Three Income Infrastructure Investments to Purchase Amid War Worries

By: Paul Dykewicz,

Three income infrastructure investments to purchase amid war worries, high inflation and continuing Fed rate hikes offer opportunities to overcome ongoing obstacles in pursuit of precious profits.

The three income infrastructure investments to purchase as Russia’s invasion of Ukraine brings terror, death and destruction appear poised to succeed amid market mayhem. Even though stocks have been volatile enough lately to show signs of a potential rally, economic and geopolitical risks cause many prognosticators to warn that a new 2022 market bottom may yet lie ahead.

A company on the list of three income infrastructure investments to purchase includes a producer of solar panels that could help alleviate a war-related energy shortfall in Europe due to Russia cutting its supply of gas to nations opposing its attack of Ukraine. A non-dividend-paying infrastructure stock showcases a company whose unmanned drones have proven their value in Ukraine as the nation’s outnumbered defenders recently have begun to push back a Russian invasion launched on Feb. 26 with more than 120,000 troops.

The attackers’ shelling of hospitals, schools, residential areas, churches, nuclear power plants, oil refineries and a theater used as a shelter became a precursor to brutal rapes, torture and outright executions of Ukrainian civilians that caused many nations to place sanctions on Russia. The penalties include scaling back or severing ties with Russia as a producer of grain, oil and natural gas.

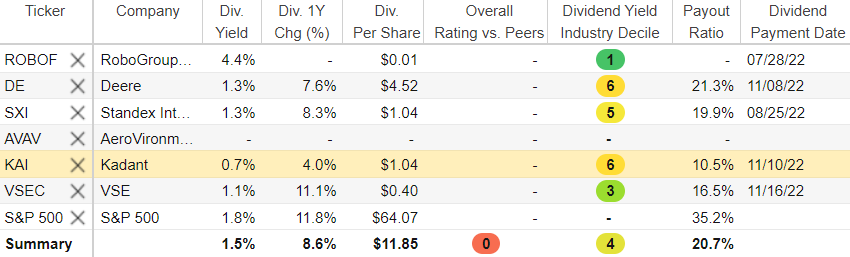

Courtesy of www.stockrover.com; Learn about Stock Rover Research.

Three Income Infrastructure Investments to Purchase Could Evade Financial Fallout

“Stocks have been beset with no shortage of problems in recent weeks,” wrote Mark Skousen, PhD, to subscribers of his weekly Home Run Trader advisory service. “The primary negative, of course, is that the Federal Reserve is determined to slow the economy, reduce demand, and thereby bring down inflation.”

Mark Skousen, Forecasts & Strategies head and Ben Franklin scion, meets Paul Dykewicz.

But too much tightening, too fast, risks pushing the United States into a recession, continued Skousen, an economist who uses his analysis of inflation, interest rates and monetary policy in recommending stocks and options to buy. Economic statistics are showing a slowdown in the economy, if not a recession, he added.

“Even though real gross domestic product (GDP) is slightly negative, second-quarter gross output (GO) — which measures total spending in the economy — grew by 1.7% in real terms,” Skousen stated. “GO includes the supply chain, which is still catching up from the lockdown-induced shortages.”

Three Income Infrastructure Investments to Purchase Must Surmount ‘Super-Strong’ Dollar

Additional concerns include a “super-strong dollar,” sliding consumer confidence and a cooling residential real estate market, Skousen counseled.

Investors can consider an exchange-traded fund (ETF) that offers broad exposure to companies providing automation infrastructure, said Bob Carlson, a pension fund manager who also leads the Retirement Watch investment newsletter.

Bob Carlson, investment guru of Retirement Watch, talks to Paul Dykewicz.

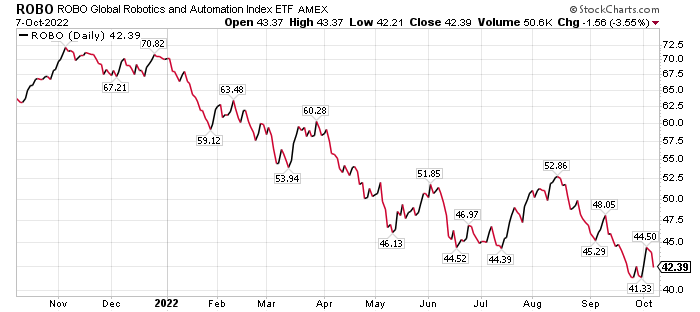

Carlson suggested Robo Global Robotics and Automation (ROBO), a fund that aims to follow an index that is focused on robotics-related or automation-oriented companies. The fund had decent performance until 2022 when it plunged. The fund became caught in the downdraft that befell technology and industrial companies.

Both sectors have done poorly as interest rates rose in 2022, Carlson commented. The fund has fallen nearly 40% in 2022, while its three-year return is just shy of an annualized 6%.

The ETF owns 81 stocks and has 17% of its holdings in the 10 largest positions. ROBO’s top holdings recently consisted of Cognex (NASDAQ: CGNX), Intuitive Surgical (NASDAQ: ISRG) and IPG Photonics (NASDAQ: IPGP).

Chart courtesy of www.stockcharts.com

Three Income Infrastructure Investments to Purchase Include Standex International

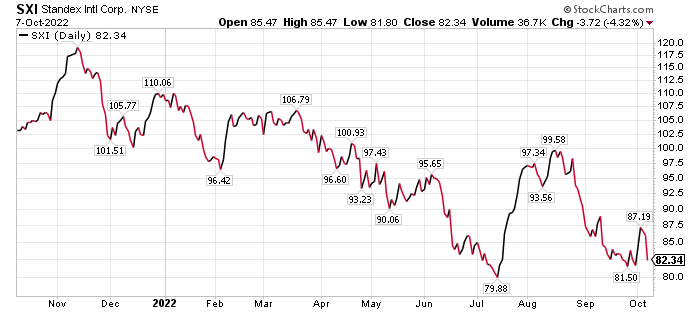

Standex International Corporation (NYSE: SXI), a multinational manufacturer of food service equipment, engravings, engineering technologies, electronics and hydraulics headquartered in Salem, New Hampshire, has many growth paths ahead of it. Rated by Chicago-based investment firm William Blair to “outperform” the market, Standex International could materially accelerate organic growth to 10% or more during the next two to three years, excluding its commercial solar panel production volumes for an innovative Gr3n joint venture with Italy’s Enel (OTCMKTS: ENLAY).

That partnership with a multinational manufacturer and distributor of electricity and gas has gained importance due to the suspected sabotage of both under water pipelines of the Nord Stream 1 from Russia to Western Europe, along with one line of Nord Stream 2. Seismologists in Denmark and Sweden suggest that sizeable explosions on the order of 100 kilograms of TNT occurred in both incidents.

With Russia’s President Vladimir Putin facing unexpected battlefield setbacks more than six months after he ordered the Feb. 26 invasion of neighboring Ukraine that the former KGB agent euphemistically called a “special military operation,” the pipeline sabotage seems targeted to hurt European nations as winter nears. Since Putin ordered troops into Ukraine in February, Russia has cut supplies of natural gas to Europe to heat homes, to generate electricity and to fuel factories.

European Leaders Complain of ‘Energy Blackmail’ by Putin

European leaders have accused Putin of using “energy blackmail” to weaken their support for Ukraine as the country seeks to repel Russia’s aggression.

Without presenting any evidence, Russian officials are trying to blame the United States for the apparent sabotage, even though the affected nations are among America’s closest allies. President Biden countered the accusations were the latest in a continuing Russian campaign of “disinformation and lies.”

Biden also described the explosions of the Nordstream pipelines as acts of “sabotage” and discussed sending divers to examine the damage to find evidence that could be brought to light. Russia’s audacious move to “annex” Ukrainian territory in a Putin-led ceremony last Friday, Sept. 30, was declared illegal by Ukraine, the United Nations, the United States and many other Western allies who said it violated Ukrainian and international law.

Solar Panel Design Aids Second of Three Income Infrastructure Investments to Purchase

Standex further plans to benefit from significantly higher research and development (R&D) investments for new product development to “materially increase organic sales growth,” William Blair opined. New product launches are expected across all five of Standex’s businesses in fiscal 2023, including high growth end-markets such as renewable energy, electric vehicles, human health, commercialization of space and sustainable products.

Standex’s Gr3n joint venture could attain full commercialization by mid-decade, potentially becoming Standex’s sixth business segment. The result may boost Standex’s “organic sales growth” to the low teens in the next three to five years, the William Blair analysts wrote.

The joint venture has developed and tested a prototype for a highly innovative, extremely efficient and 100% recyclable new solar panel design that is 30-35% more efficient and weighs 38% less than traditional glass solar panels. With interest in solar panels rising as the European Union (EU) scrambles to replace the 40% of its energy previously sourced from Russia, Standex is expanding electronics’ production capacity in Germany, China and India, the investment firm reported.

“If the new recyclable, highly efficient solar panel can be cost-effectively produced, it could become the largest new product in Standex’s history,” according to the William Blair analysts.

Chart courtesy of www.stockcharts.com

Deere Ranks Among Three Income Infrastructure Investments to Purchase

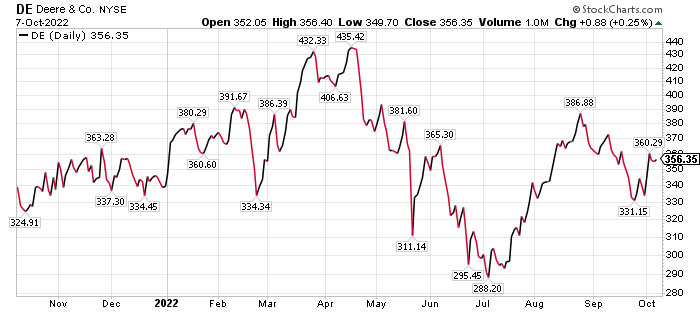

Deere & Co. (NYSE: DE), a farming machinery infrastructure company headquartered in Moline, Illinois, is recommended by Michelle Connell, a former portfolio manager who now serves as president of Dallas-based Portia Capital Management.

Michelle Connell, CEO, Dallas-based Portia Capital Management

The rationale for recommending Deere, Connell said, includes:

-More than half its revenues come from large agriculture.

-If the War in Ukraine continues, U.S. farmers will benefit from higher prices for their crops.

-Higher farm profits mean that that farmers and farming corporations will be more likely to buy large expensive farm equipment.

Deere has climbed since July and its reduced price may offer a good entry point, Connell continued.

Non-Dividend-paying Battlefield Drone Stock Shows Potent Potential

“Additive manufacturing technologies are at an inflection point in their ability to solve challenges faced by manufacturing companies, particularly with recent labor shortages and supply chain disruptions,” according to William Blair & Co. “Historically, additive manufacturing applications have been limited by productivity capabilities and lack of industrial strength materials.”

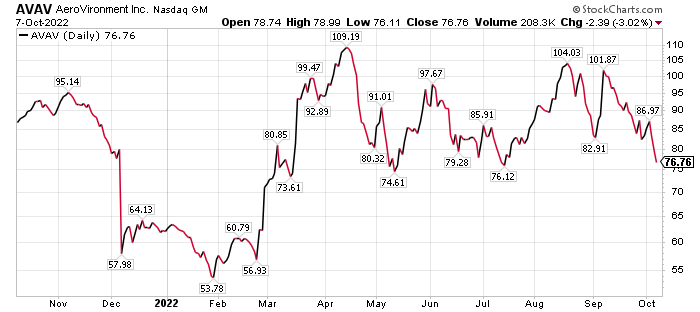

Executives of AeroVironment, Inc., (NASDAQ: AVAV), an Arlington, Virginia-based maker of unmanned drones and other multi-domain robotic systems, recently gave a presentation to William Blair analysts about how software from its Plank and Progeny acquisitions provided a key competitive advantage. Indeed, the success of AeroVironment’s “kamikaze drones” in Ukraine may extend their use into Asia.

AeroVironment officials compared the Ukraine War-related Switchblade media coverage to “100 SuperBowl ads worth of press.” Before the war, AeroVironment was not even authorized to export the Switchblade.

“It was used in the Middle East for over a decade, but it was viewed as a niche offering,” William Blair analysts wrote. “Ukraine is providing a testing ground that proves the Switchblade 300 is incredibly valuable. Now it has U.S. State Department permission to sell to more than 20 countries. In mid-September, reports revealed that Japan is evaluating purchasing several hundred kamikaze drones and is considering AeroVironment’s Switchblade.”

A recent Switchblade 600 contract for Ukraine valued at $2.2 million may be a tipping point. On Sept. 15, almost six months after an initial report that a contract was in the works, it came to fruition.

While Javelin, Stinger and TOW traditional missile systems have a three-mile maximum range, the Switchblade 600 has a 20-mile top range with similar effects. The Switchblade 600 has the same size warhead and can be launched without a visual lock on the target.

Chart courtesy of www.stockcharts.com

AeroVironment Rated ‘Outperform’

William Blair rated AeroVironment to “outperform” the market and indicated it appears to be the favorite to win the Army $1 billion/10-year FTUAS program, but an executive at the robotics company estimated that the U.S. Navy addressable market may be even larger than the potential market for the Army. Software from Planck, acquired by AeroVironment, enables the JUMP-20 military battlefield drone to perform vision-based autonomous landings onto moving platforms, such as maritime vessels.

The JUMP-20 is a vertical takeoff and landing (VTOL), fixed-wing unmanned aircraft used to provide advanced multi-sensor intelligence, surveillance and reconnaissance (ISR) services. AeroVironment’s systems “flourished” during Navy IMX 2022 exercises earlier this year, according to William Blair.

Regarded as the largest unmanned exercises in the world, IMX 2022 showed how AeroVironment’s LEAP software received feeds from manned aircraft, unmanned aircraft, manned vessels and unmanned vessels. At IMX 2022, AeroVironment’s LEAP software was not supposed to be the hub, but when other software did not execute properly, AeroVironment’s LEAP software assumed the hub role on an ad hoc basis.

“We expect AeroVironment’s success at IMX 2022 to lead to contracts for its JUMP-20, Puma and Switchblade aircraft down the road,” the William Blair analysts wrote.

U.S. CDC Halts Its Country-by-Country Travel Notices

The U.S. Centers for Disease Control and Prevention (CDC) dropped its country-by-country COVID-19 travel health notices on Monday, Oct. 3. Those warnings began early in the pandemic as COVID-19 cases and deaths climbed.

COVID risks affect supply and demand for infrastructure stocks, but not as much as cyclical companies whose share prices can soar when economic conditions are favorable but fade fast when inflation, a potential recession and Fed interest rate hikes imperil stock prospects. Savvy investors monitor COVID-19 outbreaks and lockdowns to forecast how certain stocks and sectors, such as infrastructure, are affected.

Another encouraging sign occurred when Canada announced on Sept. 26 that it would remove all remaining COVID-19 entry restrictions, such as testing, quarantine and isolation requirements. That development could boost trade and tourism between that country and the United States.

China’s strict zero-tolerance COVID policy continues to be controversial and recently sparked a rare protest in its technology hub of Shenzhen, social media video showed. The dissent came after government officials ordered a sudden lockdown due to 10 new infections on Sept. 27 in the city of more than 18 million people. Officials ordered residents in three districts there to stay home.

China has locked down more than 70 cities fully or partially to preserve its zero-tolerance policy of COVID. However, 27 people were killed and 20 more were injured when a quarantine bus overturned on a mountain road on Sept. 20.

U.S. COVID-19 deaths ticked up by nearly 4,000, up about 1,000 compared to roughly 3,000 the previous week. Cases in the country totaled 96,644,312, as of Oct. 7, while deaths jumped to 1,062,418, according to Johns Hopkins University. America stands out dubiously as the nation with the most COVID-19 deaths and cases.

Worldwide COVID-19 deaths totaled 6,555,919, as of Oct. 7, according to Johns Hopkins. Global COVID-19 cases reached 620,865,766.

Roughly 79.7% of the U.S. population, or 264,562,221, have received at least one dose of a COVID-19 vaccine, as of Oct. 6, the CDC reported. Fully vaccinated people total 225,870,613, or 68%, of the U.S. population, according to the CDC. The United States also has given at least one COVID-19 booster vaccine to almost 110.6 million people.

The three income infrastructure investments to purchase can be bought at reduced prices after a rough 2022 market wide. Despite Russia’s continuing war in Ukraine and its audacious act of claiming to annex Ukrainian territory in violation of international law, along with high inflation and recession risk after 0.75% rate hikes by the Fed in June, July and Sept. 21, the three income infrastructure investments to purchase offer access to government-supported businesses that are less economically sensitive than the private sector.

Connect with Paul Dykewicz

Connect with Paul Dykewicz