What are the Dividend Aristocrats?

By: Ned Piplovic,

Dividend Aristocrats are a group of few dozen S&P 500 companies that have a record of boosting their annual dividend distribution amount for at least the last 25 consecutive years.

Published in 1989, the first list of Dividend Aristocrats contained 26 companies. List rebalancing to add and drop companies based on their eligibility occurs quarterly in January, April, July and October. After the initial list in 1989, some companies dropped off the list for failing to meet the eligibility requirements and other companies extended their consecutive annual dividend hikes streaks to reach the 25-year eligibility milestone. More companies joined and then dropped off. The list expanded to its peak at 66 companies in 2020.

By the financial crisis in 2008, the number of Dividend Aristocrats declined to 52. Many of the Aristocrat companies succumbed to the negative effects in the aftermath of the crisis and nine dropped off the list — eight for failing to meet eligibility requirements and the Wrigley Company for being acquired by Mars, Incorporated. As the markets and the overall economy recovered from the recession the Dividend aristocrats list began expanding again and currently includes 65 companies.

Eligibility Requirements

In addition to the maintenance of at least 25 consecutive annual dividend hikes, the Dividend Aristocrats must meet some additional criteria. One of the initial conditions for inclusion in the Dividend Aristocrats group is a minimum market capitalization of $3 billion. However, the most recent eligibility requirements for inclusion in the S&P 500 index list is a minimum unadjusted market capitalization of $8.2 billion. This figure is significantly higher than the $3 billion required for the Dividend Aristocrats designation. Therefore, any stock that meets the minimum capitalization threshold for the S&P 500 index, automatically meets the $3 billion capitalization minimum for the Aristocrat designation as well.

Additionally, companies also must meet certain liquidity requirements. The Dividend Aristocrats Index must achieve an average daily trading value of at least $5 million over the three-month period that precedes the rebalancing date. Furthermore, the index also has a minimum number of components and a diversification requirement — after each quarterly rebalancing, the Dividend Aristocrat Index must have at least 40 components. Using the Global Industry Classification Standard (GICS) as the sector identification method, the cumulative share of all companies in any single sector may not exceed 30%.

Enter your e-mail address in the form below and you will gain immediate access to the Dividend Aristocrats list.

Claim Your FREE Report:

The Complete “Dividend Aristocrats” List

What does the Dividend Aristocrats designation mean for investors?

Is the Aristocrats title merely a status symbol or does it provide additional indications that investors can use to make stock-picking decisions? In addition to high dividend yields, income investors seek equities that offer long streaks of rising dividend payouts. However, since dividend distributions to shareholders reduce companies’ earnings and cash flow, some experts contend that dividend distributions impede share price growth. Additionally, financial experts and investment professionals even disagree on whether dividends have any affect on the overall performance of a stock.

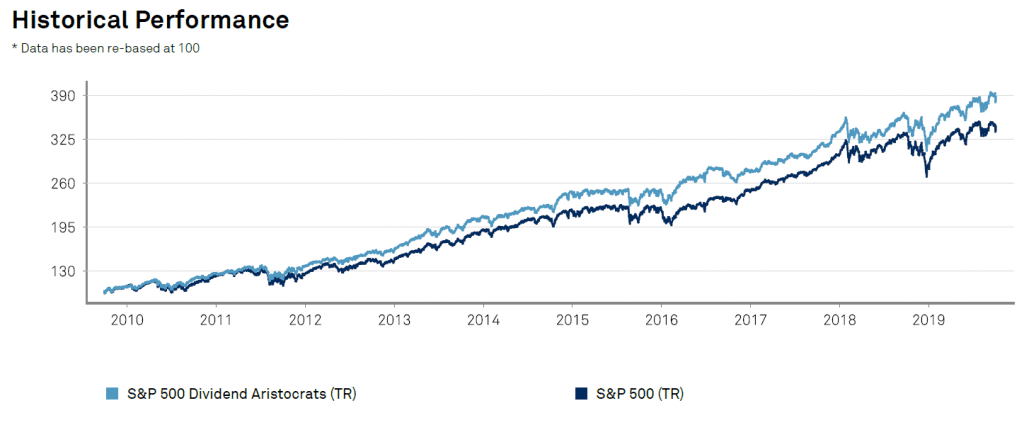

However, back-tested history supports the view that dividends do indeed add to the overall share price growth and indicate that public companies with rising dividends produce higher overall returns for their shareholders and experience lower volatility over a long-term investment horizon. Long periods of rising dividend payouts might not have a direct impact on the stock’s performance. However, rising dividend income over extended time horizons at least indicates that the company manages its capital efficiently and maintains a cash flow and profit level high enough to support the growing dividend payouts. The graph below indicates that Dividend Aristocrats even outperformed total returns of the overall S&P 500 Index.

Chart Source: S&P Dow Jones Indices

Some dividend-paying companies make dividend distribution decisions coordinated with their periodic financial results. However, most of the companies with histories of long rising dividend payouts operate with specific dividend policies that require annual dividend boosts and outline specific dividend growth targets. The companies with these specific dividend policies in place generally deliver more consistent total returns and tend to be better investment picks for reliable dividend income and long-term capital gains.

Additional advantages of investing in Dividend Aristocrats

In addition to the aforementioned efficient capital management and sufficient cash flow, long-term rising dividends also indicate that a company is able to withstand changing market conditions. During a 25-year period, a company will go through several boom-bust cycles. A company that can effectively get through the up-and-down cycles of the market and maintain its rising dividends is clearly well-managed and will provide reliable dividend income, dividend growth and asset appreciation.

Why 25 Years?

There is no specific analytical or scientific significance for the 25-year minimum requirement for inclusion in the exclusive Dividend Aristocrats group. In addition to the Aristocrats, financial institutions and investors have established several other groups of dividend-paying equities with different eligibility criteria. Dividend Kings are a subset of the S&P 500 Aristocrats group — to become a member of this extra-exclusive group, companies must meet all Aristocrat eligibility requirements and must have raised their annual dividend payout for the past 50 consecutive years. Because of this extremely high threshold, only 16 companies meet all eligibility requirements for the Dividend King designation.

In addition, the two S&P 500-based classifications explained above, investment analysts and investors created additional categories with different requirements for consecutive dividend boosts. Dividend Champions have the same 25-year requirement for consecutive annual dividend hikes, but the Champions list is not limited to the components of the S&P 500 Index. Dividend Achievers or Dividend Contenders are companies that have boosted their dividends for 10 or more years. Some investment analysts designated companies with five or more consecutive dividend boosts as Dividend Challengers.

However, the lower entry threshold expands the lists of companies from slightly more than a dozen Kings and less than 70 Aristocrats to hundreds of Champions, Achievers, Challengers and Contenders. Expanding the pool of potential stocks beyond the S&P 500 components increases the number of companies with at least 25 consecutive years of annual dividend hikes — Dividend Champions — to 137. As of December 11, 2020, there were also 239 Contenders (10 to 24 years of annual boosts) and 329 challengers (five to nine years of annual boosts).

Even small requirement modifications can change the scope of a list significantly. Lowering the threshold merely from 25 to 20 years would more than triple the number of companies currently on the Dividend Aristocrats list from 65 to more than 150. Therefore, while somewhat arbitrary, the current cutoff for inclusion among the Dividend Aristocrats of 25 consecutive years keep the list of companies to a manageable size for detailed analysis and offers enough variety to satisfy the goals of different investment portfolio strategies.

What Kind of Companies Are in the Dividend Aristocrats group?

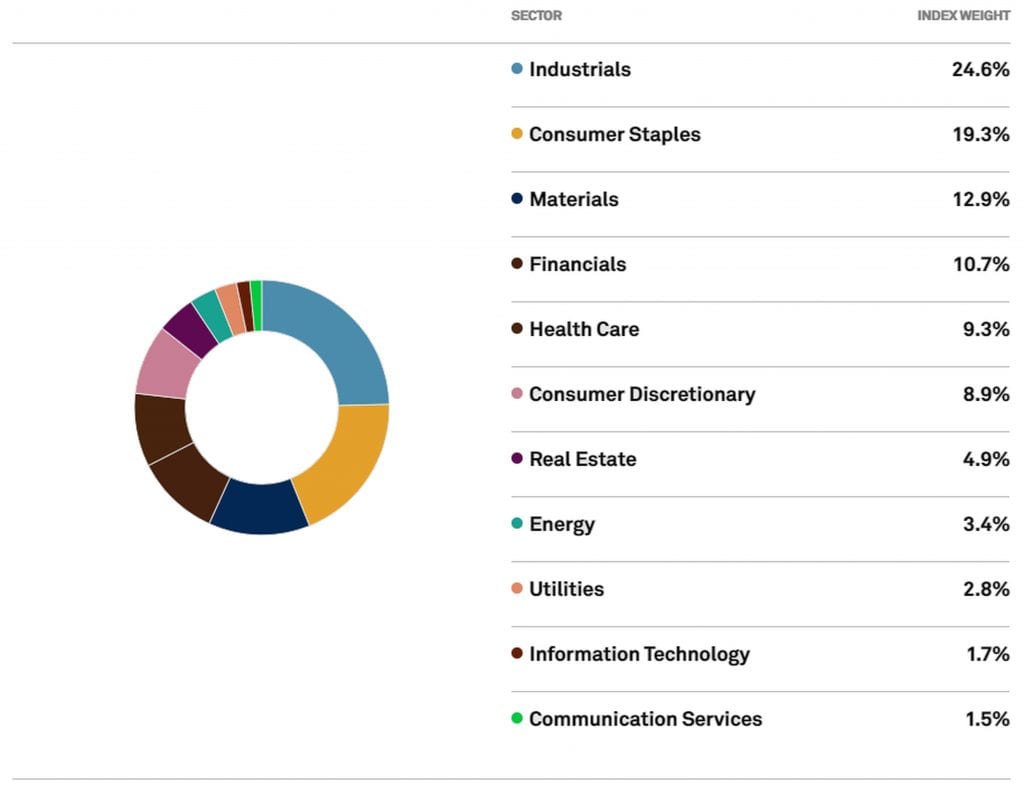

The current 65 Dividend Aristocrats companies represent all 11 of the GICS sectors. However, sector representation of the Dividend Aristocrats group differs slightly from the S&P 500 sector makeup. While the Materials, Consumer Staples and Industrials sectors are relatively better represented in the Dividend Aristocrats group, the S&P 500 is relatively more invested in Information Technology, Energy and Real Estate. Dividend Aristocrat companies are generally more established and older companies that are generally underrepresented in the technology sector. The graph below provides a summary by sector.

Chart courtesy of S&P Dow Jones Indices.

Dividendinvestor.com is one of the few financial advisory websites that has search tools capable of providing information on consecutive dividend increases that can be used to filter out the companies with long-term rising dividends. Additionally, some sites have specialized lists for these long-term dividend-paying stocks — such as those in Dividendinvestor.com‘s Dividend Allstars™ list.

The Dividend Aristocrats list provides a straightforward way to identify companies that have proven their ability to sustain rising dividend payments at least 25 consecutive years. However, as with all investment decisions, investors should consider additional indicators, such as share-price trends, price-to-earnings (P/E) ratios, moving averages, etc. before making the final stock-picking decision.

Related articles:

5 Best Dividend Aristocrats to Buy Now

The Dividend Aristocrats Investing Strategy and Stocks List

The Best Dividend Aristocrats ETFs

Why Invest in the Dividend Aristocrats?

The S&P 500 Dividend Aristocrats — Everything You Need to Know

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic