Avista Corporation Offers 4.2% Dividend Boost (AVA)

By: Ned Piplovic,

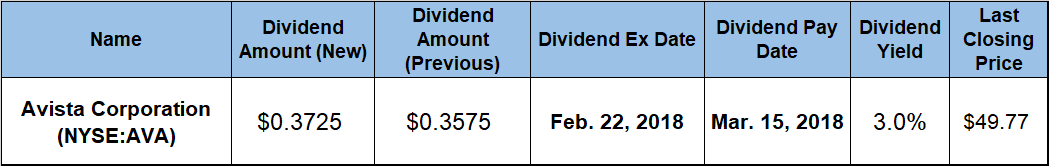

Avista Corporation (NYSE:AVA) hiked its current quarterly dividend distribution 4.2% and offers its shareholders a 3% dividend, as well as a nearly 30% one-year asset appreciation.

With the current dividend boost, the Avista Corporation upped its current streak to 16 consecutive years of annual dividend increases. The share price experienced some organic growth over the past 12 months. However, more than two-thirds of the total share price growth happened on a single day in July 2017 on the news that the company might be a target for acquisition by the Ontario-based Hydro One Limited (TSX:H.TO) company.

The company’s next ex-dividend date will occur on February 22, 2017, which is exactly three weeks before the March 15, 2018, pay date.

Avista Corporation (NYSE:AVA)

Founded in 1889 and headquartered in Spokane, Washington, the Avista Corporation operates as an electric and natural gas utility company. The company operates in two business segments — Alaska Electric Light and Power Company and Avista Utilities. While the Alaska Electric Light and Power Company segment owns and operates electric generation, transmission and distribution facilities in Juneau, Alaska, the Avista Utilities segment provides the same services in Idaho, Montana, Oregon and Washington state. The two segments combined operate more than 2,000 megawatts (MW) of power generation capacity from various sources, as well as provide electricity service to nearly 400,000 customers and gas service to approximately 350,000 customers.

The company enhanced its dividend 4.2% by raising the 0.3575% quarterly payout amount from the previous quarter to the current $0.3725. This current dividend distribution amount yields 3% and is equivalent to a $1.49 annualized payout amount. Compared to the 2.5% average yield of the entire utilities sector, Avista’s current yield is 20% higher.

The company has been distributing dividends to its investors for nearly 120 years. However, the company managed to raise its annual dividend amount every year over the past 16 successive years. Over that 16-year period, Avista has raised its annual dividend amount at an average growth rate of 7.3% per year. That level of compounded annual growth raised the company’s annual distribution amount by 210% since 2002.

The share price pulled back 0.7% in the first month of the current trailing 12-month period and dropped from $38.71 on February 7 to $38.43 by March 9, 2017. However, after that minor drop, the share price gained almost 13% by July 19, 2017, before the aforementioned one-day spike of 20.7% on July 20, 2017.

After that jump on potential acquisition news, the share price gained a few more cents and reached its 52-week high of $52.74 at the end of trading on August 1, 2017, for a total gain of 37.2% since its 52-week low at the beginning of March. Since peaking at the beginning of August 2017, the share price declined 5.6% and closed on February 5, 2018 at $49.77. That share price level was 28.6% higher than one year earlier, 29.5% higher than the 52-week low from March 2017 and 88% higher than it was five years earlier.

The share price jump in July contributed significantly to the company’s total returns of 33.5% over the past 12 months. However, even without that price spike, the company would have still rewarded its shareholders with a double-digit percentage total return for the year. Over the past three years, shareholders received a 46% total return, and over the past five years the total return was nearly 120%.

Hydro One and the Avista Corporation announced in mid-January that they received an affirmative response from the Federal Energy Regulatory Commission (FERC) to their September 2017 merger application. However, while this approval is a significant step towards the merger, the companies still must obtain approval from the Federal Communications Commission (FCC), receive clearance from the U.S. Committee on Foreign Investment and must comply with all applicable requirements under the U.S. Hart-Scott-Rodino Antitrust Improvements Act. In addition to the federal-level approval, the merger also hinges on receiving regulatory approval from each individual state — Alaska, Idaho, Montana, Oregon and Washington — where Avista currently operates.

Dividend increases and dividend decreases, new dividend announcements, dividend suspensions and other dividend changes occur daily. To make sure you don’t miss any important announcements, sign up for our E-mail Alerts. Let us do the hard work of gathering the data and sending the relevant information directly to your inbox.

In addition to E-mail Alerts, you will have access to our powerful dividend research tools. Take a quick video tour of the tools suite.

Connect with Ned Piplovic

Connect with Ned Piplovic