Ames National Corporation Boosts Quarterly Dividend Payout 4.5% (ATLO)

By: Ned Piplovic,

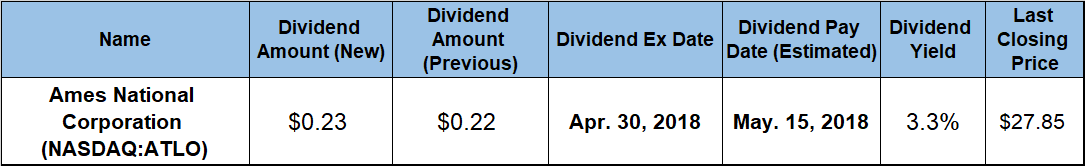

Since starting to distribute dividends to its shareholders in 1998, the Ames National Corporation (NYSE:ATLO) has reduced its annual dividend distribution for only two years in the aftermath of the 2008 financial crisis, like many other financial institutions. However, the company has resumed its annual dividend boosts after the crisis and has boosted the annual payout amount for the past eight consecutive years since, including the current 4.5% quarterly dividend boost over the previous period.

In addition to the long record of boosting annual dividend payouts, the company currently offers its investors a 3.3% dividend yield, which is marginally higher than the average financial industry yields. While the share price experienced a 10% drop over the past 12 months, the price has shown double-digit-percentage growth over longer periods.

Investors convinced that the share price might bounce back should do their research and take a position prior to the company’s next ex-dividend date on April 30, 2018, and make sure to be eligible for the next round of dividend distributions on the May 15, 2018, pay date.

Ames National Corporation (NYSE:ATLO)

Founded in 1975 as a holding company for the First National Bank in Ames, the Ames National Corporation operates as a multi-bank holding company that provides banking services primarily in the central and north central Iowa. Since its formation in 1975, State Bank & Trust Co., Nevada, Boone Bank & Trust Co., Boone, Reliance State Bank, Story City, and United Bank & Trust, Marshalltown have affiliated with the Corporation. Each affiliate bank operates independently with a board of directors and a bank president. With total assets of over $1.4 billion as of December 31, 2017, the Ames National Corporation is the sixth-largest Iowa-based commercial bank holding company based on total deposits. The company offers a range of standard banking deposit services, cash management, merchant credit card processing, safe deposit box and wire transfer, direct deposit of payroll and social security checks and several types of loans. As of March 31, 2018, the company operated 14 banking offices and 23 Automated Teller Machine (ATM) locations in Iowa’s Boone, Hancock, Marshall, Polk and Story counties.

The company’s share price reached its 52-week high just a few days into the trailing 12-month month period after rising 2.6% from $31 on April 20, 2017, to $31.80 on April 26, 2017. After the early peak, the share price fell more than 15% over the subsequent four months. However, the share price reversed direction and recovered all those loses in the following 60 days to close on October 10, 2017, within 0.2% of the April 2017 peak at $31.75. The share price reversed direction again and fell again. This time, the share price lost almost 17% and fell to its 52-week low of $26.40 by March 1, 2018. Since the bottoming out at the beginning of March, the share price rose again and gained 5.5% to close on April 18, 2018, at $27.85. This closing price was still approximately 10% below the April 2017 peak, but 8% higher over the past two years and 42% higher than it was five years ago.

The company boosted its quarterly dividend payout 4.5% from $0.22 in the previous quarter to the current $0.23 quarterly distribution. This new quarterly dividend converts to a $0.92 annualized payout and currently yields 3.3%, which is 10% higher than the company’s own five-year average yield of 3%.

After starting dividend distributions in 1998, the company more-than tripled its annual dividend payout over the next decade. However, in the aftermath of the 2008 financial crisis, the Ames National Corporation cut its dividend more than 60% over two years. After the two dividend reductions, the company resumed dividend hikes and has boosted its annual dividend payout at an average rate of 10% per year since 2011.

The company’s current yield is marginally above the average yield for the entire Financials sector. However, Ames’ current 3.3% yield is almost 80% above the simple average yield of the Regional Northeast Banks market segment and 47% above the average yield of only dividend-paying companies within the market segment.

While the share price drop contributed significantly to the 3.7% total loss over the past 12 months, the company rewarded long-term shareholders with double-digit-percentage gains over longer periods. Over the most recent three-year period, the shareholders received a 26.8% total return, and the return over the most recent five years was 73.7%.

Dividend increases and decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic