Aflac Incorporated Raised Annual Dividend 36 Consecutive Years, Offers 2.1% Dividend Yield (AFL)

By: Ned Piplovic,

Aflac Incorporated (NYSE:AFL) has maintained a current streak of 36 consecutive annual dividend hikes and presently offers its shareholders a 2.1% dividend yield.

As a component of the S&P 500 index with a market capitalization of more than $3 billion and having hiked its annual dividend at least 25 consecutive years, Aflac has earned a “Dividend Aristocrat” designation. Currently, only 57 companies qualify as Dividend Aristocrats. With its current streak of consecutive dividend boosts, Aflac has been a Dividend Aristocrat for more than a decade and its current financials suggest that the company might maintain this status for many more years.

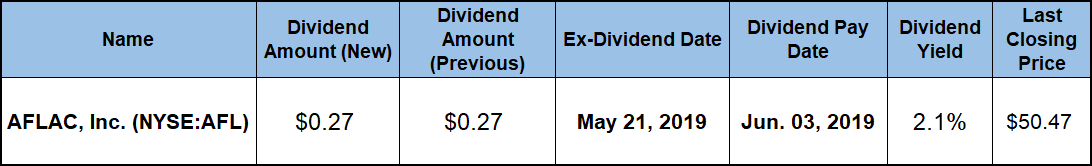

In addition to the long streak of consecutive annual dividend hikes, Aflac also has also delivered one-year double-digit percentage capital gains over the past few years. Investors interested in taking advantage of this steady asset appreciation potential and the rising dividend income should conduct their research and move quickly. Aflac will distribute the next round of its quarterly dividends on the June 3, 2019 pay date. To receive this upcoming dividend payout, investors must claim stock ownership before the May 21, 2018 ex-dividend date

next week.

Aflac Incorporated (NYSE:AFL)

Headquartered in Columbus, Georgia and founded in 1955, Aflac Incorporated, through its subsidiary, American Family Life Assurance Company of Columbus, provides supplemental health and life insurance products to approximately 50 million people worldwide. The company operates through two business segments — Aflac U.S. and Aflac Japan. The Aflac U.S. segment provides products designed to protect individuals from the depletion of their assets. These products include accident, cancer, critical illness/care, hospital indemnity, fixed-benefit dental and vision care plans. The company also offers loss-of-income products, such as life and short-term disability plans, in the United States. Additionally, the Aflac Japan segment offers various voluntary supplemental insurance products, including cancer plans, general medical indemnity plans, medical/sickness riders, care plans, living benefit life plans, ordinary life insurance plans and annuities in Japan.

The company’s upcoming $0.27 dividend payout for the first quarter of 2019 is nearly 5% higher than the $0.26 quarterly distribution for the same period last year. This new quarterly payout amount is equivalent to a $1.08 annualized payout and a 2.1% forward dividend yield.

Aflac’s current 2.1% yield trails nearly 30% behind the 3.08% average yield of the entire Financials sector. However, the company’s current dividend yield outperformed the 1.58% simple average yield of all the companies in the Accident & Health Insurance segment by more than 35%. Excluding the companies that do not pay dividends, the average yield of the segment ranges from 1.58% to 2.21%.

Many companies in this segment have experienced a share price decline over the past year, which resulted in higher individual company yields and a higher yield average for the entire segment. However, unlike many of its peers in this segment, Aflac has advanced its share price more than 10% over the trailing 12 months, which has suppressed its current dividend yield. However, even while diverging from the segment’s average, Aflac’s current yield is only 3.2% below the 2.21% average yield of the segments only dividend-paying companies.

A decade after initiating dividend distributions in 1973, Aflac started its current streak of enhancing its annual payout every year. The company has boosted its annual dividend amount over the past 36 years. Since 1998, Aflac has enhanced its annual dividend nearly 20-fold. This pace of advancement corresponds to an average annual dividend growth rate of 16% per year over the past two decades. While not as high as the growth rate over the past two decades, the average dividend growth advanced at 8% per year over the past five years. The three-year dividend growth rate was even higher at 9.6%.

Aflac’s current dividend payout ratio of 26% indicates that the company only uses approximately one-quarter of its earnings to cover its dividend distributions. This figure is slightly below the lower limit of the 30% to 50% sustainable payout ratio range. Even a dividend payout ratio increase of 15% would bring up Aflac’s current dividend yield to the lower bound of the sustainable range. This means that Aflac should have no problems continuing its current streak of consecutive annual dividend hikes.

While its dividend yield declined slightly, Aflac’s share price has advanced by a double-digit percentage to reward shareholders with a combined total return of nearly 14% over the last 12 months. Longer-term investors enjoyed a total return of 56.5% over the last three years. Furthermore, Aflac’s shareholders have received a total return of 77% over the past five years.

Related Articles:

5 Best Dividend Aristocrats to Buy Now

The Dividend Aristocrats Investing Strategy and Stocks List

The Best Dividend Aristocrats ETFs

Why Invest in the Dividend Aristocrats?

The S&P 500 Dividend Aristocrats — Everything You Need to Know

What are the Dividend Aristocrats?

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic