Arthur J. Gallagher & Co. Raises Dividend by 5% (AJG)

By: Ned Piplovic,

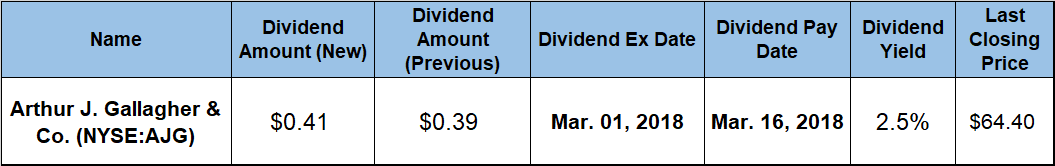

Arthur J. Gallagher & Co. (NYSE: AJG) hiked its annual dividend 5.1% in the first quarter of 2018, extending the company’s record of annual dividend boosts to eight consecutive years. AJG’s current yield is 2.4%.

In addition to eight consecutive years of dividend hikes, the company has not cut its dividend and has only failed to raise its annual dividend once in the past two decades. To complement this, the company’s share price rose more than 26% over the past 12 months for a total return of over 25%. The increased dividend will be paid on March 16, 2018 to all its shareholders of record as of the March 1, 2018 ex-dividend date.

Arthur J. Gallagher & Co. (NYSE:AJG)

Headquartered in Itasca, Illinois and founded in 1927, Arthur J. Gallagher & Company provides insurance brokerage and risk management services. The company’s retail brokerage operations negotiate and place property, casualty, employer-provided health and welfare insurance. Additionally, the wholesale brokerage operations assist brokers and agents. The company’s Risk Management segment provides contract claim settlement and administration services for enterprises that self-insure coverage and outsource claims departments. Arthur J. Gallagher & Company has operations in 33 countries and offers client-service capabilities through agents and brokers in more than 150 additional countries around the world.

The increased quarterly payout of $0.41 per share expected in March represents a 5.1% increase from the previous quarter’s payout of $0.39 per share. On an annualized basis, that means investors can expect a $1.64 per share distribution, or a forward yield of 2.38%. While AJG’s yield is lagging more than 50% below the 5.3% simple average yield of the entire Financials sector, it is significantly higher than the simple average yield of all the companies in the Insurance Brokers market segment.

As noted earlier, the company has managed to grow its dividend over the past two decades, with just a single failure to boost the annual payout in 2010, when it paid the same $1.28 annual dividend as the year before. Many other companies in the Financial sector were forced to make significant cuts to their own dividend payouts in 2009 and 2010 in the aftermath of the financial crisis.

Since 2010, Arthur J. Gallagher & Company has hiked its annual dividend every year and has enhanced its total annual payout 28% by growing the annual distribution at an average rate of 3.1% per year. However, even with the one missed annual hike in 2010, the company’s annual dividend has advanced at an average rate of 8% per year over the past 20 years. Over that period, the total annual dividend amount grew almost five-fold.

While the company’s share price was caught in the overall stock market downturn at the beginning of February 2018, it still performed well over the past year and generated a hefty total return when combined with the dividend income. The share price started its trailing 12-month period on February 9, 2017 from its 52-week low of $54.71. Rising from that bottom, the share price ascended more than 22% to $66.96 by the end of November 2017. After pulling back 7.2% to $62.17 in December, the stock rose again, with the share price climbing to a 52-week high of $70.49 on January 26, 2018. Overall, AJG saw a total gain of nearly 29% from the 52-week low in February 2017.

Since the January peak, the share price followed the drop of the overall markets, giving back 8.6% by February 8, 2018, but recovered to close on February 20, 2018 at $69.31, which was within 1.4% of the January peak price. The recent recovery makes the current closing price 26.7% higher than the 52-week low from one year earlier. In addition to the strong asset appreciation, the company’s dividend income distributions over the past 12 months rewarded shareholders with a 26% total return. The total return was 56% over the past three years and almost 97% over the past five years.

Dividend increases and decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic