Avangrid, Inc. Boosts Quarterly Dividend, Offers 3.5% Yield (AGR)

By: Ned Piplovic,

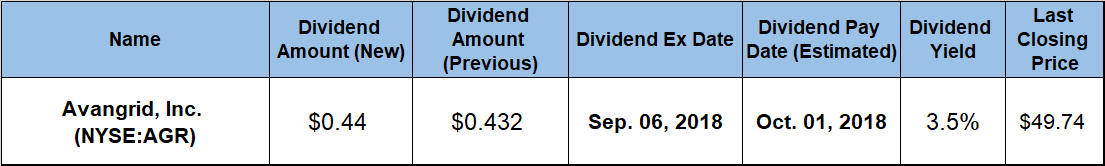

Avangrid, Inc. (NYSE: AGR) — a subsidiary of the Spanish utility company Iberdrola S.A. — has declared a small boost to its quarterly dividend payment. This increase will take effect in the upcoming October distribution and puts the annual forward yield at 3.5% at current prices.

The upcoming quarterly dividend increase represents the first one for the company since the 2015 merger that created Avangrid. For the previous 10 consecutive periods since its inception, Avangrid had paid out a flat $0.432 quarterly dividend.

Despite its relatively short history, a recent long-term outlook for the company projects that the compounded annual growth rate (CAGR) will be between 8% and 10% for adjusted earnings per share (EPS) through 2022. Additionally, future annual dividend increases are expected to be in line with EPS growth. To support this expansion, the company plans to invest $14.4 billion over the five years leading up to 2022.

AGR also increased its operational efficiency in the last year, adding $1 billion to the total debt, but generating cash from operations of almost $2 billion on an annualized basis in the first six months of 2018. With total debt of $6.9 billion, the operating cash to total debt ratio stands at 28.5%.

To summarize, while Avangrid is a relatively new corporate entity with a short history, it might have good potential for future growth. Investors wishing to take advantage of Avangrid’s first dividend increase ever would be well-advised to make their move before the stock’s ex-dividend date of September 6, 2018. The increased dividend will be paid into eligible shareholder accounts on the October 1, 2018 pay date.

Avangrid, Inc. (NYSE:AGR)

Headquartered in Orange, Connecticut, Avangrid, Inc. was created in 2015 through a merger of the Connecticut and Massachusetts UIL Holdings Corporation and Iberdrola USA, Inc. — a wholly-owned United States subsidiary of the Spanish utility company Iberdrola S.A. (BMAD: IBE). Avangrid, Inc. operates as an energy services holding company that generates, transmits and distributes electricity, as well as distributing, transporting and selling natural gas. The company operates through two primary business segments — Avangrid Renewables and Avangrid Networks. Avangrid Renewables is one of the nation’s largest producers of wind energy and owns and operates approximately 6.5 gigawatts (GW) of wind and solar generation capacity in 22 states. The Avangrid Networks segment comprises eight electric and natural gas utilities with a rate base of $9.1 billion that serves approximately 2.2 million electric utility customers and one million natural gas public utility customers in New York, Maine, Connecticut, and Massachusetts. This segment owns and operates nearly 80,000 miles of electricity transmission and distribution lines, as well as approximately 24,500 miles of natural gas transmission and distribution pipelines. Additionally, the segment owns and operates more than 67 billion cubic feet of natural gas storage capacity.

Despite only going back to 2015 in its current state, Avangrid has deep historical roots. One of the company’s direct predecessors — UIL Holdings Corporation — operated as a utility company in New England since 1971, while Avangrid‘s Spanish utility parent company traces its origins back to 1907.

After paying the flat $0.432 quarterly distribution since its inception, AGR’s new quarterly dividend payout will be $0.44 per share, a 2% increase. The annualized $1.76 dividend payout corresponds to a 3.5% forward dividend yield, which is in line with the simple average yield of the Diversified industry segment and almost 40% higher than the 2.53% average yield of the entire Utilities sector.

Following a brief ascent at the beginning of the trailing 12 months, AGR’s share price declined with the overall markets in January and closed at its 52-week low of $45.83 on February 6, 2018. After that, the share price ascended more than 18% to peak at $54.26 on May 4, only to pull back again and close on Aug. 28 at $49.74. This closing price was 1.7% higher than one year earlier, 8.5% above the February low and 33% higher than it was when the current company formed in December 2015. The combined total return over the past 12 months was 7.9%.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic