AmeriGas Partners Offers 9% Dividend Yield, 14 Years of Dividend Hikes (APU)

By: Ned Piplovic,

AmeriGas Partners L.P. (NYSE: APU) — the largest marketer of propane and propane-related products in the United States — has been boosting its annual dividend distribution for the past 14 consecutive years and currently offers shareholders an 8.9% dividend yield.

While the company’s share price has been trading in a relatively narrow price range over the past several years, the hefty dividend distributions have helped investors to secure decent total returns on their investment. With shares currently well below their 52-week high because of market volatility, now might be an opportunity for investors take a position in APU, gaining access to AmeriGas’ moderate long-term asset appreciation and quarterly dividend income.

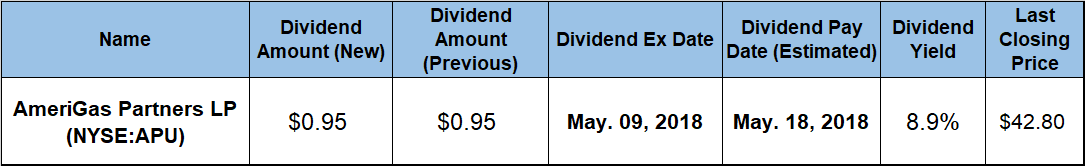

The company’s next ex-dividend date is on May 9, 2018, and all shareholders of record prior to that date will receive the next dividend payout a little more than a week later, on May 18, 2018.

AmeriGas Partners LP (NYSE:APU)

Based in King of Prussia, Pennsylvania and founded in 1994, AmeriGas Partners, L.P. is a publicly traded limited partnership that distributes propane and related equipment and supplies in the United States. Through its subsidiary — AmeriGas Propane, L.P. — the company serves nearly 2 million customers in all 50 states from approximately 2,100 distribution locations. In residential application, the company’s propane serves for home heating, water heating and cooking. Industrial propane applications include firing furnaces, motor fuel, tobacco curing, chicken brooding, crop drying and orchard heating.

AmeriGas Partners also sells, installs and services propane appliances and operates a residential heating, ventilation, air conditioning, plumbing and related services business in certain counties of Pennsylvania, Delaware and Maryland. The company markets propane and other services primarily under the AmeriGas, America’s Propane Company, Heritage Propane, Metro Lawn and ServiceMark brand names.

The company started paying a steady quarterly dividend of $0.55 in 1998 and continued to do so for the next several years. However, AmeriGas began hiking annual dividends in 2005 and, since then, the total annual payout has gone up more than 70%. Over that period, the annual rate of increase has been around 4% per year.

Currently, AmeriGas pays out an impressive $0.95 per share quarterly, which equates to $3.80 on an annualized basis and an 8.9% forward yield, which is 9.8% higher than the partnership’s 8.1% average yield over the past five years. Compared to the yield of the entire Utilities sector (2.65%) and companies in the Diversified Utilities market segment (4.1%), AmeriGas’ yield wins hands down. being 235% and 117% higher, respectively. The 8.9% yield also outperforms the average of the segment’s dividend-paying companies by more than 100%.

Over the past five years, APU’s share price has experienced moderate volatility, but it has generally traded in the $40 to $50 range, stepping outside those boundaries only twice prior to 2018. The first breach occurred in January 2015, when APU briefly shot above $50 a share. The second was later that same year, only this time, the share price dropped below $40 and continued to fall to just slightly above $32, which was the stock’s low point over the past decade.

After a period of several months, the share price recovered and returned to its range by mid-February 2016, where it then stayed throughout 2017. However, the extreme market volatility of 2018 caused APU shares to fall below $40 once more in late March and early April to a low of $39.41. This price was 22.7% below the January 2018 high of $48.37. Fortunately, since bottoming out at the beginning of April 2018, the share price has risen to close on April 30, 2018 at $42.80, which is 8.6% higher than that one-year low.

Despite an overall 5% loss in the past 12 months, the robust dividend that AmeriGas distributes actually managed to keep the total return for shareholders nicely on the positive side, which shows the power of continuous, healthy dividend payments. Longer-term investors have enjoyed a total return of more than 40% over the past five years.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic