year, Skousen wrote to his Forecasts & Strategies subscribers.

Chart courtesy of www.stockcharts.com.

BLOK’s top holdings include Galaxy Digital Holdings Ltd. (OTCMKTS: BRPHF) (TSX: GLXY .TO), MicroStrategy Inc. (NASDAQ: MSTR), Coinbase Global (NASDAQ: COIN), Robinhood Markets Inc. (NASDAQ: HOOD), Core Scientific (NASDAQ: CORZ) and PayPal (NASDAQ: PYPL). The purchase of the fund gives shareholders exposure to some of the biggest names in blockchain.

Woods, who also is a co-leader of the Fast Money Alert advisory service with Skousen that recommends stocks, funds and options, is a fellow fan of Amplify Transformational Data Fund and its call options. In November 2023, the Fast Money Alert advisory service subscribers watched a recommendation of BLOK call options jump more than 120% in just a few weeks. Rather than leave that big potential gain at risk, the seasoned leaders of that advisory service recommended that their subscribers sell half to take triple-digit percentage profits, while letting the rest ride in pursuit of additional gains.

“We simply do not want to miss out on preserving our initial capital,” the Fast Money Alert leaders wrote.

Three Dividend-paying Cryptocurrency Funds to Purchase: IBLC

A third dividend-paying cryptocurrency fund to purchase is iShares Blockchain and Tech (IBLC) that launched in 2022, said Bob Carlson, the leader of the Retirement Watch investment newsletter who recently retired as the chairman of a pension fund. It seeks to track an index composed of global companies involved in the development, innovation and use of blockchain and digital technologies. The index uses a rules-based method to change its holdings as companies in the blockchain universe and the technology evolves.

The fund recently had 41 positions with the 10 largest ones accounting for 68% of the portfolio. Top holdings were Marathon Digital Holdings (NASDAQ: MARA), Cleanspark (NASDAQ: CLSK), Coinbase Global (NASDAQ: COIN), Hut 8 (NASDAQ: HUT) and TeraWulf (NASDAQ: WULF). The turnover ratio is about 68%.

About 90% of the fund is in North America-based companies. The next largest region is Australia/Asia.

The fund is up 10.35% for the year to date and 48.17% over 12 months. It is up 5.89% in the last four weeks, but down 3.63% in the last week. The recent dividend yield was 1.28%.

Chart courtesy of www.stockcharts.com.

NATO Meeting Addresses Russia’s Invasion of Ukraine

NATO’s 75th Anniversary Summit in Washington, D.C., concluded on July 11, with the 32 allies making decisions to strengthen deterrence and defense, bolster long-term support to Ukraine and deepen global partnerships. Allied leaders met with representatives of Australia, Japan, New Zealand, South Korea and the European Union to address shared security challenges.

With a growing alignment of Russia, China, Iran and North Korea, NATO is working increasingly closely with partners in the Indo-Pacific and with the European Union to help preserve peace and protect international order. NATO Secretary General Jens Stoltenberg highlighted that China is a decisive enabler of Russia’s war against Ukraine. The Washington Summit declaration refers to the strategic partnership between Russia and China as a “cause for profound concern.”

Ukrainian President Volodymyr Zelensky joined allied leaders at the summit for a meeting of the NATO-Ukraine Council on July 11 at the level of Heads of State and Government. Secretary General Stoltenberg affirmed allies support Ukraine on its “irreversible path” to NATO membership.

On July 10, NATO allies agreed to establish Security Assistance and Training for Ukraine to coordinate providing military equipment and training. NATO announced a pledge of long-term security assistance to Ukraine with a minimum baseline of 40 billion euros in the next year.

“This pledge will ensure greater burden-sharing of military support,” Stoltenberg said in a prepared statement. “It will also provide Ukraine the reliable support it needs to deter and defend against future Russian aggression now and in the future.”

NATO allies have signed 20 bilateral security agreements with Ukraine thus far as Russia continues its invasion and attacks of its neighboring nation. Stoltenberg confirmed the allies agreed to establish a NATO-Ukraine Joint Analysis, Training and Education Centre in Poland.

U.S. President Biden’s Gaffes Gain Glare of NATO Summit Spotlight

President Joe Biden, whose cognitive capabilities came into question during his June 27 debate against former President Donald Trump, gained the glare of the NATO summit spotlight when he mistakenly introduced Ukrainian President Volodymyr Zelenskyy as “President Putin” on stage. It occurred at a ceremony marking the signing of a NATO security agreement for Ukraine.

The gaffe occurred as Biden wrapped up a speech about NATO’s enduring support for Ukraine. Biden barely stuttered during his remarks as he pledged security guarantees from Western countries even upon the end of the current war in Ukraine started and continued by Russia’s President Vladimir Putin. President Biden quickly corrected himself.

However, Biden also mistakenly called Vice President Kamala Harris by the wrong name, referring to her as “Vice President Trump.” So far, Biden is vowing to continue his campaign and seek re-election, despite some Democrats in Congress questioning the wisdom of that plan.

The three dividend-paying cryptocurrency funds to purchase are rebounding after recent share price weakness. For investors who like to purchase equities when the price pulls back, the opportunity has arrived with three dividend-paying cryptocurrency funds.

Paul Dykewicz, www.pauldykewicz.com, is an accomplished, award-winning journalist who has written for Dow Jones, the Wall Street Journal, Investor’s Business Daily, USA Today, the Journal of Commerce, Seeking Alpha, Guru Focus and other publications and websites. Paul, who can be followed on Twitter @PaulDykewicz, is the editor of StockInvestor.com and DividendInvestor.com, a writer for both websites and a columnist. He further is editorial director of Eagle Financial Publications in Washington, D.C., where he edits monthly investment newsletters, time-sensitive trading alerts, free e-letters and other investment reports. Paul previously served as business editor of Baltimore’s Daily Record newspaper. Special Sale for Graduation Season! Paul is the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a foreword by former national championship-winning football coach Lou Holtz. The uplifting book is great gift and is endorsed by Joe Montana, Joe Theismann, Ara Parseghian, “Rocket” Ismail, Reggie Brooks, Dick Vitale and many others. Call 202-677-4457 for reduced pricing on multiple-book purchases.

Ten Things You Need to Know about REITs offer important tips for investors.

REITs (real estate investment trusts) are unique investments that provide a convenient way for investors to gain exposure to real estate markets, and reap the financial benefits that those markets have to offer. Keep reading to learn 10 things you need to know about REITs.

10 Things You Need to Know About REITs #1: There are Different Types

REITs can be classified into four categories: equity, mortgage, public non-traded and private.

- Equity REITs: Equity REITs own or operate income-producing real estate, and they are publicly traded on major stock exchanges. Equity REITs are often simply referred to as REITs.

- Mortgage REITs: Also known as mREITs, mortgage REITs provide financing for real estate by buying or originating mortgages and mortgage-backed securities. mREITs earn income from the interest on the investments.

- Public Non-Traded REITs: Public, non-traded REITs are registered with the SEC but do not trade on national stock exchanges.

- Private REITs: Private REITs are exempt from Securities and Exchange Commission (SEC) registration and the shares do not trade on public stock exchanges.

Furthermore, REITs can be classified by the type of properties in which they choose to invest. For example, REITs may be categorized as residential, office space, retail, health care, lodging, and more. REITs with different portfolios operate in different real estate markets, making it important for investors to research REITs before investing in any of them.

10 Things You Need to Know About REITs #2: How to Invest

If a REIT is listed on a major stock exchange, investors can easily buy shares the same way any other public stock is purchased. The majority of REITs are equity REITs, which are all listed on public stock exchanges.

Investors also can invest in a REIT mutual fund or a REIT ETF (exchange-traded fund), through which the investor would be buying a collection of shares in an entire index of REITs. Private REITs and Public non-traded REITs can also be purchased; however it is more complicated. Those investments are generally limited to individuals and institutions who meet certain financial criteria.

10 Things You Need to Know About REITs #3: How REITs Make Money

Generally, REITs follow a simple business model: the company buys or develops properties that it leases out and collects rent as its primary source of income. The income generated by the company is paid out to shareholders in the form of dividends. REITs may also make money through buying and selling properties.

However, some REITs do not own any property, choosing instead to work on financing real estate transactions. These REITs generate income from the interest on the financing. Mortgage REITs are one such REIT that does not own any property.

10 Things You Need to Know About REITs #4: Often Volatile, But Can Produce Strong Long-Term Returns

Given that REIT performance is subject to market risk, REITs can be a volatile investment. REIT performance fluctuates in conjunction with changes in the real estate market.

There are certainly periods when REITs underperform, but the long-term performance of REITs is impressive. The five-year return of U.S. REITs was 15.76% in June 2020, as measured by the MSCI U.S. REIT Index. Additionally, REITs have historically outperformed corporate bonds over extended periods of time.

10 Things You Need to Know About REITs #5: Great for Providing Diversification

Real estate is an important asset class that investors should consider buying as part of a well-rounded portfolio. Real estate provides great diversification because it is a distinct asset class which does not have a strong correlation with other industries within the stock market. Historically, REIT performance tends to go up when other assets go down and vice versa. Therefore, REITs are largely beneficial in leveling out the overall volatility of a well-diversified portfolio.

10 Things You Need to Know About REITs #6: Differ From Direct Real Estate Buys

When looking to gain exposure to real estate markets, there are two possible routes for investors to take. Investors can either invest in REITs, or make a direct investment into real estate. In the former choice, investors become shareholders in a company that controls real estate. In the latter, an investor buys tangible real estate and operates it for his or her own financial benefit.

Direct real estate investors make money through rental income and appreciation. REIT shareholders gain money as the value of the REIT goes up, and through dividend payouts. REITs are an easier way to gain exposure to real estate, as there is no personal responsibility to maintain and operate any properties.

10 Things You Need to Know About REITs #7: Their Investing Advantages

REIT investments bring multiple benefits to the investor. REITs offer the benefits of real estate investment, but with the convenience and simplicity of investing in publicly traded stock. As previously mentioned, REITs also provide diversification because they are not correlated with other stocks and bonds. REITs also provide higher risk-adjusted returns, and REITs effectively reduce overall portfolio volatility.

REITs also give investors the benefit of receiving consistent, reliable dividend payouts. Plus, the long-term performance of REITs has been strong, as the total returns from REITs have been above that of the S&P 500 over the last 25 years. Finally, REITs are highly liquid, which eliminates the illiquidity risks that are usually associated with real estate investments.

10 Things You Need to Know About REITs #8: Their Investing Risks

REITs are sensitive to changes in the market, specifically fluctuations in interest rate. Rising interest rates are bad for REIT stock prices. REITs are subject to market risk, and REITs may underperform if market conditions are not ideal.

There are also property-specific risks associated with REITs. While investing in REITs provides diversification for the investor’s portfolio, most REITs do not hold diversified property portfolios. In other words, REITs that only hold one type of property may face serious financial distress if an event occurs that decreases the demand for such a property. For example, hotel REITs have taken a considerable hit throughout the Covid-19 pandemic, as travel has decreased and the demand for hotels has diminished.

Another shortcoming of REITs is that most of them grow at a slower pace than some other publicly traded companies in different industries. REITs are required to pay out 90% of taxable income to shareholders. Therefore, the company is generally only left with 10% of its income to reinvest into the core business each year. This may cause REITs to grow at a slow pace. In the same vein, REITs may rely heavily on debt in order to have more money available to invest in new properties. Many REIT managers choose to add leverage (take on debt) in order to expand the properties owned by the REIT.

Finally, the tax treatment of REITs presents a potential drawback for investors. The REIT does not have to pay taxes on profit, however investors must pay income tax on the dividend payouts as if those payouts are personal income. Investors can be faced with high REIT taxes, especially those in higher tax brackets. Other companies that are not required by law to pay dividends may be a more tax efficient investment.

10 Things You Need to Know About REITs #9: How Their Dividends are Taxed

REIT shareholders face an income tax liability that can be complex and difficult to understand. Each dividend payout from the REIT to its shareholders is composed of a mix of funds that are acquired by the REIT from an array of sources. Profits earned by the REIT from different sources can be placed into different categories, and each category has its own specific tax rules. Therefore, investors do not always pay the same tax rate on the distributions received from the REIT. Rather, the payout must be dissected and categorized to determine the tax treatment.

Dividend distributions may be allocated to three categories: operating profit, capital gains and return of capital.

Oftentimes, the dividend payouts are only made up of operating profit. When the company passes along operating profit to investors, it is received as ordinary income, and therefore the investor must pay his or her ordinary income tax rate on the dividend.

When the distributions consist partially of capital gains or return of capital, the tax rate that the investor must pay is different. To read about the taxation rules in these scenarios, click here.

However, it is most common that the payout consists only of operating profit, in which case the investor must pay his or her ordinary income tax.

10 Things You Need to Know About REITs #10: Passive vs. Active Investing

When deciding to invest in REITs, there are two main approaches: passive and active investing.

The passive investing approach entails investing in a REIT mutual fund or REIT ETF. In these options, investors buy an entire portfolio of REITs. Buying a collection of REITs has its benefits, including wide REIT diversification and little requirement of time and knowledge. However, this approach means buying every REIT in the index, regardless of considerable factors such as price, performance and quality.

The active REIT investing approach involves doing research, picking specific REITs to invest in and building an individual portfolio of REITs. This would entail finding REITs that the investor believes to be undervalued, or REITs that are a smart investment for another reason. The active approach is certainly more time consuming, and can be risky, but it has the potential to provide far greater returns than the passive approach if it is well executed

Want more? Read our related articles:

The Ultimate Guide to Investing in REITs

Why Do REITs Have High Dividend Payout Ratios?

The 13 Types of REIT Stocks and How to Invest in Them

Investing in REITs: Pros and Cons

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

Six dividend-paying satellite stocks to purchase are gaining a lift from rising demand for launches and the industry’s expanding role in supporting national defense.

The six dividend-paying satellite stocks to purchase have earned the recommendation of seasoned industry observers who are forecasting which companies should gain a boost from the latest advanced services. The wars started by Russia with its invasion of Ukraine in February 2022 and by Hamas militants with its murderous attack of residential communities in Israel last Oct. 7 have only fueled demand for satellite services to provide military applications, as well as aid commercial users.

The six satellite stocks to purchase are benefitting from reduced prices for putting spacecraft into orbit due to the advent of reusable rockets. To protect freedom, the U.S. Department of Defense and countries in the North Atlantic Treaty Organization (NATO) are providing weapons, equipment and satellite reconnaissance to Ukraine in its defense of its sovereign territory against Russia’s invasion that began on February 24, 2022.

Six Dividend-paying Satellite Stocks to Purchase Shine With Defense Spending

Defense spending, in particular, is on the ascent amid mounting geopolitical security risks, according to BofA Global Research. A recovery in the commercial satellite and space sectors appears potent enough to overcome economic uncertainty, BofA continued.

In the United States, the Space Force-operated Defense Support Program (DSP) satellites are a key part of North America’s early warning systems. In their 22,300-mile, geosynchronous orbits, DSP satellites help protect the United States and its allies detect missile launches, space launches and nuclear detonations.

The DSP satellites use an infrared sensor to detect heat from missile and booster plumes against the Earth’s background. Technological advancements to ground processing systems dating back to 1995 enhanced detection capabilities of smaller missiles to improve warnings of attacks by short-range missiles against U.S. and allied forces.

U.S. Defense Strategy Sparks Growth

U.S. National Defense Strategy addresses the need to use deterrence as a primary way to protect the homeland and modernize military preparedness, wrote Jason Gursky, an aerospace and defense analyst with Citigroup. The U.S. government is investing in nuclear defense capabilities, as well as conventional military planes, ships and tanks, he added.

In addition, the U.S. Department of Defense is funding an initiative called Joint All-Domain Command and Control – whose primary mission is to reduce timelines between “sensors and shooters” to provide further “deterrence and tactical advantage,” Gursky wrote in a recent research note.

“This is being done through the proliferation of sensors across the space, land, air and sea domains and the ability to quickly analyze vast amounts of data using AI,” Gursky continued. “In our view, investments in this initiative support higher defense spending through the end of the decade, and that a rising tide will lift all boats – with most contractors benefiting from it.”

Rocket Lab Achieves 50th Launch

Several companies engaged in the satellite and space businesses have received “buy” recommendations from Citigroup. One is non-dividend-paying Long Beach, California-based Rocket Lab USA, Inc. (NASDAQ: RKLB), a global launch services and space systems provider.

On June 20, Rocket Lab announced it successfully launched its 50th Electron mission to deploy satellites for France-based Kinéis, an Internet-of-things (IoT) company. Rocket Lab reported that Electron reached the milestone of 50 launches faster than any commercially developed rocket in history. Both Citigroup and BofA Global Research are among investment firms that recommend Rocket Lab as a buy.

In addition, prime contractors now appear willing to buy dedicated launch vehicles to support internal research and development (IRAD) projects – something previously not seen in any great numbers, Gursky wrote in a research note.

A recent $515 million award by the Space Development Agency (SDA) is a verification of the company’s products and technical prowess, following a commercial award on a Globalstar (NYSE American: GSAT) low-earth orbit (LEO) program. These two programs together show customer adoption of the company’s satellite products is accelerating, and the recent improvement in liquidity is likely to allow for more seamless execution on this backlog as the company expands capacity and working capital.

Six Dividend-paying Satellite Stocks to Purchase: Honeywell (NYSE: HON)

Another of the companies involved heavily in the satellite and space business gaining a “buy” recommendation from Citigroup is Honeywell International Inc. (NASDAQ: HON), a Charlotte, North Carolina-based manufacturer of aerospace and automotive products; residential, commercial and industrial control systems; specialty chemicals and plastics and engineered materials.

The company announced a $1.9 billion acquisition of CAES Systems Holdings LLC (CAES) from private equity firm Advent International on June 28 to enhance its defense technologies in space, air, land and sea. CAES’ high-reliability radio frequency technologies have the potential to help Honeywell drive long-term growth and further diversify revenue streams in the defense industry.

Courtesy of www.StockRover.com. Learn about Stock Rover by clicking here.

Honeywell is a current profitable recommendation in the Flying Five portfolio of the Forecasts & Strategies investment newsletter led by Mark Skousen, PhD, an economist who serves as a Presidential Fellow at Chapman University. The Flying Five stocks consist of the five high-dividend-paying Dow stocks with the lowest prices, Skousen said. He has been recommending a Flying Five Portfolio each year since the early 1990s. Those stocks typically outperform the market.

Ben Franklin scion Mark Skousen, head of Forecasts & Strategies, talks to Paul Dykewicz.

Honeywell has a tradition as a space and satellite company that includes serving NASA with the Apollo moon landing missions. Roughly 1,000 satellites, or 80% of those currently in orbit, have Honeywell components on board, according to company officials.

Citigroup rates Honeywell as a “buy” due to its solid long-term earnings-per-share (EPS) growth potential, despite an uncertain macro environment. Short-cycle weakness should ease over time and longer-cycle end markets, particularly aerospace, could stay resilient and let the company remain well positioned in secular growth markets such as automation and digitalization, Citigroup wrote in a recent research note.

Plus, recent structural cost actions could drive better-than-expected operating leverage in a growth environment, Citigroup continued. Finally, accelerated cash deployment and an under-levered balance sheet with good cash flow could spur further upside over time, Citigroup concluded.

Chart courtesy of www.stockcharts.com.

Six Dividend-paying Satellite Stocks to Purchase: Booz Allen Hamilton (NYSE: BAH)